5 Ways On How To Increase Cashflow For Startups

More than 30.7 million small businesses and startup companies are currently operating in the United States. 69% of entrepreneurs in the US started their businesses in their homes. The reason is to save money as much as possible. However, because of failing to improve cash flow, 50% of these startups get shut down within the first five years.

It happens because most of these startups fail to track their cash. Running the business without tracking the cash flow can bring down even the richest startup. An entrepreneur must be proactive regarding the finance of his startup.

Managing the cash flow is not tough if you know the tricks. But before you know how to increase cash flow in small businesses or startups, you must be aware of what is cash flow management?

What is the cash flow?

Cash flow is the metric to measure the amount of cash that comes in or out within a time frame. Often, a business gets money from sales, return on investments, and loans. However, the money goes out on loan repayment, utility bills, taxes, etc. For running the business successfully, one must know to balance the in and out of the cash flow.

However, one thing needs attention here, and that is the cash flow is different from profit. Hence, your earned profit in the business may not suggest the condition of the cash in the company.

Schedule A Consultation Today!

Now, as you know what cash flow is, here are ways to increase cash flow in a business.

1. Collect the Debts as Quick as Possible

The easiest way to improve cash flow is to collect the debts and bills. Consider it if you have customers and clients who often fail to pay the bills on time. Even if you are not able to collect the full payment, partial payments can also improve the cash flow.

However, for a quick and timely payment, discounts can work best. On the other hand, you can penalize the people for the late payments provided you mention this in the sales agreements.

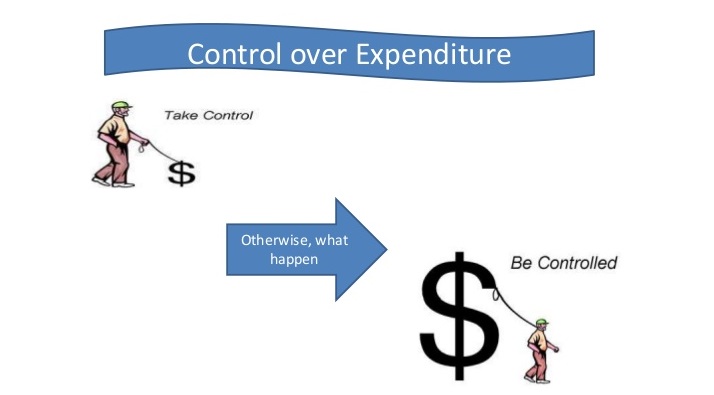

2. Control the Expenditure

For proper cash flow, you must prioritize the spending. Figure out what is necessary for the business and what are the elements which are not essential. As a startup company, every single penny is crucial. If you run a small e-commerce, decoration of the office is not less important, unless clients visit the office. On the other hand, you must focus on timely delivery. Thus, you can hire or buy trucks.

Figure out what will increase the amount of cash in the business. Spend money on essentials only helps to increase cash flow for startups.

Schedule A Consultation Today!

3. Pay the Bills at the End

While paying the bills or utility charges, try to avoid the cash and debit cards. Using them will drain out the cash instant. For paying the bills, wait till the last few days of the deadline, or the time till when you can avail of the payment discount. Further, if possible, use the zero interest credit cards for paying the bills. It will ultimately offer your cash a prolonged period to stay in the bank.

The much the cash stays in the bank will benefit you more and help in managing the cash flows better.

4. Keep the Cash in Reserve

As per the records, 55% of the businesses with five or fewer employees can only cover one months’ expense from their savings. Further, 30% of the companies don’t keep that reserves too. Thus, these businesses often succumb to these financial vulnerabilities. The report suggests that 31% of the owners say they need to use personal credit cards to borrow the money, and 15% said that they could not cover that expense.

Hence, don’t allow the situation to go to that extent. Keep always emergency funds for the business. It may slow down the growth, but in the end, help in the long run.

5. Get a Professional Help

An entrepreneur needs to manage several works. Often, they able to give time to the finance section that it deserves. Hence, in such a situation, the startup should take help of professional bookkeepers or small business accounting services.

Based on the effectiveness of cash flow management, companies develop their financial and tax planning strategies. Thus, it is better to consider hiring a professional as an initial investment for your business.

Bottom Line

Profits are not worthy enough without any cash in hand. Startups and small businesses that understand cash-flow management early can handle the businesses better.

In case you require any expert opinion to improve cash flow, please feel free to connect with us.

Contact Us Today:

Locations: