What is a Payroll Register? A Guide to Master

Whether you own/manage a small or medium-sized business, you need accurate and comprehensive employee compensation records. To do it, you need the payroll register. So what is it, and how vital is it?

The Payroll Register

It is a document containing a record of wages, deductions, and net pay for every employee within a specific pay period. It is an integral part of payroll management because it ensures each employee receives accurate compensation and that the business complies with labor and tax laws.

Components of a Payroll Register

It generally includes several pieces of information for each employee.

- Employee Information: Name, employee identification number, and social security number.

- Earnings: Details of the gross pay, including regular and overtime wages, bonuses, and other compensation.

- Deductions: A breakdown of all deductions from the employee’s gross pay, including state and federal taxes, Medicare, social security, health insurance premiums, retirement contributions, and other mandatory or voluntary deductions.

- Net Pay: The amount the employee receives after deductions.

- Year-to-Date Totals: Cumulative totals of the employee’s earnings, deductions, and net pay from the beginning of the year to the current pay period.

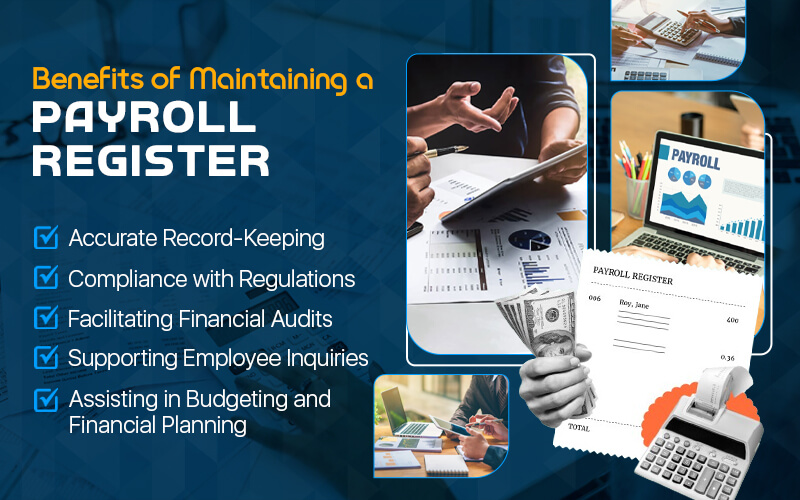

The Importance of a Payroll Register

There are numerous benefits to maintaining a payroll register, whether we talk about employees or employers.

-

Accurate Record-Keeping

A payroll register ensures that all employee compensation records are accurate and up-to-date. Accuracy is crucial for calculating taxes, ensuring compliance with labor laws, and avoiding potential disputes or discrepancies in employee pay.

-

Compliance with Regulations

Businesses are required to comply with various state, federal, and local payroll regulations. A payroll register helps ensure that all tax withholdings and deductions are calculated correctly and that employees receive the correct pay.

-

Facilitating Financial Audits

A well-maintained payroll register provides a clear and organized record of employee compensation during a financial audit. It simplifies the audit process and demonstrates the business’s commitment to accurate financial management.

-

Supporting Employee Inquiries

Employees often have questions or concerns about their pay, deductions, or year-to-date totals. With a payroll register, employers can quickly and accurately respond to these inquiries, nurturing transparency and trust within the organization.

-

Assisting in Budgeting and Financial Planning

A payroll register provides a detailed record of payroll expenses, which can aid in budgeting and financial planning. Business owners can use this information to forecast payroll costs, identify trends, and make informed financial decisions.

Maintaining a Payroll Register

Maintaining a payroll register is easy. Here is everything you need to do:

Gather Employee Information: Ensure that all employee information is up-to-date, including personal details, tax withholding preferences, and any changes in compensation.

Calculate Gross Pay: Determine each employee’s gross pay based on their salary or hourly rate, including overtime, bonuses, or other compensation.

Calculating Deductions: Apply all relevant deductions, including federal and state taxes, social security, Medicare, and any voluntary deductions such as health insurance or retirement contributions.

Recording Net Pay: Subtract the total deductions from the gross pay to determine the employee’s net pay.

Updating Year-to-Date Totals: Add the current pay period’s amounts to the year-to-date totals for each employee.

Tools for Managing Payroll Registers

You can use payroll software to manage their payroll registers. These tools can automate much of the process, reducing the risk of errors and saving time. Some popular options include:

QuickBooks Payroll: A comprehensive payroll solution that integrates with QuickBooks accounting software.

Gusto: A user-friendly payroll and benefits platform designed for small businesses.

ADP: A well-known provider of payroll and HR services, offering scalable solutions for businesses of all sizes.

When selecting payroll software, consider the following factors:

Ease of Use: Look for intuitive, easy-to-use software with a clear interface and helpful support resources.

Features: Ensure the software includes all necessary features, such as tax filing, direct deposit, and compliance management.

Integration: Choose software that integrates with your existing accounting and HR systems to streamline your workflow.

Scalability: Consider your business’s growth potential and choose software that can scale with your needs.

Cost: Compare pricing plans and choose a solution that fits your budget.

Conclusion

A payroll register is essential for managing employee compensation and ensuring compliance with payroll regulations. By maintaining accurate and up-to-date records, businesses can avoid potential issues, support financial planning, and foster employee trust. Whether you manage your payroll register manually or use payroll software, the benefits of accurate payroll management are clear.

Streamline Your Payroll With Small Business Payroll Services

Should you invest in payroll services online for small businesses? There are different reasons why you must consider searching and pricing.

We expect business owners expected to be a jack of all trades on any given day. Though staying busy as well as tackling challenges may be exciting, it can be overwhelming at times. All this is because you cannot be an expert in everything you do.

The key to finding balance is knowing which tasks to delegate. One of the ideal ways to streamline operations is to save time in partnering with a third-party provider for solving problems.

Business owners who choose payroll services get to enjoy the perks of saving time and money. Are you wondering how to do payroll for my small business? Let us see how payroll helps first.

Schedule A Consultation Today!

1. Payroll Expertise

Professional payroll companies employ individuals who know payroll processing within and out. The individuals specialize in several complexities of payroll processing and taxes and compliance with government regulations.

- Updating W-9 forms and adjust accurate tax deductions.

- Manage involuntary and voluntary employee withholding and submitting them to a government entity.

- Calculate and submit yearly and quarterly year-end payroll tax.

2. Payroll Services Help Save Money And Time

The most expensive asset in any business is the people. Hiring the right staff is essential for the success of your business and for operating within the budget.

Thankfully, choosing a payroll system means not only paying the employees efficiently but also automating some of the human tasks. Now you have an idea regarding how to do payroll for small business online.

3. Payroll Providers Maintain Employer Compliance

Working with professional full-service providers comes with its perks. As part of the payroll packages, they will provide resources and services essential to your small business.

It includes some services you probably may have never thought of. With offering such as state unemployment insurance, garnishment payment service, the experts address the complex and requirements for the business.

4. Payroll Providers Manage People And Recruitment

Schedule A Consultation Today!

Compliance, recruiting, and benefits are areas payroll services that can assist you with their experts. Check out the steps and the related costs of taking an employee on board, sourcing, job posting, tracking applicant, conducting background checks, etc.

These tasks don’t come cheap and often require extra help from agencies. The cost of adding a new employee can go up to $4000.

Comparing the cost with the amount you’ll spend on the payroll- which you need in some form to pay employees- gives way to hiring payroll services. The advantage payroll services are more than this.

5. Payroll Help Avoid Unnecessary Fees And Fines

-

Payroll Penalties And Tax

When small businesses think about the IRS, annual Form 1120 comes to their mind and the risk of an audit. Though you cannot avoid taxes, you can lower the audit risks. It is common for the IRS to enforce penalties for tax mistakes.

The IRS in 2016 had assessed $2.1 million as penalties against business income tax filers. As soon as you have just one employee on your business payroll, you have taxes due to the IRS as federal income tax, social security tax, and more.

Failing to pay these taxes timely becomes expensive. The US business owners were fined more than $6 million for employment tax error in 2015.

One of the benefits of payroll services is that the expert can assist you in every possible way to keep you safe from IRS audits.

-

401k Staff Salary Deferral Penalty

If you plan on providing retirement benefits to your staff, including a 401 (k) plan, there are many extra potential payroll-related errors you need to be aware. The staff salary deferral gets deposited into the person’s retirement account within a week of payroll.

Depositing the funds even one day late can make you an offender in the eyes of the IRS and can trigger 401(k) plan audits.

If you are thinking of how to set up payroll for my company, talking to an experienced company can help.

Finally, when you are launching a business, it is easy to think you are too small to need payroll services, but investing in team up with an industry expert can ease your business hassles.

Related Article: What You Must Know About the Payroll Mistakes?

Contact Us Today:

Locations: