Top FAQs On How To Pay Property Tax Online?

Have you been wondering how to pay property tax online? This easy-to-understand blog will help you know everything you must about property taxes.

What Is Property Tax?

Municipal authorities like municipalities or municipal corporations impose a property tax on real estate owners.

Some of you may call it house tax. The government uses your information to maintain and upkeep local civic amenities. These include parks, street lighting, sewage, roads, and other infrastructural facilities. The tax helps keep them running to serve the purposes of the localities.

Schedule A Consultation Today!

How To Calculate Property Tax?

They calculate property taxes by multiplying the assessed tax value by the tax rate. Property taxes apply to assessed values, and the rate varies according to location. The standard Californian tax rate is 1% per proposition. So, the residents pay the set percentage of their property’s value for real property taxes. If it seems complex, avail professional tax services in California for errorless filing and repayment.

When Is Property Tax Due in California?

The first installment of the secured property taxes is due November 1 and inadvertent beyond December 10. The second installment is due February 1 and inadvertent beyond April 10. Property tax deadlines are December 10 and April 10. Do not confuse it with the IRS. The best way to avoid missing deadlines is to subscribe to e-notifications.

However, taxpayers can pay both installments together during the first due. There is no penalty for not receiving a bill.

How To Pay Property Tax Online?

Professional business accounting services can help you pay your taxes effortlessly. The other easy way is to use electronic software called eCheck. It is free to use and requires your PIN (Personal Identification Number). You can find it printed on both unsecured and secured property tax bills.

Secured property tax bills have a unique PIN for each AIN (Assessor’s Identification Number). For unsecured property tax bills, every PIN is unique to the bill number and roll year. The per eCheck limit is $999.999.99.

Where To Pay Property Tax by Credit or Debit Card?

Apart from paying using software, you can pay property tax online using your cards. The transaction limit is the same but includes a service fee of 2.22% of the transaction amount.

You need to use your PIN on your unsecured property tax bill for your current unsecured property taxes. You have the option to pay 24 hours a day, every day of the week before midnight.

How Much is the Property Tax in California?

The overall property taxes in California is below the national average. While the national rate is 1.07%, the average property tax rate is 0.73%.

What States Don’t Have Property Tax?

The US enables each state the ability to discern how it generates revenue through taxation. Currently, it has nine states that do not tax income at the state level. These are:

● Wyoming

● Washington

● Texas

● Tennessee

● South Dakota

● New Hampshire

● Nevada

● Florida

● Alaska

But every state includes property taxes. Here are the ten lowest:

● New Mexico (0.55 percent)

● Mississippi (0.52 percent)

● Arkansas (0.52 percent)

● South Carolina (0.5 percent)

● West Virginia (0.49 percent)

● District of Columbia (0.46 percent)

● Delaware (0.43 percent)

● Alabama (0.33 percent)

● Hawaii (0.26 percent)

● Louisiana (0.18 percent)

Are Property Taxes Included in Mortgage?

Yes, a property owner’s monthly mortgage payment usually includes 1/12th of the annual property taxes. While some lenders manage their taxes by preparing an escrow account and replenishing it with monthly payments, small business accounting services can play a crucial role.

Lenders safeguard the tax bill to secure their investment. Any government claims for due property taxes must be paid from the foreclosure sale if they foreclose on your property. So, lenders ensure all the taxes are paid.

Conclusion

These are some of the most critical pieces of information property owners need to understand their property taxes. Now you know how to pay your property tax online and the due date and calculation process. Since all of these can be complicated if you are not familiar with tax procedures, you can consult with a professional tax and accounting company for assistance.

Contact Us Today:

Locations:

Are Fringe Benefits Taxable- What To Know?

If you love your job, at least part of the reason for your happiness at work might have something to do with fringe benefits you receive.

According to the IRS, the fringe benefits as pay that an employer gives an employee for performing services. Fringe benefits are usually taxable unless the law particularly excludes the benefit from taxability.

As per recent numbers from the Bureau of Labor Statistics, employee benefits account for about 32% of the total cost of compensating employees.

Benefits may include everything from paid leave, retirement savings to flexible work arrangements, and more. The trick here is understanding whether there are taxable fringe benefits.

Are Fringe Benefits At All Taxable?

What Is De Minimis?

You may be familiar with several benefits included in the above list. But unless you deal with human resources and employee benefits as part of the job, the term de minimis benefits may not be familiar.

The IRS defines de minimis taxable fringe benefits as any property you provide to an employee that has little value that accounting for it would be unreasonable or administratively impractical.

How Are Fringe Benefits Taxed?

If the employer provides taxable fringe benefits, the value of those benefits must be determined before January 31 of the following year. This would let the employer withhold and deposit payroll taxes.

The value of those benefits is determined using the general valuation rule, which is basically the fair market value of the fringe benefit. For many fringe benefits, this is really easy.

Your employer can even add the value of your fringe benefits to your regular wages and apply an ordinary withholding rate to the total, or they can withhold federal income tax at a rate of 25%.

How Does W-2 And W-4 Differ?

The W-4 is a form that employees need to fill out and employers use to help determine federal tax withholdings all through the year. It’s information that’s necessary prior to or during that tax year. The W-2 form is the one that employers send to employees who made $600 during the year or for whom they withheld income.

How Did Tax Reform Impact Fringe Benefits?

The Tax Cuts and Jobs Act eliminated the tax breaks for few taxable fringe benefits. As of January 1, 2018, your employer should treat some fringe benefits as taxable income, that used to be tax-free. It includes:

Moving expenses– The TCJA eliminated the provision for tax-free reimbursements of moving expenses unless the employee is a member of the US armed forces and inactive duty.

Employee achievement award– Before Jan 1, 2018, an employer could recognize employees by providing tax-free achievement awards in terms of cash, gift certificates, and more. These must be included in the employee’s taxable income.

Finally, from an employee’s perspective, handling fringe benefits should be simple. Your employer is responsible for figuring out which fringe benefits to include in taxable income, how much tax to withhold on the amount, and what needs to go in your W-2 bill.

Contact Us Today:

Locations:

Tax Law Changes To Know Before Filing Tax Return In 2021

With 2020 over, it means the tax season to account is round the corner. Just like 2020, this tax season promises to be full of unique considerations- due to the coronavirus pandemic.

So it is essential to familiarize yourself with the latest updates to the IRS tax code and how it may affect you. The IRS is pushing the filing deadline back this year.

Below listed are the biggest tax law changes you will want to take heed of when filing in 2021.

Increase In Tax Brackets

What tax bracket your household income comes under defines what tax rate you will have to pay. While rates remained the same for 2020, the tax brackets increased by a few hundred dollars since 2019 to account the inflation.

You can determine at what percentage your income will get taxed this year from the AARP chart.

Standard Deduction Increased

The standard deduction for the tax year 2020 increased relative to inflation by $200 for single or married taxpayers filing separately, $300 for heads of households, and $400 for married couples filing jointly.

Remember, you can opt for itemizing deductions that take more time to calculate but may be worth it if the expenses exceed the standard deduction amount.

What To Know About Postponed Tax Deadline?

The IRS announced that it planned to extend the usual April 15 tax deadline to May 17 2021. This extension is necessary to give US citizens some needed flexibility in a time of unprecedented crisis.

This one of the tax law changes 2021 that you must know about that will prevent you from confusing tax deadline

Greater Deductions For Charitable Contributions

Under the Coronavirus Aid, Relief, and Economic Security Act, taxpayers no longer have to itemize deductions to write off charitable contributions. It is one of the other tax law changes 2021 you should be aware of.

If you do itemize deductions, you can deduct up to 100% of the remaining adjusted gross income based on how much you contributed to charities.

Medical Deductions

Under a bill Congress passed, Americans can now deduct for 2020 and beyond out-of-pocket medical expenses that exceed 7.5% of their AGI.

It is good news for taxpayers getting enough health care last year, provided they itemize deductions to write off the treatment bills.

Schedule A Consultation Today!

Unemployment Benefits

According to CARES Act, taxpayers under 59 ½ were allowed to withdraw up to $100,000 from their 401(k) or IRAs. That too without incurring an early withdrawal penalty.

The downside is that money taken out of the tax-deferred retirement accounts prematurely will be taxed as ordinary income.

You can still score a refund on that tax amount by replacing the emergency withdrawals in 401(k) or IRA within three years.

More Time To Deposit In IRAs

Under the Setting Every Community Up for Retirement Enhancement Act of 2019, owners of traditional IRAs can continue depositing money into them past the earlier ceiling age of 70 1/2.

It means an ongoing chance for seniors to defer paying taxes on whatever income they stashed away in 2020, though the funds will get taxed on withdrawal down this road.

It is another crucial tax law changes you should be well aware of.

Increased Threshold For Earned Income Tax Credit

Any refundable credit eligible to low- and middle-income earners, the Earned Income Tax Credit got a bump in the maximum credit amount available and the income limits they get.

For 2020, taxpayers are eligible if the adjusted gross income isn’t higher than $50,594 or $56,844 for those filing jointly as married.

This credit can help save anywhere from $538 to $6,660 on taxes, depending on income; and household size. Keep this in mind as it is one of the crucial tax reforms 2021.

Finally, if you did take some money out of 401(k) or traditional IRA and you are facing a huge tax bill, don’t panic! You have three years to put the funds back and get a refund on any taxes you paid on that money.

Contact Us Today:

Locations:

IRS Tax Levy: What It Is and How To Get Exemptions?

Tax levies put your assets at risk. To remove them, you need to work with the IRS to pay your back taxes. A tax levy is a serious business if you owe back taxes.

Here’s how a tax levy can affect you, and how you can remove the IRS levy.

What Is An IRS Tax Levy?

A tax levy is the seizure of property to pay taxes owed. Tax levies can include penalties including garnishing wages, seizing assets and bank accounts. Tax levies show up after you have gotten a tax lien. It is a claim the government makes on the property, when passed due on the income taxes.

![]()

What To Know About IRS Levy Exemptions?

Pay The Tax Bill

Sounds obvious, but in most cases paying back taxes is the only way to stop the tax levy. The most important thing is to cooperate with the collection action. If they ask for something, you give it to them.

Get On IRS Payment Plan

Your tax balance will accrue interest and penalties until it’s paid off, but if you allow the IRS to take three consecutive payments, you may convince the IRS to withdraw the lien from public record.

Ask For Offer In Compromise

It is a request to settle your back taxes for less than the full amount you owe. Beware: the IRS accepts fewer than half of the applications it gets in a year. You also won’t be considered if you are in bankruptcy or being audited.

File An Appeal

You have 30 days from the time the IRS notifies you of its intent to levy an asset to make a formal appeal. This appeal temporarily stops the IRS levy from being enacted until a decision is made on the tax situation.

Now, to file a formal appeal, you need to complete and submit IRS form 9423 that can be found on IRS.gov.

Appealing a levy may be a relatively straightforward process. However, it is no guarantee that the IRS will reverse its decision to levy the assets.

Request Installment Agreement

When the levy your assets, it will not relinquish its claim until tax debt is satisfied.

Rather than wait for months or years before it happens, you could have the IRS levy release fast by requesting an installment agreement with which to pay off the debt.

How Can Tax Levy Affect You?

Can You Reverse Tax Levy?

The IRS is required to provide a legal notice stating the time gap the taxpayer has for arranging the funds, reversing a tax levy, and securing assets once again.

However, it is harder for levied assets to be returned than it is to avoid levy before it takes place. The IRS only reverse a levy if:

- The IRS levy was made before a taxpayer was given 30 days to request a hearing.

- The IRS didn’t follow procedures

- The seized property is needed to earn income, thus helping the taxpayer pay the debt.

Finally, these methods are available to you when you want to have a tax levy against the property released. These are designed to help avoid having the assets sold off in order to settle the IRS debt.

Related Article: Dealing with Tax Problems- IRS Problem and Solution

Contact Us Today:

Locations:

Dealing with Tax Problems- IRS Problem and Solution

Every year numerous people run into trouble with the IRS. You might have unpaid taxes or unfiled returns or facing audit or garnishment, etc.

In other words, there are several IRS tax problems that you might have to face if you don’t hire proper CPAs. However, regardless of these problems, there is a resolution.

The IRS is willing to work with the taxpayers, and a tax professional can help you deal with the IRS. Here are some of the common tax-related problems that you might have.

Schedule A Consultation Today!

What Are Unpaid Taxes?

Do you have any unpaid tax? The best option is to pay the balance in full. Nut if you cannot afford it, the IRS has several options.

Depending on how much you owe and the current financial situation, you might be able to set up the payment plan or pay less than the total balance.

In some cases, you might even get the account labeled as not collectible whereby the IRS suspends temporarily all collection activity.

To get proper help, you can of course get in touch with the tax experts for tax problem-solving.

What To Know About Tax Lien?

When the IRS files the Notice of Federal Tax Lien, it alerts the creditors the IRS has a legal claim against the property.

Now, at this point, the IRS is not taking the property yet. Also, traditionally the tax liens show up on the credit report.

To sort this income taxation problem solving, you must contact the IRS immediately for making arrangements as soon as possible.

|

Why is Tax Lien Important? |

What Is Tax Levy?

The tax levy is when the IRS actually starts seizing the assets. It is one of the agency’s harshest collection methods undoubtedly.

Through this, the IRS takes the money from your bank account, real estate, cars, and almost anything holding value.

Usually, the IRS gives you a time period of 30 days before moving ahead with the tax levy and provides you the right to hear.

So, if you have already received the tax levy notice, you must act quickly to stop it from taking the assets. Hiring a tax expert would be really helpful in solving problems with taxes today.

How To Deal With Unfiled Tax Return?

Do you have returns that you have never filed? Now, the fees and penalties for the unfiled returns are really worse than the penalties for unpaid taxes.

Even if you cannot pay, you must file the return. There is a statute of limitation for audits and tax debt. But in both cases, the clock doesn’t start ticking until you prepare as well as submit the tax return of the IRS file for you.

If you don’t have the right documentation or money to pay, the tax specialist can help you file the taxes back.

For tax problems and solutions, you must hire proper experts with sound knowledge and experience.

Contact Us Today:

Locations:

What Are The Tax Strategies For High Income Earners?

No one wants to pay more taxes than they legally have to. After all, income tax is typically the largest expense for most people.

With this in mind, the government offers tax deductions and credits to ease this financial burden. But the system seems to favor those who fall in a certain income range.

Why?

For the most part, tax services Westwood is phased out for higher-income individuals.

In some situations, higher-income means adjusted gross income $186,000 for IRA contributions or $315,000 for the new business income deductions for partnerships.

In both scenarios, taxpayers earning above these thresholds don’t qualify for the tax benefits. There are several individuals who earn higher than these amounts but fall in the middle class or who have a lot of expenses to cover.

It just doesn’t seem fair. So, tax planning exists. For further assistance hiring a CPA Westwood can really help.

Tax planning involves the analysis of a financial position from a tax perspective. The purpose of tax planning is to achieve tax efficiency. Tax efficiency ensures that you pay the least possible tax in a given situation.

Since tax brackets cause higher-income individuals to pay a higher percentage tax rate, tax planning becomes more difficult.

However, there are strategies for high-income earners. This is where forethought strategy and a little creativity comes to play.

Schedule A Consultation Today!

The Present Tax System

The current tax system takes individuals based on brackets. How tax brackets work is the higher your income, the more you pay in taxes.

The government implements a credit and deduction system designed to limit the amount of taxes you pay. As you know, the system is not necessarily designed for individuals who make over 6 figures.

While that covers the vast majority of individuals, there are still a large number of taxpayers who can’t benefit.

Yet, the top 1% of taxpayers pay roughly 40 percent of federal income taxes. The system does not seem to treat these individuals the same. The effects of the tax disparity are people committing tax evasion.

If you don’t want to fall into any trouble connecting with the best CPA Westwood is the right thing to do.

Tax evasion is the illegal underpayment of tax. By no means should you commit tax evasion? Those found guilty are imprisoned for up to 5 years.

The tax services Westwood is important for high-income earners. There are several legal ways to minimize tax.

if you make a high salary, there are some tax strategies for high-income earners that will help you save thousands or more on the taxes.

Retirement Accounts

There’s no doubt that everyone should be planning retirement to help in tax services Westwood. Besides the fact you want a comfortable retirement, investing in certain types of retirement accounts is one of the best strategies for high-income earners.

|

Avoid IRS Audit with Tax Planning! |

Individual Retirement Accounts (IRA)

Back Door Roth IRAs

Traditional IRAs don’t offer any tax-deductible benefits for those with a Modified Adjusted Gross Income (MAGI) of above $72,000 and earnings are just tax-deferred.

However, Roth IRAs allow you to contribute after-tax dollars while earnings and withdrawals are tax-free. But there’s a catch

If you have an MAGI of above $120,000, you aren’t able to contribute to a Roth IRA. Unless, you convert your non-deductible contribution from the traditional IRA, also known as backdoor Roth IRA.

Simple IRA

If you are self-employed and have employees, consider setting up a Simple IRA. They are less costly for the business with a slightly lower contribution limit of $12,500 annually.

Other Tax Saving Retirement Accounts

There are other types of self-employed retirement accounts you must know about for tax services Westwood, which allow you to make higher tax-deferred contributions.

As much as $60,000 if you are over the age of 50. Also, $54,000 for those younger than 50.

Health Savings Accounts

Do you qualify for a Health Savings Account (HSA)? If so, you definitely want to max out your contribution limit.

HSAs are a wat to save pre-tax income into a specific account and withdraw the funds for medical purposes.

By putting pre-tax money aside, you lower the taxable income and pay in taxes. Then when funds are withdrawn from the HSA, it becomes tax-free.

If you want to know how to take advantage of the HSAs, hiring CPA Westwood helps a lot. Do you know distributions become tax-free? As if they were used on health-related expenses.

The catch is the healthcare-related expenses you’ve been paying out of pocket have to be greater than or equal to your HSA distribution. So, you would need to keep up with the receipts to validate your distribution.

Stock Donation

Your charitable donations are not just limited to cash only. Many wealthy individuals find it advantageous to donate, here’s why.

When the stock of appreciated value is donated, the owner doesn’t pay any capital gains tax. In fact, they are able to deduct the full market value, also known as an appreciated value, not the price you paid.

This tax services Westwood strategy works best for stocks that have increased in value since you bought them.

Factors To Consider When Tax Planning

Paying tax later is better than paying now

This is known as tax deferral or deferring tax. If tac can be deferred for a later time, that’s better for you as the taxpayer.

But how when you potentially might end up paying some amount later?

Well, the tax you deferred could potentially be invested until it’s time to pay or you might end up being in a lower tax bracket later.

Also, situations change and you could find some more incentives are available or may incur losses to offset any income later.

Either way, tax deferring provides you with flexibility. If and when legally possible, you must defer your taxes.

Don’t spend a dollar to save 30 cents in taxes

This rule is usually geared towards business owners but can actually apply to anyone. Near the end of the year, taxpayers try their best to find ways to reduce the taxable income by spending more.

Spending more to reduce taxable income is not tax planning. Hiring CPA Westwood can help you plan it right.

A strategy like this makes sense if you purchase items you were planning on purchasing, regardless of the tax plan.

Finally, for the most part, everyone pays tax. Whether you work full-time or part-time at any level, the IRS expects you to pay taxes.

It’s unlikely they’ll inform you that you overpaid or miss out on applicable tax incentives, which is why tax services Westwood is so important for all.

Contact Us Today:

Locations:

What Happens If You Cannot Pay Taxes You Owe?

You have finished preparing the tax return and notice that you have to pay someone a huge sum, but can’t afford to pay it.

Will you go to jail? Probably not. The realization that you can’t afford to pay your taxes can make you feel uneasy, but don’t worry.

There are things you can do to remedy the situation with the right business accounting services and avoid landing in trouble with the IRS.

File the Return On Time

Even if you don’t have enough money to pay the taxes due, you still need to send in the return by the filing deadline.

The IRS assesses two types of tax penalties: one for filing late and one for failing to pay taxes on time.

Now, the penalty for filing late depends and varies each year. If you can’t pay the tax bill in full on time, you’ll still garner a much lower penalty than you would by waiting to file the return. So bottom line, get the return in by filing deadline if not before.

Also, pay as much of your taxes owed as you can when you file. Even if you can’t pay in full, paying something towards the balance due can reduce the amount of interest and penalties later.

Hire the right tax accountant services Beverly Hills for the best assistance.

Review the option for paying

Whether you owe $100 or $10,000, the first thing you must do is try to find possible sources to obtain the money you need to pay.

For instance, you may consider tapping the equity in your home, using a credit card to pay the taxes, digging into the savings, getting a personal loan, borrowing from friends, or cashing out paid time off at work.

A more extreme option is pulling money out of your IRA or retirement savings. But again, this can trigger its own penalties, so it’s best to view this as the best option of last resort.

Next, if you are considering a loan or credit card o pay the tax bill, remember to weigh the interest rate and fees in the balance.

If you can repay the loan or credit card fairly quickly, or use a credit card with 0% APR, the cost may be minimal.

But if you owe a large tax bill when it comes to business accounting services, the interest may add up really fast. Apart from these, be aware that the IRS charges processing fees for paying income taxes with a credit card, which can increase the total cost.

|

Start Early Tax Planning! |

Do check the timeline

While it’s always the best to pay the taxes, and avail tax accountant services Beverly Hills you owe in full and on time, there are scenarios when all you may need to pay is to get the next paycheck. In such cases, you could file your return and accept the late payment penalty.

As long as you filed the taxes on time, the IRS will send you a letter in the mail stating how much you owe plus additional interest or penalties due.

Schedule A Consultation Today!

The downside is that your tax bill will be lingering over the head a bit longer and what you owe will accrue penalties and interest until you pay.

The upside, however, is that the interest you pay will be low compared to financing the money with any source.

However, this is not going to be a long-term solution and your goal should be to pay the IRS as fast as possible, since the longer you wait the more the penalties and interest can add up.

Wait too long to pay and the IRS may take action against you to place a lien against the property or garnish the wages or bank account. The right expert offering you business accounting services can help a lot.

How To Pay The IRS When You Owe Taxes?

You’ve finished the tax return only to realize that you owe money to the IRs. Having a balance due to the IRS is never good news, but you have some options for paying what you owe- even if it’s more than the cash you have on hand.

First, file an extension

Don’t take that completed tax return and your debt to the IRS at face value. You can get an automatic extension of six or more months from the IRS. This gives you 180 additional days to review your return.

Look for deductions you might have missed or miscalculations you have made. Consult a tax professional if you don’t do so before- you might be eligible for a tax credit or deduction that you aren’t even aware of. The idea is to reduce the preliminary tax debt if at all possible.

If you don’t have the money to pay, remit as much as you can. If it ends up that you pay too much-your tax bill is less than you thought it was after you spent some time finalizing the return.

Note, the IRS will send you a refund just as it would if you had overpaid all year through withholding from paychecks.

The tax accountant services Beverly Hills can actually help you file the extension easily.

Meeting the deadline

The most important thing is getting Form 4868 to the IRS on or before the tax filing deadline. Also, the IRS charges a late filing penalty, a late payment penalty, and interest on unpaid balances owed if you don’t file the return or the extension on time and if you fail to pay on time.

It’s better to file the extension and pay as much as you can, and then go back to the drawing board to ensure you really owe all that you think you owe.

Finally, if you can’t pay off the tax debt monthly, or if you owe a lot, it’s better to seek assistance from an experienced tax accountant services Beverly Hills. He would help evaluate the other ways to resolve your tax debts.

The IRS also considers offers in a compromise where it may be willing to accept an amount that’s less than what you owe under some circumstances.

Schedule A Consultation Today!

Contact Us Today:

Locations:

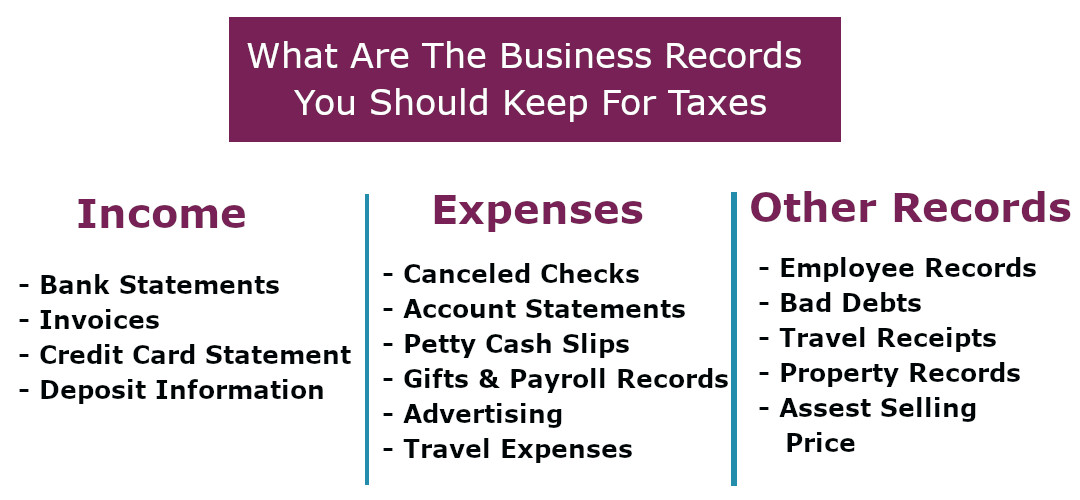

Why And How Long To Keep Business Records For Tax Purposes?

For many new small business entrepreneurs, the first year is actually the hardest. First, you need to decide what form of business you actually want, then there’s extensive business record keeping.

Bad record-keeping can be a big pitfall if you are a small business owner. You can avoid headaches when you are filing your tax return, keeping business records for tax purposes becomes useful. You need to keep the records all through the year.

Everyone in business must keep tax records for small business. Good business records will surely help you do the following:

Monitoring the progress of the business

You definitely need good records to monitor your business’s progress. Records can show whether your business is improving, which items are selling or what changes you need to make.

Do you know that good records can actually increase the chances of business success? But, how to find business tax records? Read on and you will find out.

Project the estimated tax payment

During the first year of business, you will need to project the tax liability so that you can make the estimated tax payments. Estimated tax is the method used to pay tax on come is not subject to withholding.

When you are dealing with tax preparation, keeping the business records can actually be a lot of help. Estimated tax is used to pay income tax and self-employment tax, as well as other taxes and amounts reported on the tax return.

Preparing the financial statements

You need good business records for tax purposes to prepare accurate financial statements. These include income such as profit and loss statement as well as balance sheets. These statements can really help you deal with the bank creditors and manage your business, well.

Preparing the tax return

You also need good business records to prepare tax returns. These records support the expenses, income, and credits you report. Now, these are the same records you use to monitor the business and prepare the financial statements.

Now, you may wonder how to find business tax records. This is easy. Every business leaves a paper and electronic trail of tax records, business licenses, corporate filings, financial statements, etc.

If you are a small business owner, you can find tax records information online and hard copies at government offices.

So, once you know why you should keep business tax records, your next questions may be how long should you keep it. Let’s see.

How Long Should You Keep Business Tax Records?

Good business recordkeeping allows you to prepare the financial statements, helps you keep tabs on the expenses as well as comes in handy in case you get audited or sued.

But did you know the IRS requires you keep the business records for tax purposes? Let’s find out which records you are legally allowed to keep and how long you must keep it. Also, how to ensure that you don’t lose it, at all.

| Record type | How long to keep it |

|---|---|

| Previous tax returns | 3 years |

| Receipts | 3 years |

| Miscellaneous financial records | 3 years |

| Employment tax records | 4 years |

| If you omitted income from your return, keep records for.. | 6 years |

| If you deducted the cost of bad debt or worthless securities, keep records for.. | 7 years |

The Eight Small Business Tax Record Keeping Rules

You never know which record you need when dealing with tax preparation, so keep these handy.

- Always keep bank statements, receipts, payroll records, invoices, receipts and any document that supports an item of deduction, income or credit shown on the tax return.

- The most supporting document needs to be kept for at least three years.

- Keep employment tax records for about four years.

- If you omitted income from the tax return, ensure you keep the records for at least six years.

- If you deduced the cost of bad debt, keep the records for up to seven years.

- It is better to get the documents electronically backed up and go paperless.

What receipts to keep for taxes?

As much as you live by your words, the IRS requires that you keep documentation that includes your income, deductions, credits you report on the tax return.

Here are the main records you must keep for tax preparation:

- Cash register tapes

- Receipts

- Deposit information such as cash and credit sales

- Invoices

- Credit card receipts

- Bank statement

- Tax filing

- Payroll records

Are there documents you don’t need to keep?

It is impossible to keep all the documents. Receipts at times get lost, especially for small expenses. But can you still claim those receipt-less expenses as tax deductions?

Maybe, but the expenses need to be less than $75. You can get away with not keeping tax records for small business for three reasons:

- The expense is less than $75. (This isn’t applicable for lodging expenses)

- The expense is for transportation and it is not possible to have a proper receipt.

- You are reporting meals and lodging expenses under an accountable plan.

Wait, in order for the IRS to uphold a deduction under $75 without any receipt, you need to present them with:

- The expense amount

- Where and when it was made

- The essential character or purpose of your expense

The easiest way to keep the records

The IRS suggests that you can use any recordkeeping system as long as it shows your expenses and income. However, the IRS accepts digital copies of documents as long as they are identical to original copies.

No wonder, digitizing the records is the best way to prevent accidentally tossing them in the trash can. Also, paper records can fade and are susceptible to damages.

It is better to scan each record and receipt in your business and archiving forever.

Concluding words

When dealing with tax preparation and wish to avoid the IRS audit, it is better to stay sorted. One of the most important things is to keep the necessary business records. So, before tossing them up, double-check whether you or anyone else you do business with might need it.

Contact Us Today:

Locations:

Few Tax Preparation Mistakes To Avoid In 2020

Do you know your business’s cash flow takes a hit when you owe IRS money? In such a case, avoiding a tax debt can be really simple like knowing when and how to file the small business tax return.

Also, by knowing what business tax mistakes to avoid, you can prevent having to pay the IRS money than what you legally and rightfully owe every year.

Whether you own a small business or a big one, you need help. Hiring skilled professionals helps you get small business tax tips in 2020 so you don’t need to worry at all.

Neglecting Hiring A Financial Expert

One of the easiest ways to avoid common small business tax filing mistakes is by hiring skilled tax experts. These individuals understand that as an entrepreneur you have very little cash left in your budget for anything other than the basics.

The tax expert can even ensure that your finances are just in order and also help you find ways to save money while bulking up the cash flow.

More importantly, the qualified financial expert professional can advise you on matters such as tax credits, small business tax preparation that you claim on the tax returns.

Now, the money this individual saves can cover the cost of hiring him and just leave some cash on your budget at the same time. So, this is again a win-win situation for you, right?

Missing Out On Legitimate Business Expense Deductions

Another important reason for hiring a tax expert for your small business involves finding and using legitimate expense deductions to which you are actually entitled. The IRS permits small business owners to deduct some expenses on the returns to help reduce their taxable income.

Knowing what these expenses actually are, however, tricky. Even more, failing to claim them when filing your returns can result in paying huge and unnecessary taxes to the IRS every year.

Some of the common business expenses you can deduct when filing returns are:

- Minor cash purchases

- Travel expenses such as car repairs, mileage, and gas

- Training classes

- Food expense such as entertaining clients

You can keep a record of these costs during the year so you can show proof of these when you are filing the taxes.

Falsely Classifying Hobbies As Businesses

One of the other tax mistakes to avoid is not classifying your hobby as a business.

Legitimate home-based business owners can actually deduct expenses such as postage, internet bills, purchase of equipment such as cameras, printers on the returns.

However, when you have a home-based business that constantly losses more money than it makes, the IRS labels it as a hobby and not a business.

As a rule, you can’t deduct hobby expenses on the taxes unless these are lower than the amount of income you make from it. If you are unsure of whether or not your endeavor is a hobby or business, you must check the IRS guidelines on their website.

You can then choose whether or not to deduct the related expenses on the tax return.

Incomplete Or Inaccurate Records

When you don’t keep your business records properly, you only make it more difficult to file and pay your taxes on time every year. Incomplete records often lead to you misplacing important tax documents such as income-earning statements or deduction receipts.

If you hire an expert to help you with small business tax preparation, you are likely to make the person’s job really challenging. However, you can avoid it by organizing the records. Take enough time to organize the business’s books.

If you lack the time or talent, you can hire staff specifically for the purpose. You even have the option of outsourcing the tax services to a recognized firm.

Inappropriate Income Reporting

It may be really tempting to under-report what your small business really made during the tax year. However, purposeful and inaccurate reporting of the income only puts the business at risk of having IRS audits.

In fact, the IRS will sooner or later find out that you manipulated the numbers on your tax return. Now, once they find you, you will definitely be at risk for having criminal and civil penalties levied against you.

You can also avoid penalties by being truthful about your income when filing the tax returns. If you aren’t sure of how to report the income, you must hire a tax expert to file your business’s returns on your behalf.

Failure To Pay Or File On Time

As with filing the personal tax returns, your business’s returns need to be filed on time every year. Further, if you owe anything to the IRS, you must pay in full by the mentioned deadline if you don’t want to pay huge penalties and fines.

Finally, you must keep in mind these small business tax tips 2020 so as to avoid paying fines and penalties to the IRS unnecessarily.

Locations:

Types Of IRS Installment Tax Agreements And Plans?

Owing money to the IRS is common for every working individual across the US. However, several affected individuals aren’t aware of the IRS installment agreement plan & payment options available to them.

The IRS has set up payment options that can be applied to people in various financial situations. This is established through a proper payment plan, which is often the agreement between the IRS and the individual in tax debt to pay the tax amount owed within a mentioned time frame.

Depending on the amount owed and the individual’s ability to pay the sum total to the IRS, one can either opt for full payment or an IRS installment agreement online. There are rules and regulations that govern and help you determine which payment plan you must opt for.

This blog elaborates on the types of IRS installment plan that would assist indebted taxpayers to pay the taxes easily.

Guaranteed Installment Plan

The guaranteed installment plan is a monthly installment agreement between the taxpayer and the IRS which is based on qualification. The qualification is determined after the taxpayer makes the request to the IRS and succeeds.

Wondering how to pay IRS tax installments? To qualify, the taxpayer needs to meet the requirement:

- The taxpayer needs to owe less than $10,000 including interests and penalties accrued on tax payments owed.

- The taxpayer must indicate an inability to pay the tax liability when it is due or within 120 days.

- The taxpayer must also show filed tax return, payment of taxes initially owed within the preceding five years and no current entry into an installment agreement.

- She or he must be able to show they are not at all bankrupt.

- The taxpayer must indicate their ability to pay taxes in installments within three years.

As per the IRS approval, a taxpayer using the IRS installment plan is free from a federal tax lien. The guaranteed installment agreement is easy to apply and acquire since it assured by law once the taxpayer meets the requirements.

Another benefit is that you can pay as little as $25 or lower. However, it is advisable to pay as much as you can during the agreed-upon time to avoid increased interest and penalty payments.

Streamlined Installment Plan

The name of this IRS installment agreement online is based on the verification requirements. The streamlined IRS installment agreement doesn’t require one to verify their expenses, assets, debts, and income. This means that no information is needed, making it quite convenient.

It is common for qualified taxpayers to be eligible for applying for a streamlined IRS installment plan as well. The installment agreement requires the following for you to qualify.

- Your collective tax liability, accumulated interest, and penalties must not be over $50,000.

- You must indicate your ability to pay the balance within 72 months and a maximum of 84 months.

- Your proposed payment must be greater than $25 or the least amount got when your liability, interests are divided by 50.

- He must not be filing for bankruptcy.

- You must also show willingness and ability to pay for the streamlined installment agreement fee which is considered as the initial payment.

Partial Payment Installment Plan

Confused about how to make payments to IRS? Partial payment is also an option for you.

If you don’t qualify for the streamlined installment agreement, the partial payment agreement plan is the next option.

However, remember you need to avoid IRS tax audits by making proper payments. Thankfully, the IRS gives you chances so that you can choose the payment plan.

The installment agreement requires you to divulge the financial information to the IRS. You can do so by completing the financial statement using the right Form that records information on assets, debts, etc. Now, the IRS on receiving this information reviews and verifies the information provided.

Additional information on assets that can be liquidated to pay part of the taxpayer’s tax liability is required by the IRS.

For the partial payment installment plan, the following is required:

- Your tax liability penalties, interest must be accumulatively above $10,000

- All the past tax returns must have been filed prior to application

- You shouldn’t have accepted the offer in compromise

- You must have filed Form 433 for the collection information statement and installment agreement request.

Offer In Compromise

The Offer in Compromise is a rather unique installment agreement between you and the IRS which allows you to settle the tax liability at a lower amount than what you actually owe. Taxpayers who can afford to pay taxes in installments aren’t eligible to apply for offers in compromise.

The major basis for an offer in compromise is a determined scenario by the IRS that establishes the taxpayer’s accrued tax debt is greater than the reasonable collection potential.

- To qualify for offers in compromise the taxpayers needs to show:

- The taxpayer must file all the tax returns

- The estimated tax payments for the current year needs to be made

- You must make all tax deposits for the present quarter in the event that you own a business with employees.

Keep these in mind and consider the type of agreement you want to opt for.

|

Struggling With The IRS?Are you facing any other challenges with IRS? Give us a call today. We’ll be happy to help you set one up.

|