Why Call A CPA when Business Disaster Strikes?

When you land yourself in the center of a sudden crisis, the last thing on your mind would be the current tax calculation. However, if you have faced any sudden or unexpected disasters, hiring a CPA in Santa Monica would be the first thing to do. Even though you should hire the professional earlier to avoid such a scenario, but in case you didn’t, you should right away.

Wondering what would happen if you have incurred a huge loss and have to pay a hefty tax? Well, with the experienced CPA by your side, you don’t need to worry about a thing. Now, here are some of the ways the accounting professional would help you come out of the loss.

Assess the loss

If your business has suffered a sudden loss which is huge at the same time, the CPA would begin by analyzing how much loss you have actually suffered. If you have tax payment, he would help you show the loss so that you can get deductions.

Calculating the payroll

Business loss whether foreseen or sudden might leave you in a state when you lose your sense of reasoning. This is exactly when the CPA comes to your rescue. If you have a business, you definitely need to pay the employees even if your business has suffered a loss. The CPA would help you calculate the cost and then decide the next step. This professional would also help you calculate how much you need to pay as per the law.

Extending tax deadlines

Suffering a business loss would leave you with very little money. So, the CPA Santa Monica would help you in every way possible. The IRS would extend the tax deadlines; however, it would depend on the severity of the disaster. Moreover, the CPA would help you make estimated tax payments to avoid additional interests.

Creating a comprehensive plan

Hiring a CPA before a business disaster or after is extremely crucial. He would help you develop a comprehensive plan. It would include everything from the loss you have suffered, the amount you have at present, the tax payment, etc. Once you have a proper plan, you would be able to bounce back easily.

Also Read: Importance of Hiring a CPA for Your Start-up

Restructuring finance

Do you have business loans? The CPA in Santa Monica would help you check the financial restructuring. It would save the interest on the business loan. Also, by refinancing the debt, you would be able to save interest, thereby helping you make profits.

Reducing bad debts

Your CPA would help you implement a proper debt collection system so your business doesn’t suffer more due to bad credits. No wonder, the bad credits eat the profits. The CPA would analyze the debt collection policies as well as formulate some new policies to increase the profit after your business has suffered a loss.

Contact Us Today:

Santa Monica Address:

Mistakes New Businesses Make When Hiring A CPA

Accounting is a proper way to track down the exchanges. It really sounds simple, right? However, thorough and precise accounting is essential for maintaining the health of your business. There is nothing like accurate accounting that provides data you can use to make proper financial decisions. If the data is inaccurate, the decisions would also become inaccurate. To avoid this, you need to hire a CPA in Beverly Hills.

It simply doesn’t matter if you are hiring a full-time CPA or outsourcing it to a firm, ensure your accounting task is in safe hands. Keeping this in mind, here are top mistakes you must avoid.

Concentrating on wrong qualifications

You should know there is more to accounting than just crunching numbers. Due to this CPAs must have a thorough knowledge of your business, be it indirectly or directly. The CPAs need to work with your employees closely to get information they need. You must also consider the accountant’s ability to communicate and cooperate since it is essential to deliver assistance.

You must also ensure you hire the right CPA having proper accounting knowledge, background and trait. For example, technical accounting needs a certain skill where the accountant offers technical guidance. You must find out if he is patient enough.

Hiring without knowing the requirement

One of the other mistakes you make is hiring a CPA Beverly Hills without knowing your need. Does your business need a CPA to check the taxes, prepare invoice or create financial statements and budgets? Find that out before making a huge list of CPA. Find what you and the business need actually before hunting for a CPA. This way you can find the right professional who can actually live up to your expectations.

Check the business revenue to find out if you need a full-time or a part-time CPA. For instance, if you are making big money in one month, doesn’t mean the volume of the transaction would require a full-time professional, so consider this.

Also Read: How to Hire a Good CPA? Know Yourself Before Knowing Him

Choosing CPA who doesn’t perform financial analysis

Hiring a CPA in Beverly Hills doesn’t mean he would only concentrate on your business account services. Moreover, a good accounting service should be able to make proper financial analysis. You should be able to receive essential indicators such as gross profit margin, net profit, etc. It is simply because the better information you have, the better business decisions you would be able to make.

Doing Own Accounting

One of the serious mistakes you can make is trying to do the accounting all by yourself. Since you wouldn’t have the proper knowledge, it is better not to do it yourself. This is definitely not a DIY thing you want to mess with. CPA in Beverly Hills would help you get error-free accounting service.

Contact Us Today:

Beverly Hills Address:

Why You Should Hire an Experienced CPA to Do The Taxes?

Filing for taxes can really a daunting task depending on the situation. If you are an individual filing a tax, you can handle it easily. But when the return is complex, you might feel the need of hiring an expert. By expert, there is definitely no one better than a CPA in Beverly Hills.

Now, there are many good reasons for hiring a CPA and if you own a business or you an individual, you won’t regret your decision. With that being said, here are some of the important scenarios when you need hiring a CPA.

You Own A Small Business

If you own a business, there are chances of tax write-offs and a professional has the right expertise to help you succeed. Owning a business and keeping tax preparations in the mind can take a toll on your work. The CPA comes to your rescue by offering excellent tax preparation services. Moreover, if you have no idea about tax planning and preparing, hiring a CPA in Beverly Hills is a boon.

Good Stability And Consistency

One of the other reasons for choosing a CPA is the availability. An experienced and knowledgeable CPA would be there with you when you need his assistance. In fact, the practicing CPAs are in it for a really long time. Since tax preparation is not a one-time matter, the CPA understands this and remains available.

Also Read: How to Hire a Good CPA? Know Yourself Before Knowing Him

Offers Record Retention

A CPA would maintain your tax information like a doctor holds a patient’s medical records. He would act as your accountant for several years. In fact, you would receive your own copy of the return and the necessary documents in an organized manner. So, you don’t have to remember tax related information since the CPA has got you covered in this.

Efficient Tax Planning

One of the top reasons for choosing a CPA Beverly Hills is due to the assistance in tax planning. The experienced CPA offers you year-round advice on tax planning. There are many year-end tax moves you need to make every year that can save hundreds of dollars. You definitely wouldn’t get this benefit by hiring any tax preparation company.

Helps Save The Time

Business owners don’t really have enough time to spare on tax planning and preparation. Due to this, hiring a CPA is the right thing to do. The professionals take the entire burden on their shoulders so you can concentrate on your business and making money. He does all the work on your behalf and leaves you with enough time to concentrate on your business.

Beverly Hills Address:

How Can A CPA Help You Grow The Business?

If you are an entrepreneur, your main focus would be to grow the business. But when taxes get involved, you might lose track. Due to this, hiring a tax and financial advisor is always crucial. But your business needs an experienced CPA in Marina Del Ray.

Before you plunge into the market to hire a Certified Professional Accountant (CPA), you must consider few important things.

How are they different frompntants?

The term accountant is used for referring tax and financial professionals who follow proper regulations and rules. However, CPAs are professionals who have passed the licensing examination in a state.

In other words, you can say that all CPAs are accountants, but not all accountants are CPAs.

It is better to contact the CPA Marina Del Ray before starting or forming a new business.

When The Business Is In A Starting Stage, The CPA

Advices on the type of company you should form (S corporation, C corporation, LLC).

Helps set up the accounting and bookkeeping services.

Guides the entire financial section of the business plan.

Already own a business? Here are some ways the CPA helps you in other areas.

When Your Business In Operation, The CPA

Helps the business operate in a great tax efficient way

Checks the payroll operation.

Plan the changes in business expense to avoid hardships by cutting down extra costs.

During The Business Growth Period, The CPA

Advice you on handling financial growth by providing budgets, financial reports.

Protect the business from audits and help when you get audited by the IRS.

Provide assistance with growth transitions like hiring staff, taking more office space.

When The Business Faces Financial Issues, the CPA

Help identify the problems first.

Work with the creditors to set up the payment plans, reduce interest charges.

Why do Businesses need a CPA?

Many businesses use the service of an accountant. However, there are competent accountants serving big and small business. The accountant might fill up some of your accounting needs, but using a CPA in Marina del Ray has its benefits.

Proper Licence- the CPA is licensed by the state and keeps up with the tax laws to maintain a license in the state. The CPA exam is also difficult and that’s not all. After the completion of the exam , they require continuing education to maintain the license. Due to this constant learning, they always have an upper hand over the accountants.

Knowledge of tax laws- All the CPAs are familiar with the tax laws than regular accountants. Since knowledge of the tax laws plays a big part in the CPA exam and many CPAs take the exam every year, they stay updated.

Thorough financial analysis- The CPAs conduct a proper analysis and offer advice on financial and tax matters. Even though the CPA in Marina del Ray may be the best person to give you this advice since he puts the license at stake to give this financial and tax advice.

Contact Us Today:

Locations:

How to Hire a Good CPA? Know Yourself Before Knowing Him

If you are a small business owner in Beverly Hills, you would know the importance of hiring a CPA. This is true that some businesses do their tax and accounting work themselves, but if you are not an expert in this, hiring an expert would be a wise idea. Only a professional knows how to make your work done in the most efficient way possible.

Being in the tax and accounting industry for years, we understand it is not an easy task to hire a CPA in the Beverly Hills. You have to conduct a thorough research to hire the best CPA Beverly Hills. However, before starting your research for finding the best CPA, you need to know who can be the best CPA for you. Every business does not need the same service from a CPA. Therefore, the definition of the best CPA might vary from business to business. In order to understand who is the best CPA Beverly Hills for you, you should know a few things about yourself and about your business. Below are discussed a few questions that you can ask yourself to understand what type of CPA would be the perfect option for your business needs.

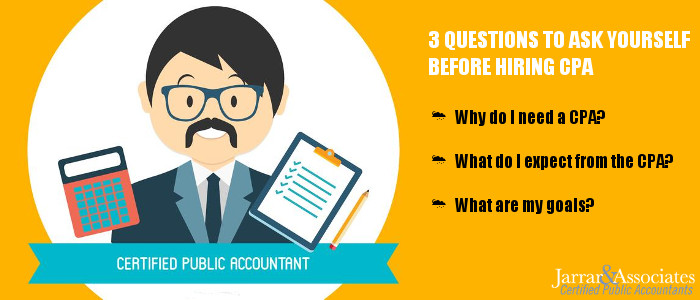

Why do I need a CPA?

The very first question that you need to ask yourself is, why you need a CPA. A certified public accountant can help you in multiple ways.

They can help you in

• preparing your taxes

• IRS audit

• Looking after your business payroll or

• Doing all of the above

Knowing your need is highly important to choose the best.

What do I expect from the CPA?

Depending on the business, your business needs might be different from the others. However, every business owner expects a few basic things from his/her CPA, that are –

• A relationship of trust

• Proactive advice

• Straight-forward counsel

• Worry-free approach

• Comprehensive services

What are my goals?

After knowing what your business needs are and what you should expect from your CPA Beverly Hills, you should set a goal that you want to accomplish with the help of your CPA. Note down your goals to make them more strong. Make sure the CPA, you consider choosing, is able to accomplish your goals.

When you get the answer to the above questions, it becomes easier for you to search a good CPA in Beverly Hills. You already know by considering a few factors, you can find a good CPA. The thing that is more vital is to know the definition of a “good” CPA for your particular business. Hope, you will be able to find your good CPA by asking yourself the above questions.

Three Most Common Types of IRS Tax Penalties and The Ways to Waive Off

There are a number of business owners and individuals who have filed and forgotten their tax returns. If you are among those, you might have already got an abrupt reminder for an IRS penalty. Below are discussed three most common types of IRS tax penalties and the way how can get relief.

1. Unable to file and unable to pay:

The IRS considers a number of factors that prove that you were really unable to complete your federal tax obligations in spite of trying to do so by using all the ordinary business care and prudence. The factors, that the IRS considers, include fire, natural disaster, casualty or other disturbances. The agency also accepts the unavoidable circumstances like deaths, serious illness and unavoidable absence of the taxpayers.

If your reasons for not being able to file and pay tax does not include the above causes or if you don’t have a strong reason for filing and paying late, you might be able to apply for FTA (first-time penalty abatement) waiver. In order to qualify for a relief, you should have

• The receipts of no penalty for the last three tax years along with the year in which you received a penalty.

• To arrange and pay the tax in the due date

• The valid reason for the extension of time to file

The CPA Beverly Hills can help you to take you out of the situation in the most efficient way possible.

2. Tax miscalculation:

You can abate your penalties if you are able to prove that the IRS has made a mistake in calculating penalty by using different methods or crediting your payment to the inaccurate tax period. If you are able to do so, you can reduce or eliminate the penalty. Needless to say, only a professional CPA Beverly Hills are able to do so.

3. Incorrect tax filing:

You might be able to apply for a penalty if the IRS finds that your tax return file was prepared negligently. However, you can get relief from this penalty if you can show that you disclosed your tax position properly in your return.

It can be said that you can get relief from the IRS penalties if the chances of withstanding an IRS challenge is more than 50%. However, if you want to enjoy your tax season without giving any penalty or if you want to save money on tax, then you should outsource your tax work to a CPA in Beverly Hills who has years of experience in this field.

Step-by-Step Guide to Make You an Esteemed CPA

Becoming a CPA is probably one of the most prestigious professions after a health officer. A Certified Public Accountant or CPA gets a higher esteem in the eyes of professional peers, business contacts, regulators, and clients alike. This is due to the fact that a CPA has to undergo certain minimum educational requirement, pass a rigorous four-part examination, and agree to abide by a certain code of ethics. This is the reason the designation of CPA in Beverly Hills is one of the most versatile and sought-after credentials for accountants.

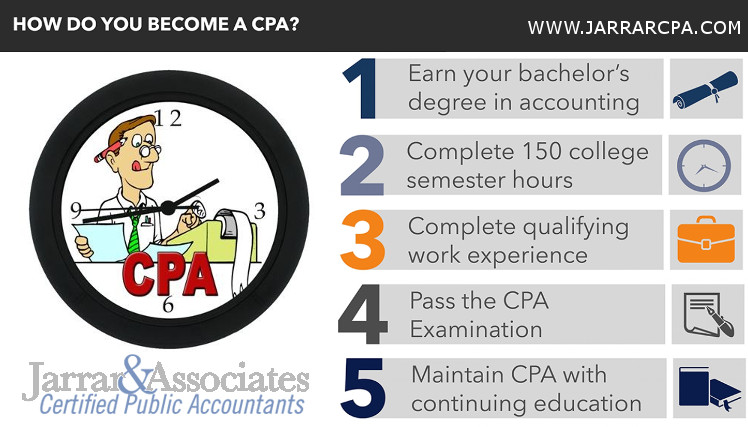

Steps to becoming a Certified Public Accountant

1. Getting the required education:

To become a CPA in Beverly Hills, you need to find about the various accounting programs offered by the colleges and universities in CA. According to the California Board of Accountancy, all CPAs need to have a bachelor’s degree and 150-semester units of education. The program you attend should be accredited by any of the regional or national agencies listed in the U.S. Department of Education Database of Accredited Postsecondary Institutions and Programs.

2. Taking the Uniform CPA examination:

Once you are granted the bachelor’s degree and the course requirements of the CBA (California Board of Accountancy) get fulfilled, then you can appear for the Uniform CPA examination. You can do online registration at the CBA’s website to take the uniform CPA examination.

3. Acquiring necessary experience:

If you want to become a licensed CPA, then after clearing the examination, you need to have prescribed work experience. You need to complete twelve months of general accounting experience (including use of financial advisory, consulting tax, compilation, management advisory, accounting skills) and 500 hours of attest experience (involving experience in planning the audit and selecting procedures, preparing and reporting full disclosure financial statements, preparing working papers, preparing written comments and explanations on the work performed, and applying a variety of auditing techniques and procedures. You can gain the required experience in private industry, public industry or a government sector and the earned experience needs to be documented.

4. Getting CPA license:

Once you meet the requirements and experience as stated by the California Board of Accountancy, you are ready to get the CPA license. The CBA makes it easy for you to get the reciprocal CPA license in CA, even if you hold the certificate and license from another state through the interstate reciprocal license.

5. Continuing education in Beverly Hills:

As a licensed CPA Beverly Hills, you need to complete CPE (continuing professional education) hours in order to keep the license active and updated. At every two years, you need to complete 80 hours of CPE, of which at least 20 hours of CPE needs to be completed in one year, at least 12 hours of CPE needs to be completed in approved subjects each year, and minimum 4 hours should be completed in ethics every 2 years.

After all these steps, you become a licensed CPA and can further specialize in management, finance, auditing, governmental accounting, forensic accounting, and information systems accounting.

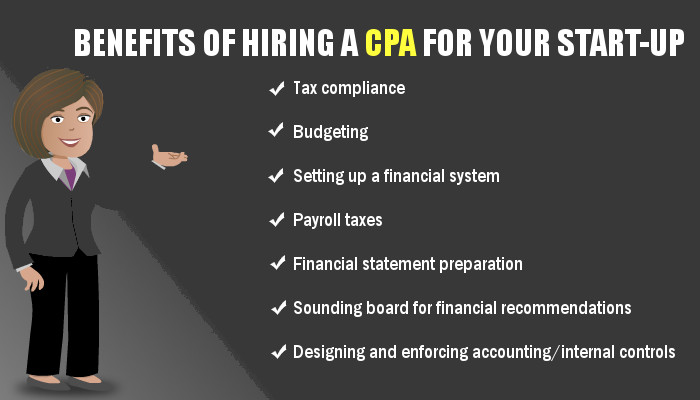

Importance of Hiring a CPA for Your Start-up

Establishing a business in Beverly Hills is equally lucrative and challenging for a new entrepreneur. This is the place which is home to some of the prominent companies around the globe. The city dedicatedly supports all existing and new businesses, right from the smallest unit to the largest MNCs. If you are starting out or have been operating for a few months, you need to ensure that your business is kept in good hands. In order to maintain success for the business, everything including inspection schedules, public records, and permits need to be kept and documented in a proper manner. This is the reason a CPA – Beverly Hills prove to be an important resource for the business.

Starting a business in Beverly Hills

Beverly Hills is already a thriving business hub, with the annual economy reaching $20 billion. The central location of the City in the high-income west side of Los Angeles (CA) County makes it one of the well maintained and safest cities in the United States. Having a business location in this City would open up endless opportunities for your company.

In order to start the business, you need to have a proper business planning. You can take help from the Office of Economic Development. You can contact them to get information on the economy of the city and market data of various retail and commercial districts. You would also get their assistance and support to address the start-up issues that involve other divisions or departments of the City. The most important division that requires experienced professionals is the finance division to open a business in Beverly Hills. This is the reason; you need to hire a reputed CPA in Beverly Hills right from the onset of the business.

Role of finance division and CPA in a Beverly Hills business

You need to discuss with the CPA Beverly Hills whether your business needs to obtain special permit. Certain types of businesses like clubs, amusement centers, massage parlors, escort bureaus, police-patrol, television/motion picture filming, pawnbrokers, taxi cab services, second-hand dealers, solicitors, peddlers, canvassers, and such others require to have the permit to operate in Beverly Hills.

Once you are ready to start the business, you need to apply for a business tax certificate before operating. All types of businesses, professional and non-professional services, wholesalers, retailers, contractors, commercial property owners or brokers, real estate dealers, need to have this tax certificate and license to start with the business operations.

Starting a business requires a lot of understanding about the different sectors of business functions and dredging through an endless stack of financial documents. Only a knowledgeable and experienced CPA can provide you with a clear picture about the success of your business.

Accounting and finances happen to the heart and pulse of a business. Right from income to expenses, cash flow, and budgeting, these functions are essential for the business, irrespective of its size of nature. The CPA keeps track of where your business stands financially. He tracks the financial health of the business with accounting software and tools and lets you know how to grow and become successful.

CPA Vs Accountant: Things To Consider For Your Business Needs?

Being an owner of a startup or a small-sized business, you probably have to deal with a lot of issues, right from the operations to administration. You are the key person to make important and timely decisions, by investing your time in the daily activities that have crucial effects on the resources. It is no wonder, many business owners fail to survive till the second year, due to the lack of a professional who would take care of the finances. This is the reason, you should think of hiring a CPA for business and save yourself from financial hassles all the year round. Before hiring such a CPA, you need to have a basic understanding of what actually they do and how their proficiency differs from a regular accountant.

Who is CPA? What Does CPA Stand For?

An accountant becomes a Certified Public Accountant (CPA) after meeting the minimum educational requirements and passing a rigorous examination, conducted in four parts. A CPA has to abide by a code of ethics. After completion of the examination, the CPA has to work as a practicing apprentice under an experienced CPA Westwood for a fixed number of years.

This designation is the most sought-after credential for an accountant and an individual possessing this certification achieves the highest position in the eyes of professional peers, business contacts, client, and regulators. In order to maintain their CPA license, they need to keep themselves updated and appear for the examination at regular intervals.

CPA Vs Accountant: How they are different?

Public accounting includes a wide array of domains, right from the accounting to tax management, financial consultation, and auditing to a myriad type of organizations, like non-profit organizations, government and non-government organizations, small businesses, corporations, and so on. Any certified accountant can take responsibilities for these tasks. However, there are two tasks which cannot be done by an accountant unless he/she has a CPA license.

Schedule A Consultation Today!

These two tasks specialized for a CPA –

Representing the client in front of the IRS (Internal Revenue Service). Other than a CPA, only an enrolled agent, an attorney, an enrolled actuary, or an enrolled retirement plan agent can represent the clients.

Only the CPAs can prepare an audit or review the financial statements of a company and file the report with the SEC (Securities and Exchange Commission).

Also Read: How To Overcome Common Small Business Accounting Challenges

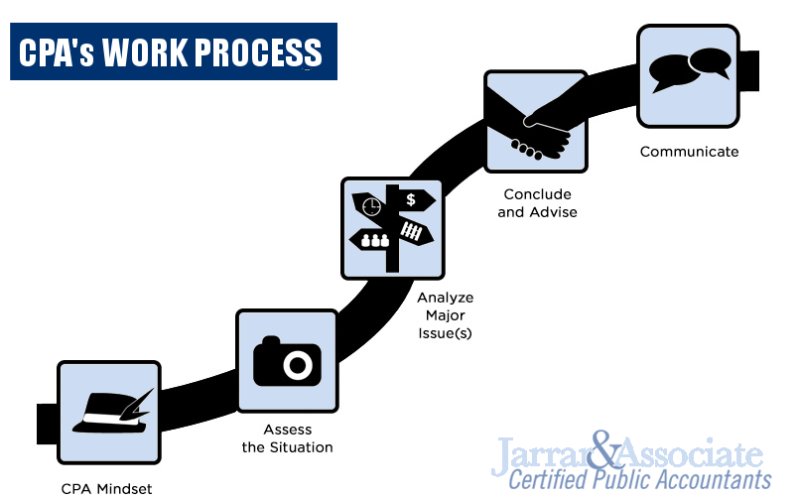

What are the services rendered by a CPA?

The CPA works in any of these three major areas:

Audit/Assurance service:

Auditing involves objective evaluation of the economic and financial information, in order to ensure that the information meets the designated criteria like GAAP (Generally Accepted Accounting Principles). Assurance is an independent professional service that aims to enhance the context or quality of both non-financial and financial information to make important decisions.

Tax service:

This service includes preparing and filing the local, state, and federal tax returns, and working all the year round to minimize the tax obligations of the organization or an individual, with whom they work.

Also Read: Why Hiring A Bookkeeping Service Is Essential

Management service:

This includes providing assistance with managing and supervising the day-to-day activities of an organization or an individual to provide strategic and long-term planning. The service includes budgeting, cash management, insurance coordination, financial planning, risk management, preparing financial statements, estate planning, and investment guidance.

In conclusion for CPA vs accountant, it’s important for small business owners to understand the key differences between a CPA and an accountant when it comes to the services they provide. While both professionals can handle basic accounting tasks, only a CPA can offer specialized services like tax preparation, auditing, and financial planning. Knowing the difference between a CPA and an accountant can help small business owners make informed decisions when it comes to their financial needs.

Contact Us Today:

Locations:

4 FAQs that help to hire the right CPA for your business

Every business owner faces a time when there is need to look for an experienced CPA. If you know exactly what to look for while availing services from a firm that provides CPA in Brentwood, then not only you would save a lot of money by avoiding potential hassle with the IRS, but can get useful inputs to grow your business as well. A CPA does much more than just dealing with the numbers or finances. He would actually communicate what the finances mean to your business.

This is the reason, you need to shop around, contact a few CPA firms, ask questions, and then finalize on the one who suits you and your business the best.

The following FAQs help you to make the right decision:

FAQ#1: Are you available all the year round?

There are some CPA firms in Brentwood, which do not work after 15th April and again resume work on the following tax season. However, if your business is small or a startup, then you would need their help all the year round. So, you should select such a CPA Brentwood, who would available all the time.

FAQ#2: What kinds of businesses do you work with?

Before hiring a CPA, you need to know whether he has experience in handling the type of business you have. The accountant or the CPA needs to understand your business and its objectives. For instance, a restaurant business differs from that of a real estate firm, where the former has specific rules for tips and wages the latter has issues related to contract workers, and such other things. So, the CPA in Brentwood needs to have experience in working with other businesses like yours, and have knowledge on the ins and outs of the industry.

FAQ#3: What kind of experience you have with the IRS?

There are certain firms, who have both CPAs and EAs. While most business owners go for CPAs (Certified Public Accountant) as they carry more comprehensive certifications’ CPAs are state-certified and expert in areas like bookkeeping and financial planning. However, EAs (Enrolled Agent) are Federal government certified, whose specializations like in handling taxes. The EAs are often former IRS agents who have extensive experience in dealing with audits. So, instead of focusing on certifications, you need to prioritize your requirement, and then see how the CPA’s experience is relevant to your trade.

FAQ#4: How do you handle working with multiple entities?

If there is more than a single entity under your name, then you need to hire such a CPA who would be able to manage the multiple entities simultaneously, a skill which a common accountant would not possess.

Once you are sure that the chosen firm has the ability to take responsibility of your business, you can go for a yearly contract with them and let your finances be handled by the expert.