What tax penalties can you avoid with top-notch tax services?

As a common proverb, nothing is permanent except death and taxes. Well, even if everyone knows about it, a surprising list of people fail to file the income tax return. Are you one of them who thinks you would be able to evade it? It is time to reconsider your plans. However, why worry when you have experts helping you with the tax services Beverly Hills.

Even if you have not been able to do pay the tax, you must file a return. It is mainly because if you don’t do it, this would give rise to numerous domino effect of consequences. No matter how many individuals tell you that it’s no big deal and the IRS have bigger things to look on, remember the IRS have a job to do. Even if no legal action would be taken against you, if you fail to file the return it would work against you.

By hiring the expert professionals, you can make the most of it and not face negative consequences.

Filing tax return is mandatory

When you are confused about whether to file the return or not, it is always better to leave it in the hands of the experts. You can avail tax services Beverly Hills and ensure that you file the return at the right time to escape dire consequences later

There are instances when you don’t need to file the tax return. For instance, if your income is less than the standard deduction and you don’t owe self-employment taxes, then you don’t have to file any tax return. Even if you don’t have the money to pay the tax, then too you need to send a tax return rather than skipping it completely. Here’s why;

The IRS imposes a fee for not paying the tax and also imposes a separate fee for not filing it. Also, the fee gets charged every month. You sure don’t want to face this hassle, right? This is one of the reasons why hiring tax experts would be beneficial. In fact, whatever you pay or you don’t, you would be able to save big by submitting the necessary paperwork.

You must also consider the facts what IRS does or how they take action when you don’t pay taxes. It involves preparing a substitute return that would be completed without consideration of tax advantages. The best way to find about this is by availing tax services Beverly Hills. The tax experts have all the necessary knowledge that would help you in the long run.

The IRS is also limited to the statute of limitations, which gives you three years time from the date you have filed to perform the audit. This time period starts when you file the return. So, the sooner you get the paperwork done, the chances of IRS audit reduces. The tax professionals can actually help you in it.

What happens if you file the return without submitting the money you owe?

Once the IRS processes the return that doesn’t have a payment or discover that you have failed to file and pay the tax, they would issue a Notice of Tax Due and would demand a payment related to how much you owe in the tax, penalties and interest. However, if you don’t have enough funds for the payment, it is better to avail assistance from tax services Beverly Hills to help you resolve it.

Options for resolving include;

• Allowing a temporary delay

• Setting up an installment agreement

• Settling through an Offer in Compromise

It is better to avail the tax assistance before you land yourself in such tax return issue.

Beverly Hills Address:

Essential Tax Strategies for High Net Worth Earners

No high-income earner wants to pay a heavy tax. In fact, for them, the tax is a matter they prefer to discuss in a hushed tone. Moreover, it appears as if their trying to save money is like cheating the government, which is not the way it is.

For the most part, the tax incentives usually come from the high-income earning individuals. Due to this most of the wealthy people take the assistance of tax filing services from renowned experts. In some of the cases, the taxpayers don’t actually qualify for the tax benefits. There are numerous Americans who earn higher, but fall in the middle-class section or those who have many expenses to cover.

Tax planning is crucial since it helps achieve tax efficiency. It ensures you pay the least amount of tax in the given situation. This type of practice is present for all taxpayers having annual earnings of $40,000 and above. But there are some tax strategies that every high come earners need to follow. This is where a little analysis, proper strategy and your creativity comes into action.

The Current Tax System At A Glance

The present tax system usually taxes the individuals based on the income brackets. This is how it works, the higher your income, the higher the tax you need to pay. The government implements a credit and deduction system that has been designed to limit your tax amount.

You would see that only 1 percent of the taxpayers pay just 40 percent of the federal tax income. Since most individuals lack the skill and knowledge about tax filing, they go ahead and hire tax accountant Los Angeles. Whether you have inherited your family business or you own a business, there are some tax strategies you need to follow to save thousands more on the taxes.

Consider Retirement Accounts

You definitely need to have a retirement plan, after all you won’t be going on working till your death. However, if you really want a comfortable retirement plan, investing in the right type of retirement account is one of the ideal strategies for high income earners.

About 401 (K) Plans

If you are working for a company having 401(k), ensure you make the most of it. This is mainly because the 401(k) contributions consist of pre-tax dollars. This usually gets deducted from your salary or paycheck and gets deposited in the 401(K) account. It is a great plan if you are considering a low tax rate during retirements. If you have an accountant, know about this when discussing tax filing services.

Individual Retirement Account (IRA)

The traditional IRAs don’t actually offer you any tax-deductible benefits if you have a Modified Adjusted Gross Income of $72,000 and the earnings get tax-deferred. However, the IRAs allow you to contribute after tax dollars while the earnings get tax-free. You must keep in mind that if you have pre-tax IRAs, the IRS would usually impose a tax on the accounts during the conversion.

If you are self-employed and you have employees, try setting up a Simple IRA. It is less costly for the business and you need to make a low contribution annually.

Crucial Factors To Consider During Tax Planning

Before you take the assistance of a skilled tax accountant Los Angeles, you need to make some considerations.

Paying tax later is better than paying it now- It is known as deferring tax. If it can be deferred for a later time, it is better for you as a taxpayer. Tax deferring provides you flexibility and if legally possible, you can defer it.

Don’t spend a dollar to save 30 cents- It is a rule that you must follow if you are a business owner, but it applies to all taxpayers. Usually at the year end, the taxpayers always try their best to reduce the taxable incomes by overspending.

A strategy like this actually makes sense if you are purchasing items you wanted always, irrespective of the tax plan. You definitely don’t need to spend money haphazardly just to save a few cents on your tax.

Contact Us Today:

Locations:

The Pros of Outsourcing Tax Services in Marina Del Rey

By hiring experienced and professional tax services in Marina Del Rey you don’t need to handle the tax compliance yourself. The expert CPAs would take all the burden on their shoulders so you can concentrate on other crucial matters. One of the top reasons for hiring qualified professionals is they can handle the diverse needs successfully.

Outsourcing tax services not only saves your time and energy, but also ensures accuracy in your accounts following government rules and regulations. Whether you own a business or you are an individual, outsourcing tax services can really help you deal with it efficiently.

Helps You Focus On Your Work

One of the primary reasons for outsourcing your tax services in Marina Del Rey, it helps you save a lot of time. If you own a business you definitely have a lot of things on your mind and tax services necessarily don’t need to add on to it. Due to this, outsourcing tax services is what you must do. The professionals would carry out all the work so you and your staff can pay attention to other things.

Tax preparation or tax planning is not a piece of cake if you have no idea about it. So, hiring expert professionals would ease your tension since you don’t need to keep all the difficult calculations and things on your mind.

Feels Light on Pocket

Another advantage of choosing to outsource tax services Marina Del Rey is due to the affordability. If you hire tax experts they would do the proper tax preparation and saves a lot of money. Now, if you try to do the same you might not be able to do it correctly. Moreover, it would help you increase the bottom line as a result of reduced expenses. Another way you would be able to save is by not hiring an in-house employee for the same task.

Reduce Or Eliminates Errors

Do you what software or tools are available for calculating your taxes? Well, the tax professionals offering you tax services in Marina Del Rey know which software to use. By using the right tools and methods they help you get the right amount you need to pay thereby reducing errors. Whether it’s tax calculation or tax preparation, they do it all with ease and care.

On-time service availability

One of the other top reasons for outsourcing tax services is due to the availability of fast and on-time service. The professionals know how important it is to get the tax filing done so they offer extremely fast service. However, if you try to do it, this might take time and result in mistakes.

Contact Us

Marina Del Address:

Why Should Your Business Outsource Tax Return Service?

As a business owner the thought of filing taxes can make you sweat. Moreover, if you are a small business owner without proper knowledge, tax services in Marina Del Rey can become a cause of tension and worry. Do you find yourself in trouble collecting all the financial and business transaction records at the end of a year? In that case, hiring professional CPAs can actually come to your rescue.

Preparing last minute tax returns is not only difficult, but also expensive. In fact, recruiting seasonal professionals and then managing them for a short period of time add to the woes. Instead of such problems, you can outsource it by sending all the documents to a skilled CPA.

How does Outsourcing tax services in Marina Del Rey Help?

Made up your mind that you need well-trained and experienced professionals to do the tax filing task? Well, there is nothing like hiring a professional since they are expert in dealing with small business and big business tax services in Marina Del Rey.

More Professionals Available

– The number of CPA is not few, but with the ever changing rules for tax services, it get might get difficult finding the right CPA. In such a case outsourcing is the best thing to do. You would get various CPAs under the firm ready to offer the right assistance.

Reduced Cost

– Many big businesses outsource CPA for tax services not only because they didn’t find any local professional, but to save money. The same applies to many small businesses as well. In fact, after you have outsourced the tax services Marina Del Rey, you can clearly see the benefits. Moreover, the fixed costs would turn into variable ones and the business would be able to redirect funds for better productivity.

Fast Turnaround Time

– When outsourcing tax services you would get a fast turnaround time. In fact, in some cases, it could also be 3 hours to 6 hours. The main reason for this is the wide availability of CPAs. More experts are ready to offer you the fastest result in the nick of time.

Reduction In Paperwork

– No need to worry about keeping all essential documents safeguarded and worrying about losing it. When outsourcing tax services in Marina Del Rey, the CPAs store all the tax related documents online.

Finally, for a hassle-free and smooth functioning of your small business, it is important you consider outsourcing tax services. It is time saving and cost-effective. Moreover, the CPAs have the skill to offer the right assistance to any business and any industry.

Contact Us

Marina Del Address:

Top 5 Tax Deductions That Are Eliminated in 2018

If you are a taxpayer, you should be concerned about the fact that under tax reform, the deductions that you have counted on to minimize your taxable income is not available or it has disappeared this year, 2018. Read below to learn what the tax deductions are that have disappeared this year.

1. Moving expenses:

Before tax reform (the tax years before 1st January 2018), taxpayers had the opportunity to deduct the expenses related to moving for the job or for other purposes that met certain IRS criteria. But, from the tax years starting in 2018 and ending in 2025, you will no longer be able to get the deductibles, unless you are one of the Armed Forces members and you have to move because of military order.

2. Tax preparation fees:

This year, you are also not eligible for getting the deductions for tax preparation fees that fall under miscellaneous fees on Schedule A(Form 1040) if it exceeds 2%. The tax preparation fees include the payments to CPA Santa Monica, tax preparation firm, payments to accountants and the cost of tax preparation software.

3. Unreimbursed job expenses:

For the tax years 2018 to 2025, you will not get deductible on Schedule A (Form 1040), if your miscellaneous unreimbursed exceeds 2% of AGI (adjusted gross income). Unreimbursed job-related expenses include continuing education, union dues, regulatory and license fees, employer-required medical tests and out-of-pocket expenses that are paid by an employee for tools, uniform and supplies.

Also Read: Top 5 Secrets to Ax Your Tax

4. Transit Reimbursements and subsidized parking for employers:

Prior to tax reform (before 2018), the employees used to get the advantage of a perk in which transit pass and parking costs, up to $255, were reimbursed by their employers. These reimbursements were not included in the taxable income of the employees and they used to get deductibles on their tax returns. However, under this tax reform, you will not get the employer deduction anymore.

5. Personal Exemptions:

Prior to the tax reform, the personal exemption allowed the taxpayers to minimize their taxable income. The standard deduction was $12,000 for individuals, $24,000 for married and $18,000 for heads of a family. However, this year, some taxpayers might lose the deductions.

Also Read: Top 4 Myths about Accounting & Bookkeeping and The Truth Behind Them

For any query about tax reform or to hire a CPA Santa Monica to stay upgraded with the latest tax reform, don’t hesitate to give us a call.

Contact Us Today:

Earn Some More! Rent Your Vacation Home Wisely and Save on tax

There is no denying the fact that the tax rules on rental income from your vacation homes or second homes can be quite complicated especially when you rent your home for several months and also use the home yourself.

As a homeowner, if you rent your property or home for 2 weeks or fewer days in a year, you can make the rental income tax free. This happens if your home is close to a vacation destination. You can make some extra money by renting your principal residence for 2 weeks or less. A tax accountant in Culver City can help you to make you understand how you can earn some more money without paying extra tax.

The rental income of your holiday home for 2 weeks or more must be included on your tax return file on Schedule E, Supplemental Income and Loss. Also, your rental income might be subject to the net investment income tax. An accountant Culver City makes you understand about tax rules for vacation homes.

Tax rules for vacation homes:

If you have a holiday home that you mostly use for personal use but sometimes give it on rent for up to 14 days in a year, you don’t have to pay anything as taxes for rental income. In case of rental income for up to 14 days or less, some expenses are deductible. However, you may have to pay for the personal use of the home limits deductions.

What rental home expenses are tax deductible?

There are a number of rental home expenses that are tax deductible. An efficient accountant Culver City will help you to make the list of the expenses that are tax deductible. In order to get the deductions, you have to save the receipts and other documentation.

Below are discussed the expenses list, for which you can claim the deductions –

• Cleaning and maintenance

• Insurance premiums

• Advertising

• Legal fees

• Commissions paid to rental agents

• Condo or homeowner association dues

• Mortgage interest

• Legal fees

• Utilities

• Taxes

What is considered as the rental homes or vacation homes by the IRS?

The IRS considers your mobile homes, condos, and boats as the vacation homes. Remember, if you have a houseboat or trailer with the facilities of sleeping, cooking and a bathroom, it might also be considered as a rental home or vacation home.

Facing problems with how to earn from your vacation home without giving extra tax? Want to learn more about tax rules for rental homes? Then, count on us today. Our expert accountants in Culver City can guide you to earn some extra money even from your permanent residence when you are on a vacation.

Contact Us Today For More Information:

Top 5 Secrets to Ax Your Tax

Tax planning is an integral part of any financial plan. It does not matter whether you are a small business owner or a salaried person, you must be interested in reducing your tax liability. According to the US Small Business Administration’s Office of Advocacy, you might face an average tax rate of 19.8% as a small business owner. If not managed properly, it might increase to a great extent.

The good news is, you can save your tax by filing your tax on time by hiring tax services in Marina Del Rey. Below are discussed a few ways by following which you can ax your tax.

1. Keep separate bank account for business and personal uses:

This is true that unless you are an incorporated company, having separate bank accounts are not required. However, having a separate bank account can be beneficial for you for a number of reasons. When you keep the accounts separate, it becomes easier for you to track the personal and business expenses and prepare tax filing. It also helps you to audit your business transactions easily.

2. Claim your home office deduction:

If you have a home office, you might get a good amount of money back through the home office deduction. You can calculate the home office deduction in two ways. The first one is, you can get the deduction worth $5times of the total square feet of your home office. The second way is, calculating the other utilities, property taxes, mortgage interest or rent along with the square footage.

3. Keep track of the miles driven in your car:

Yes, it is possible to get deductions for business use of vehicles. There are also two ways to calculate the deduction. You can get the deductions based on 54% of the total miles driven or based on the actual expenses of maintenance, gas, repairs, tires, depreciation, insurance and other costs.

4. Hire a family member for an open position:

By hiring a family member, you can be able to deduct his wages as a business expense. Hence, you can reduce the amount of taxable income. Also, light and part-time work around the office can save a good amount of money on tax.

5. Track your expenses and taxes:

If you can record the expenses as they happen, it will help you to save your time and minimize the chance of making errors. Thus, it maximizes the tax returns. It is really difficult to remember what you spent six months ago. But if you have the right track report, you will be able to calculate it in no time.

When you know the secrets to ax your tax, what are you waiting for? You can find several tax services Marina Del Rey that can help you to ax your tax and save money.

Contact Us Today:

Prepare Your Tax Return in a Smarter Way: Make a Strategy

According to a recent study, almost 50% of small businesses in the Us spend at least 40 hours per year to manage their federal taxes. Still, when it comes to preparing tax, most small business owners get overwhelmed. There is no denying the fact that preparing tax is indeed a daunting task for everyone. In order to minimize the hassle of tax return preparation, people often hire tax services West Los Angeles. However, if you want to save your tax, you can make a strategy that can help you to prepare your tax in the most efficient way possible. Below are discussed a few tips that might help the small business owners to make a strong strategy so that they can take a smart approach to taxes.

Tip 1

Hire a financial advisor:

There is no doubt that a good professional financial advisor can be helpful to make you successful with your taxes. A professional accountant maintains all your tax return requirements on a month to month basis in an efficient manner. The financial advisors know how to prepare your tax and save your money.

Remember, the tax season is indeed a busy time for the good financial advisors and the new tax law 2018 has already made them even busier. So, it might be difficult for you to find a good financial advisor.

Tip 2

Find the tax services Consultant in West Los Angeles who is well aware of the ins and outs:

As it has already been discussed that finding a good financial advisor can be difficult especially in the tax season. Therefore, the very first thing that you need to do is to start your hiring process before the tax season. The more you invest time in hiring tax services West Los Angeles the better it would be for your tax return preparation. Now, you might think how to find a good financial advisor who can help you with all your tax return preparation. Well, you should consider an accountant, who has extensive knowledge and awareness of all the ins and outs of tax return preparation.

It means someone who has:

1. Years of experience in this field

2. Remarkable reputation for his/her honesty, efficiency and professionalism

3. A valid license and the proper certification

Tip 3

Use tax technology:

In today’s world of digitization where everything is apps and tools oriented, tax preparation is no more a complex system. With the help of the latest technology, you can get everything within your reach. The technology helps us to go for paperless tax preparation. You can research online for finding a good tax return professional, make a virtual meeting through Skype or other communication tools with your accountant and get all the work done in an efficient way. Also, there are several apps and software that can help in preparing tax, but they are not as accurate as the professional tax accountant.

So, what’s more? Make a strategy for the tax return preparation and get all the benefits of the tax refund. Choosing the professional tax services in West Los Angeles can help you to make your strategy in an efficient way. To learn more about professional tax return solution, you can contact us anytime.

Hire An Agency for Tax Services to Take Care of the Recent TCJA

At the end of last year, the Congress has passed the H.R.-1 – TCJA (Tax Cuts and Jobs Act), which provides the largest change brought in the history of US tax code since the year 1986. The bill was signed and came into law with effect from December 22, 2017.

As per the changes brought into the US Federal tax law, under Tax Cuts and Jobs Act, it would maintain 7 tax brackets but rates would be cut at every level. This has raised the income thresholds of many individuals who now qualify for the higher brackets. For instance, the top rate is reduced down from 39.6% to 37% and this applies only to married individuals who earn more than $600,000, as contrary to the previous current top-level kicking in at $470,000. This is also the level where the highest long-term capital gains rates enter, which results in further tax savings for individuals who are higher taxpayers. Whether it is for your individual tax return or for your business, you need to take help of a reliable agency that offers tax services in Santa Monica. Unless you take help of a professional CPA, there would be chances of error while filing the tax return. So, you have to rely on the experienced professionals, when it comes to taking care of your taxes.

The IRS or Internal Revenue Service has also revised the form 1040-ES and instructions to help the tax practitioners and the taxpayers prepare in advance for the changes that have taken place, in the wake of this recently enacted TCJA. The first quarterly estimated tax payment would be on April 17, 2018, which is also the filing deadline for annual tax. The agency offering tax services Santa Monica calculates the tax for individuals and businesses, even including those who have substantial income that is not subject to withhold the taxes. For instance, the newly enacted tax law has brought in a change in the tax brackets and laws, upped the standard deduction, overhauled business expense deductions, increased the child tax credit, got rid of personal exemptions, and stopped or limited certain deductions. This means that as a taxpayer, you would need to lower or raise the amount of tax you pay each quarter, through this estimated tax system. This is where service of the hired tax professionals is required.

The professional proving tax services in Santa Monica would explain to you in brief about the major tax changes, the income tax rate schedules for 2018, and determines the correct amount of tax you need to pay. The professional also gives a detailed look into all your financial statements, considering each financial transaction, and then helps you to determine whether you need to pay estimated tax, owe Alternative Minimum Tax, or have some other special situations because of the capital gain or dividend income you have. This is the reason you need to select a reliable tax servicing agency and get the best professionals in the industry to take care of your tax-related matters.

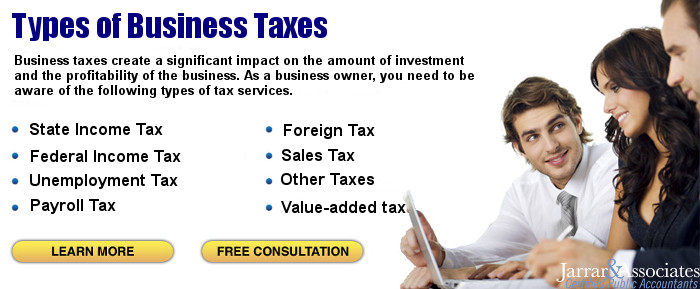

Types of Business Taxes That Need to Be Taken Care of

As a business owner, you need to pay various kinds of taxes, on the basis of your office location, nature of the business, and structure of ownership. Business taxes create a significant impact on the amount of investment and the profitability of the business. This is the reason, taxation is such an important factor in the decision-making process of a financial investment, as lower tax burden allows a company to generate higher revenue or lower the prices, which can then be paid out in the form of salaries, wages, and/or dividends.

As a business owner, you need to be aware of the following types of tax services in Santa Monica:

Local and/or State Income Tax: This is the tax levied by the local or state government on the annual turnover of your business. However, not all states in the US implement state-level income taxes.

Federal Income Tax: The tax levied by the federal government on the annual income of the business.

Unemployment Tax: This tax is allocated to the state unemployment agencies to fund unemployment assistance to workers those have been laid off.

Payroll Tax: As an employer, you need to pay or withhold this tax on behalf of your employees, on the basis of salaries or wages of the employees. In the United States, both federal and state authorities collect some form of payroll tax. The Social Security and Medicare (also known as FICA) make up the payroll tax.

Foreign Tax: If you have a brand operating in a foreign nation, then you need to pay income taxes to the foreign government on the income earned from the branch operating in that nation.

Sales Tax: If you sell goods and services, then this tax needs to be paid to the government. You need to collect the tax from your consumers and pass on to the state. This tax is based on the percentage of the selling price of the products and services and is generally set by the state.

Value-added tax: This is a national tax collected at each phase of manufacture or consumption of a product. Depending on the political climate, sometimes the taxing authority exempts certain necessary living items like medicine, baby food, and other food from the tax.

As a business owner, whether you have a corporate office or a retail store or a manufacturing unit, it is not possible to take care of all such varied types of taxes and decides which are the taxes you need to pay for your business while keeping the focus on administration and operation of the business. So, you need to hire a professional agency that provides tax services Santa Monica.

This is the reason you need to hire a professional CPA, enrolled agent, tax attorney or other such accounting professional, who come with proficient knowledge on tax services in Santa Monica and help to prepare the tax return for your business. The more complex is your tax situation; it is more compelling for you to bring in a tax professional at the earliest.