Year-End Tax Planning Hacks for The Small Business Owner In 2019

Taxes for small businesses can be confusing. Several questions are there roams around the mind. Confusion is not an unnatural thing. Few Questions comes to the mind such as:

- How much do I pay?

- Why do I have to pay this amount?

- How can I reduce taxable income?

However, it is better to do year-end tax planning to avoid these confusions. Preparing everything from the starting helps to win the game at the end. There are 70000 pages in US tax code, and it is impossible for a business owner to go through all these.

The current post includes a small business year-end checklist that can help you save tax money.

Adjusted Gross Income (AGI)

Many tax breaks, limitations, and additional taxes tee off of adjusted gross income (AGI) or modified adjusted gross income (MAGI), which for most filers is the same as AGI. One can enjoy a 0.9% additional Medicare tax unless the AGI exceeds $200,000. The limit exceeds $50000 more in case of being married and filing a return together.

Review the Tax Withholding

In the case of tax withholding, one may suffer issues. Therefore, while you are doing year-end tax planning, you must review it. The tax reforms can change your tax withholdings. It’s not too late to make an impact this year, and you can also make changes for 2020.

Review the Business Structure

The tax amount largely depends on business entity formation. If you have 2019 year-end planning ideas in mind, then you must think about the entity formation as well. It will help you save a good amount of tax.

A big change in the tax law in this year decides how business entities are taxed. Corporate tax rates were cut, and pass-through entities will get a break. Structure your business now to avoid a good amount of money. Remember, in business, a single penny also counts.

Use the Accountable Plan

If you pay for the travel, entertainment, tools, or other costs to your employees, then it is recommended that you must continue it further. However, use a plan that is permitted by the IRS known as an Accountable Plan.

Using this plan, you can deduct the amount from the business, but these reimbursements will not be recorded as income to employees. It will save company employment taxes and lower taxable income overall.

Give your employees an accountable plan for reimbursements. It can help your employees save money, as well as help your business — it’s a win-win.

Plan Smart Tax Deductions

Several ways are there to save tax money. However, it depends on the company that will select the usual ways or will go for smart tax selection. While doing year-end planning, you must have to be strategic in your choice.

For example, one can deduct up to $1million for gaining machinery and equipment for the business. Those who are startups can ask their accountants to put the cost under the depreciation. Further, one can claim disaster losses happens like that. A business can also deduct the business insurance amount that they pay every year. IRS Form 1040 can help you determine the business insurance deduction.

Write off Bad Debts can save taxes

One can write off the bad debts prior to the year-end. In addition, you can use the uncollected debts for lowering your profits. During the year you have some accounts receivable which you face difficulty to collect.

During the year-end, if you find that a customer did not pay you for a long time, you can write off the balance amount from the total. You can add all the bad debts to avail a tax deduction. However, you must sit with your accountant before adding to the list.

Final Words

Therefore, over here you have seen the ways year-end tax planning can save a good amount for your small business. However, it is always a good idea to hire a professional to maximize the benefits.

How to Choose Which Type of Business Entity Will Suit You?

Million things one needs to keep in mind while starting a business. The owner needs to handle things like, raising funds, hiring staffs, fabricating marketing strategies, paying salaries, etc. However, before all these, you need to know the type of business entity structures and what is entity formation.

Your sole decision can influence your legal and financial sides of the business. The taxation of a business largely depends on the entity type of your business. Based on the entity type you can also get loans and can ask the investors to raise the money for the business.

In this post, the four business entity types will be discussed with their pros and cons, which are generally selected by the small business owners. It will help you to know how to choose the right business entity?

These are as follows:

- Sole proprietorship

- C-corporation

- S-corporation

- Limited Liability Company (LLC)

Sole Proprietorship

A sole proprietorship is a simple business entity where there will be a sole owner or operator of the business. In case you are launching a business on own, it will automatically come under the sole proprietorship entity formation. There is no need of registering the business with the state, but only the owner has to get the local business permits or licenses needed for the injury.

Pros

- Easy to start

- No corporate formalities or paperwork

- You can deduct most business losses on your tax return

- Easy to file the tax returns by simply filling Schedule C-Profit or Loss from business to your income tax return

Cons

- Being the sole owner, the liabilities & debts depends on you

- Difficult to get loan or investors

- Hard to build business credit without registering the business entity

C-Corporation

A C-corporation entity formation is a completely separate legal entity without having any connection with the owner of the business. The entity is controlled by the Shareholders (the owners), a board of directors, and officers. However, a single person can play all the roles. So, without any hassle, you on own can handle all these.

Pros

- No personal liability of the owner for the debts and liabilities

- Gets more tax deduction than other types of entities

- The owner usually pays low self-employment tax

- The stock option enables you to raise more funds

Cons

- Expensive to create such an entity, difficult for startups

- Double taxation as the company pays tax on the corporate tax return and individual shareholders on personal tax returns

- Owners won’t be able to deduct business losses on their tax return

S-Corporation

The S-corporation preserves the limited liability but offers a pass-through entity to the owners for tax matters. No corporate-level taxation is there in the S-corporation.

Pros

- Owners are not personally liable for company liability and debts

- No corporate taxation and no double taxation

Cons

- Creation of an S-corporation is a costly affair. It is difficult for a startup with limited capital to go for S-corporation entity formation.

- Limits are more in issuing Stock in S-corporation than of C-corporation

- Needs to maintain all the corporate formalities

Limited Liability Company (LLC)

It is probably one of the most preferable entity formations among the business owners. LLCs offer limited liability protection, but the amount of paperwork and other requirements are very less. Another important aspect of LLC is that it offers you to choose how IRS will tax you such as a corporation or a pass-through liability.

Pros

- No personal liability for the debts or liabilities of the business

- Option to choose how IRS will tax you such as a corporation or a pass-through liability

- Very fewer corporate formalities to follow

Cons

- Expensive to create the LLC in compare to any other entity formation

Final Words

Over in this post, four of the most used business types are being discussed. In case, you are looking for any advice you can get connected with us.

However, if have to smooth to say, please feel free to comment. It will be great to from you.

Contact Us Today:

How To Make The 2020 Tax Season Effortlessly Easy?

With the 2019 tax season coming to closure, you might be happy to forget about taxes again for another year. But if you do it, you would be making next year’s tax season quite difficult for yourself.

You might file a tax return just once a year, but taxes affect you all through the year. Now, by understanding this and starting to prepare for the taxes now, you can make tax season 2020 a really smooth ride.

Here are some of the steps you must take to get all set for the next tax season.

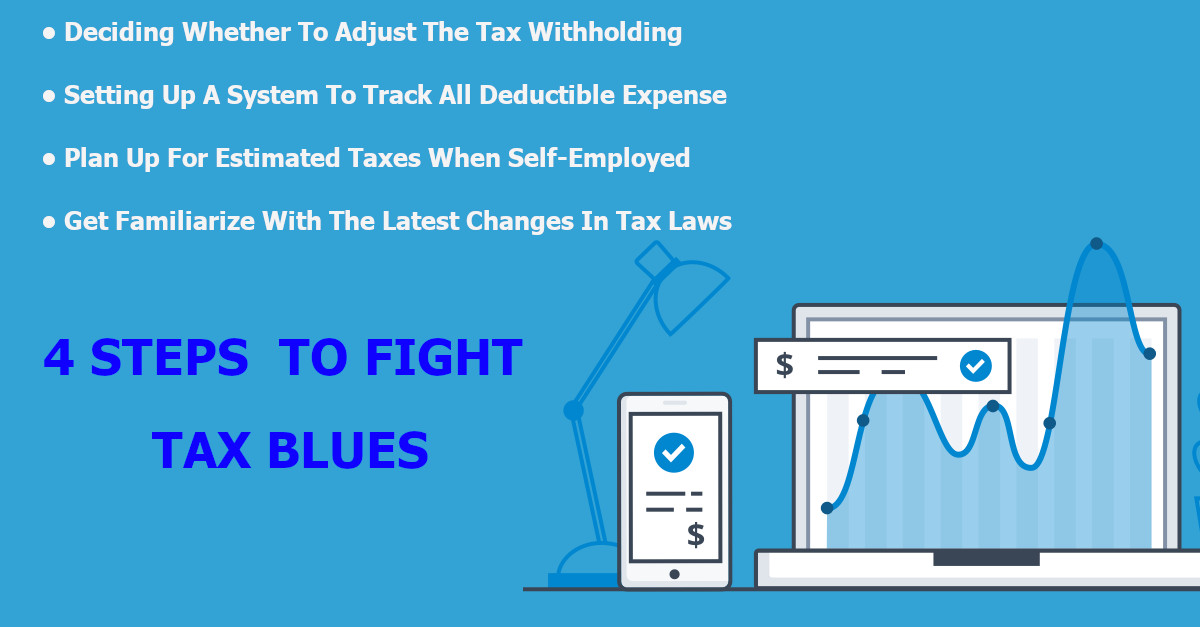

Deciding Whether To Adjust The Tax Withholding

When you are an employee, the government takes a cut of the earnings from each paycheck. The amount it deducts usually depends on how much you earn and how much tax allowance you have claimed.

The more allowance you claim, the less money the government would tale from the paycheck. Generally, single adults tend to claim one or more allowances, while working parents might claim more.

When you claim more allowances, the paychecks become larger, but the tax refund check might be smaller. This is mainly because the amount you pay through the year is closer to the tax liability.

You surely don’t want to claim more allowances than you actually should, else you might owe taxes at the year-end.

Talking to experienced accountants can surely help since they would be able to offer better assistance.

Setting Up A System To Track All Deductible Expense

This applies to self-employed individuals who might need to deduct office expenses and travel expenses as well as other business-related costs on the taxes.

However, there are other deductions that any person can qualify for, such as medical expenses that exceed more than 10% of the adjusted gross income. This is the income minus certain tax deductions for 2019 as well as charitable contributions you have made to churches or non-profit organizations.

To make things easier, it is better to set aside a folder for the receipts and all paperwork that’s related to tax deductions so you have them at one place when dealing with tax season 2020.

If you think you aren’t confident enough, it is always better to hire accounting professionals for more assistance.

Plan Up For Estimated Taxes When Self-Employed

Usually, self-employed workers must pay taxes quarterly as they don’t have regular paychecks the government can withhold taxes from.

Now, failure to pay estimated quarterly taxes might result in a penalty. So, if you were self-employed in 2018, the 2018 tax return must indicate how much you should pay in each quarter based on the 2018 earnings.

However, you need to set aside more or less when you expect the earnings to be either high or low in 2019. If you pay the amount suggested on the 2018 return, you wouldn’t get hit with a penalty even if you earn more this year.

Get Familiarize With The Latest Changes In Tax Laws

Each year, the government loves to tinker with the tax laws. However, the tax brackets often change and so does the value and qualifications required for tax deductions.

Even though you don’t need to understand all tax rules, but is no doubt better to familiarize yourself with the key changes that might affect you in 2020.

Hiring skilled accountants would help since they are well accustomed with all the tax rules and the changes.

You must remember that the taxes would be enjoyable. Moreover, if you lack proper knowledge, it can often become a nightmare. If you don’t want that, you must hire trained professionals to help you.

Contact Us Today:

Locations:

How Much Should You Keep Aside For Small Business Tax?

Not quite sure how much you need to save for small business tax? There are many ways to go ahead calculating what you actually owe and saving the right amount.

The right method to use would depend on how long you have been in the business, how stable the income, how willing you are to crunch the numbers, etc.

Now, if your business is losing more than it is making, you need to pay tax! Moreover, if your business is making money, here’s how you can save in this tax season.

Hiring experienced professionals offering tax services can be of great help.

First Step: Get Clear On Your Tax Obligations

In the guide, we have come up with methods that would help you set some money aside for the taxes your business actually owes. It means your self-employment tax as well as income tax that you and your business, most likely pay the IRS on a quarterly basis.

When you hire employees, you would need to deal with employment taxes. But the federal taxes are just a tax pie. Also depending on the nature of your business, you might have to pay a variety of local and state taxes.

For instance:

- Sales tax: Most of the states actually charge you sales tax that you collect at the time of making a sale.

- Franchise tax: If you have sales tax nexus in any state, the state might charge you a franchise tax. But how this tax would be calculated differs in every state.

- Property tax: Charged on real estate you or your business operates, property tax actually varies state by state.

But you need to consider that this list is not comprehensive. The only sure-shot way to determine the business’s tax obligations is to work with a qualified CPA. They help you and outline what the tax services your business needs and guide you on how and when to pay.

Tip: it is your responsibility to set the money aside for all the taxes the business is obliged to pay- federal or state- all through the year.

Second Step: Just Use 30 Percent Rule To Save For Taxes

In order to cover federal taxes, saving 30 percent of the business income is the rule of thumb. It has been found that the total amount you must set aside to cover state and federal taxes must be around 30%-40% of what you actually earn.

Now, tax obligations differ from one business to another. If you would like to get granular or see if you can get away with saving less than 30%, you must talk to your CPA.

He would help find what percentage of the business income you save to cover taxes.

Third Step: Choosing The Proper Saving Method

You must set aside money for the small business taxes as often you can. The best savings method for your need would depend on what type of business you run as well as how long it has been operating.

The per payment method- this method makes real sense if you haven’t been in business for real long, or if this is the first year filing the tax return for the business.

The monthly method- this is the best to if this is this is the first year of your business that has turned profitable.

The yearly method- if you have filed tax return for the business last year and don’t expect the business to change a lot this year, you can opt for the yearly method.

The hired CPA can actually help you choose between these payment methods of tax services.

What Happens If You Underestimate The Tax Owed?

As per the rules set by the IRS, as long as you pay 100 percent in the present year of what you paid the earlier year in quarterly estimated tax, you wouldn’t be penalized for underpaying. Yes, even if the amount is too low you wouldn’t get penalized.

4 Things You Can Do to Help Your Tax Preparers

Tax preparers always to try to help their clients in their tax preparation process. However, you can help your tax preparers also by doing certain things. One of the very common things is to make your tax preparers updated about your business with all the necessary information.

Often during the tax preparation process following issues come in front.

- Unorganized information

- Pile of receipts

- Incomplete paperwork

- Less communication with Tax preparers

However, the current blog post will let you aware of the ways you can help in tax preparation services.

Updated tax related information

Often it happens that people used to change the addresses of but forget to update that to the tax preparing agent. However, often people take it as a small and petty issue but it is not. The tax preparers cannot be able to communicate with you. Neither, they can update your information to the IRS authority who can contact you in case of an emergency.

It can create a lot of mess and can lead to a crisis. Therefore, by letting your Tax consultant about the updated information, you are ultimately helping your own business. It is not about only the address but you must let your tax consultant know about all the updates.

Pile of Receipts

Often it has been seen that people used to put a pile of receipts in front of their consultants during tax preparation services. It looks great that client has kept all the details. But often the work becomes tiresome when you found the bills of ice-cream, pizza and others in that pile.

Therefore, it is better than before you submit the receipts to the tax preparers, you check it once. Those which are completely personal expenses, keep those aside. However, in case you are not being able to understand or have confusion about any expense, then keep them in another pile. Do not mix all the receipts in one.

Incomplete paperwork

Often small business owners used to send the information not once. Thus, sending the incomplete papers create often confusion for the tax preparers. Additionally, in the case of sending the paper at different times can often lead to the misplacements of the papers. One must understand that a singular misplacement can create a huge issue.

Additionally, often the business owners send the papers at the final time when the process has taken a shape. Changing these phases can be huge issues. It also increases the chance of error.

Less communication with Tax preparers

One of the issues often tax consultants faces during the tax preparation services is the less amount of communication with the clients. Often people used to contact the tax preparers at the final moment. One must understand that often the tax consultants used to have several clients to handle. Thus, getting the work done at the last moment makes it difficult, especially for the small tax consultancy firms.

It is always advised to keep the communication with the consultant throughout the year. One must know that tax preparation is a complicated matter and the more time means, more chances of saving. Therefore, continuous communication will not only let your tax matters updated but also helps in reducing the error.

Final Words

Over here you have seen that way you can help your tax preparers during the tax planning phase. To get the help with your tax matter contact us now.

Contact Us Today:

Locations:

How Can You Spot IRS Scams And Report Them?

If you are getting hounded by numerous calls, emails or letters from the IRS, how do you know these are legit? There are some warning signs of scams that you must always lookout for.

Every year you might seem to get numerous calls from scam artists who pretend to be from IRS. Whereas some people can identify the scams, others may not be able to identify and fall for it.

There are many elderly people who fall for such scams, especially widows since they might be a financially or technically less sophisticated.

With every tax season, it seems these scams get more advanced, increasing the chance of odds enticing innocent people into sharing personal information making unrequired payments.

To avoid falling for such traps, ensure you hire accountants.

Lookout for phone calls

It is rare for the IRS to call taxpayers. In fact, the IRS also initiates most contact through regular mail and not by phone. Even when it calls for a taxpayer, it would send many notices by mail. Along with this, the IRS don’t leave urgent time-sensitive calls where you need to immediately pay the tax bills.

There are robo-calls tapping the honest people who wants to do the right thing. When you are told that you owe money, they become really scared and accidentally break the law as they don’t want to get into trouble. They mistakenly follow the instructions to make payments, at times wiring money.

Now, it isn’t always a recorded voice. At some real people give you a call. If they are demanding in any ways, that’s a warning sign you might fall into a trap.

Beware of fake emails

Phishing is the actual term that is used to describe email attempts to get sensitive information appearing to look like it has been coming from a trustworthy organization or person. They might often link to fake websites that might seem real.

Apart from that, they often ask for real information to make refunds, this allows you to steal money out of the accounts.

If you don’t want to fall for such traps, it is better to hire accountants who can guide you and help you avoid such scams. Even by clicking on the links, it allows malware to be installed on the phone or PC, allowing the bad guys in so they can get exact information and capture your activities.

Take note of letters

It is easy for any graphic designer to take the IRS logo and make letterhead appear official. At times, they even create supporting documents that appear really official.

They even use the website’s URL that look quite close to official website address, with one or two letters differing. If you get a letter from the IRS it seems suspicious, you must call the agency to verify if they have contacted you.

Now, if the letter is real, the IRS would confirm it. If not, they would be help you track the latest scams. You can visit https://www.irs.gov/ to know more. If you have doubts, you must always check with a financial planner, an accountant to ensure the request is legitimate.

Finally, you must always stay alert when it comes to receiving any calls or emails from the IRS.

Critical Financial Challenges Faced By The Business Owners

A successful business venture may not always result in successful wealth creation. Often due to several challenges, owners found it difficult to convert the business into a wealth creation machine for own. However, a senior CPA mentioned that conversion of the business into a wealth enhancement machine requires some systematic approach.

Before that, we must figure out the financial challenges that business owners usually face. Here is a list of challenges which one must overcome.

How to Overcome Financial Challenges – Finalizing Strategies to lower the tax levels

The biggest challenge business owners used to face is to lower the tax amount by following all the government norms. If you can reduce the tax amount, it will help you to save more wealth for your business and personally. Here are some common things that help in tax management.

Business Entity: It is about the structure of the business that determines the tax. Like if your business is S corporation then you can show the losses to the personal tax filing. It will lower your overall tax value. But you will not get this benefit in C corporation.

Tax deductibles: You can buy a property on your own and can then lease or rent it to the business. It will benefit you in two ways. You can show the depreciation in the personal tax and can show the rented property in your business expenditure.

You need to adjust your financial goals to and plan the strategies to get the best benefit out of it.

How to protect the business against the loss of a key person?

It is difficult to fulfill the loss on a personal level but you can manage the revenue loss if you plan strategically. It is true that most of the small business used to stay on some key people. So, plan it in prior in the following way:

An owner must also make sure that in case of his absence or demise his family must get the due benefit from the business.

Protecting the business and property against liability

Legal aspects are crucial in managing the business. However, it is important to protect your business against legal liabilities. A legal entity can play a crucial role in this. It may not be able to protect the business assets but can help you to protect the personal properties. You must do the following:

- A periodic review of all the documents

- Make sure that all the employees are working in the designated sphere

- Make a review of the unutilized cash or asset to avoid the depreciation

- Review the taxation matters

You know that failing to pay the proper tax can create several issues. However, you must know the ways to save taxes to protect your business against any liability.

Final words

Therefore, you can see that it is not very difficult to overcome the challenges. However, what is needed is to plan strategically to stop the challenges to become detriments for your business.

Contact Us Today:

How to Save Taxes for The Small Business Applying These 5 Techniques?

Tax saving is an important matter for all types of business. However, the small business owner faces several difficulties due to the restricted amount of capital for the business. A CPA for tax preparation for years mentioned the importance of knowing the tricks and way to lower the taxes. An experienced CPA can help a lot in saving taxes.

In this current post, we will discuss some of the ways to save taxes for small businesses:

You must look for adjusted gross income (AGI)

One can adjust several tax breaks limitations through the AGI or Modifies Adjusted Gross Income (MAGI). You can avoid 0.9% Medicare tax over the earned income by not exceeding your AGI $200,000 in case of being single. However, if you are married it is more $5000.

Never to look over the carryover

Some limitations on the deduction and credits are there, which you cannot use in the same year. However, you have permission to carry some of them over to the next financial year. Therefore, it is important to keep track of those carryovers. You can use them in the next year.

However, if you will hire a CPA for tax preparation, they will automatically include this during preparing the tax preparation. Some of the examples of such carryovers are as follows:

• Capital losses

• Charitable contribution deductions

• General business credits

• Home office deduction

• Net operating losses

Related Article: Role of CPA’s For Business

Leave the Property rather than selling it

If you find a particular property has no value, it is better to leave it in the way instead of selling the property for a less amount. Remember that amount that you will get by selling the property will come under taxable income.

On the contrary, leaving the property as it is will be countable as a loss to the company, which is deductible.

You can classify the property under Section 1231. It allows you to show it as capital or ordinary loss.

Look out for tax-free ways to generate income

Salary, bonus, share distribution all come under the taxable income of the business. However, certain ways are there which do not come under taxable income. Your accountant can help you with the following matters:

• Medical Plans

• Retirement Plans

• No-interest or lower interest loans

Use the fringe benefits for employees

Giving fringe benefits to the employees can lower the amount of taxes for your business. in IRS Publication 15-B (2017), Employer’s Tax Guide to Fringe Benefits, you can find the details of the fringe benefits. Increasing the wages of the employee can increase the tax but give fringe benefits can be a smart way to avoid tax. Following things, you can consider in this regard:

• Health benefits

• Long-term care insurance

• Group term life insurance

• Disability insurance

• Educational assistance

Therefore, you can see several ways are there to save a good amount of tax. However, hiring a CPA for tax preparation can help you more to save the taxes for your business.

Contact Us Today:

Locations:

Outsourced Payroll Service Providers Can Really Be an Asset

With many companies looking for various ways to save on the operational costs, it is better to look for outsourced payroll services provider who can actually help the company oversee the financial management.

Most of the payroll service providers operate to help you handle staff wages, government taxes, update employee benefits such as sick leaves, vacation leaves, etc., as well as impose the deductions needed by the federal and state government.

However, businesses that would want to make the most of their time as well as remove the burdens of handling employee payroll functions, getting the assistance from a third-party management team is like a boon. It reduces the burden in hand as well as worker expenditure.

Offering Convenience and Accuracy Like Internal Finance Department

Running each and every department in the company requires proper precision and skill that might sometimes turn into a huge tiring task. However, outsourcing the financial department is one of the best things to do to reduce the overall burden. Moreover, experienced accountants would relive you from incurring extra personnel so you can concentrate on other aspects of your business.

There is nothing an outsourced payroll services provider since they have all the skills and expertise you need to streamline payroll service. Many big and small businesses are taking to hiring an external service provider who can help you in streamlining your services for the betterment of your business. The service providers have their own team and don’t disturb your operations.

Ensures The Company Complies With Federal And State Laws

The payroll department needs to get updated with the new laws that has been passed wit the Federal and State government. Now, being up to date with the new legislation might be difficult if you have too many things on your mind. However, with outsourced payroll services, you never need to worry about keeping yourself updated with so many laws. Since it is the work of the experts, leaving it on their hands in what you need to do. Moreover, the best service providers stay updated on new and existing laws as well as legal issues.

Since payroll service is an intricate process, most big and small businesses take the help of external service providers to make financial management, easy and hassle-free.

Finally, hiring payroll service providers can be extremely cost-effective since you get expertized service without paying a lot. The experts know what service suits your need and offer it accordingly so you can concentrate on other important matters except payroll of employees.

Contact Us Today:

Locations:

Projected to Owe Taxes Coming Year – What Should Your Tax Planning Be?

With the onset of a new year, you might wonder about the tax plans for the next year and how you must prepare for the tax season. Now, with the constant tax reforms coming up, it is essential to hire experts who can assist you in tax planning Beverly Hills. Tax reforms might also mean you owe money next year. What would do you to prevent that? Well, this is when the tax services professionals actually come to your assistance to help you ease the tension.

It might also happen that you miscalculated the numbers and you owe money. However, there’s nothing to panic as you have tax planning experts by your side to help you out of this situation.

Here are some of the tax planning tips you must follow

Contribute Towards Retirement

Not only are you building up the retirement stash, but if you are doing it, you are also contributing to traditional IRA thereby lowering the taxable income now. You can find out the contribution limit for 401(k) For your IRA. However, the tax accountant would always be at your service. By contributing to retirement plans you can easily save on your taxes.

Donation For Charity

The holiday time is great to clean your home and to give those in need. You can help others while reaping the benefits. Ensure you consider a donation to charity organizations as part of your tax planning Beverly Hills. This would help you get benefits of tax deductions for non-cash and monetary donations that you have donated to a recognized charitable organization if you can itemize the tax deductions.

However, if you volunteer at any proper charitable organization, do not forget to deduct the mileage that’s driven for the charitable services. When you choose a proper tax accountant, he would track the yearly donation and the mileage for volunteering.

Don’t forget to count on the taxes by donating. However, even if you donate by paying through your credit card, you don’t need to pay it off to get a tax deduction.

Consider Things You Do Year Long

Do not forget that things you actually do in your daily life when thinking tax planning Beverly Hills would amount to tax deductions or credit that might improve the tax picture. Also, don’t forget to start gathering important receipts for the tax-deductible expense such as college, medical, childcare and more so that you can include it in the taxes.

Know Your Stand

When you move to the end of the year, you must find out where you exactly stand, especially with your taxes and the finances. This would help you make good monetary moves. However, if you haven’t found out yet, you must go ahead and review the numbers carefully.

By hiring tax professionals for tax planning Beverly Hills, you would be able to find out exactly your financial status and make the right tax saving moves.

Start Saving Early

One of the other things that you must do is start saving early. This would give you time to start planning how to pay and save. If saving becomes difficult for you, start up with a money challenge.

Beverly Hills Address: