What Are The Tax Strategies For High Income Earners?

No one wants to pay more taxes than they legally have to. After all, income tax is typically the largest expense for most people.

With this in mind, the government offers tax deductions and credits to ease this financial burden. But the system seems to favor those who fall in a certain income range.

Why?

For the most part, tax services Westwood is phased out for higher-income individuals.

In some situations, higher-income means adjusted gross income $186,000 for IRA contributions or $315,000 for the new business income deductions for partnerships.

In both scenarios, taxpayers earning above these thresholds don’t qualify for the tax benefits. There are several individuals who earn higher than these amounts but fall in the middle class or who have a lot of expenses to cover.

It just doesn’t seem fair. So, tax planning exists. For further assistance hiring a CPA Westwood can really help.

Tax planning involves the analysis of a financial position from a tax perspective. The purpose of tax planning is to achieve tax efficiency. Tax efficiency ensures that you pay the least possible tax in a given situation.

Since tax brackets cause higher-income individuals to pay a higher percentage tax rate, tax planning becomes more difficult.

However, there are strategies for high-income earners. This is where forethought strategy and a little creativity comes to play.

Schedule A Consultation Today!

The Present Tax System

The current tax system takes individuals based on brackets. How tax brackets work is the higher your income, the more you pay in taxes.

The government implements a credit and deduction system designed to limit the amount of taxes you pay. As you know, the system is not necessarily designed for individuals who make over 6 figures.

While that covers the vast majority of individuals, there are still a large number of taxpayers who can’t benefit.

Yet, the top 1% of taxpayers pay roughly 40 percent of federal income taxes. The system does not seem to treat these individuals the same. The effects of the tax disparity are people committing tax evasion.

If you don’t want to fall into any trouble connecting with the best CPA Westwood is the right thing to do.

Tax evasion is the illegal underpayment of tax. By no means should you commit tax evasion? Those found guilty are imprisoned for up to 5 years.

The tax services Westwood is important for high-income earners. There are several legal ways to minimize tax.

if you make a high salary, there are some tax strategies for high-income earners that will help you save thousands or more on the taxes.

Retirement Accounts

There’s no doubt that everyone should be planning retirement to help in tax services Westwood. Besides the fact you want a comfortable retirement, investing in certain types of retirement accounts is one of the best strategies for high-income earners.

|

Avoid IRS Audit with Tax Planning! |

Individual Retirement Accounts (IRA)

Back Door Roth IRAs

Traditional IRAs don’t offer any tax-deductible benefits for those with a Modified Adjusted Gross Income (MAGI) of above $72,000 and earnings are just tax-deferred.

However, Roth IRAs allow you to contribute after-tax dollars while earnings and withdrawals are tax-free. But there’s a catch

If you have an MAGI of above $120,000, you aren’t able to contribute to a Roth IRA. Unless, you convert your non-deductible contribution from the traditional IRA, also known as backdoor Roth IRA.

Simple IRA

If you are self-employed and have employees, consider setting up a Simple IRA. They are less costly for the business with a slightly lower contribution limit of $12,500 annually.

Other Tax Saving Retirement Accounts

There are other types of self-employed retirement accounts you must know about for tax services Westwood, which allow you to make higher tax-deferred contributions.

As much as $60,000 if you are over the age of 50. Also, $54,000 for those younger than 50.

Health Savings Accounts

Do you qualify for a Health Savings Account (HSA)? If so, you definitely want to max out your contribution limit.

HSAs are a wat to save pre-tax income into a specific account and withdraw the funds for medical purposes.

By putting pre-tax money aside, you lower the taxable income and pay in taxes. Then when funds are withdrawn from the HSA, it becomes tax-free.

If you want to know how to take advantage of the HSAs, hiring CPA Westwood helps a lot. Do you know distributions become tax-free? As if they were used on health-related expenses.

The catch is the healthcare-related expenses you’ve been paying out of pocket have to be greater than or equal to your HSA distribution. So, you would need to keep up with the receipts to validate your distribution.

Stock Donation

Your charitable donations are not just limited to cash only. Many wealthy individuals find it advantageous to donate, here’s why.

When the stock of appreciated value is donated, the owner doesn’t pay any capital gains tax. In fact, they are able to deduct the full market value, also known as an appreciated value, not the price you paid.

This tax services Westwood strategy works best for stocks that have increased in value since you bought them.

Factors To Consider When Tax Planning

Paying tax later is better than paying now

This is known as tax deferral or deferring tax. If tac can be deferred for a later time, that’s better for you as the taxpayer.

But how when you potentially might end up paying some amount later?

Well, the tax you deferred could potentially be invested until it’s time to pay or you might end up being in a lower tax bracket later.

Also, situations change and you could find some more incentives are available or may incur losses to offset any income later.

Either way, tax deferring provides you with flexibility. If and when legally possible, you must defer your taxes.

Don’t spend a dollar to save 30 cents in taxes

This rule is usually geared towards business owners but can actually apply to anyone. Near the end of the year, taxpayers try their best to find ways to reduce the taxable income by spending more.

Spending more to reduce taxable income is not tax planning. Hiring CPA Westwood can help you plan it right.

A strategy like this makes sense if you purchase items you were planning on purchasing, regardless of the tax plan.

Finally, for the most part, everyone pays tax. Whether you work full-time or part-time at any level, the IRS expects you to pay taxes.

It’s unlikely they’ll inform you that you overpaid or miss out on applicable tax incentives, which is why tax services Westwood is so important for all.

Contact Us Today:

Locations:

What Happens If You Cannot Pay Taxes You Owe?

You have finished preparing the tax return and notice that you have to pay someone a huge sum, but can’t afford to pay it.

Will you go to jail? Probably not. The realization that you can’t afford to pay your taxes can make you feel uneasy, but don’t worry.

There are things you can do to remedy the situation with the right business accounting services and avoid landing in trouble with the IRS.

File the Return On Time

Even if you don’t have enough money to pay the taxes due, you still need to send in the return by the filing deadline.

The IRS assesses two types of tax penalties: one for filing late and one for failing to pay taxes on time.

Now, the penalty for filing late depends and varies each year. If you can’t pay the tax bill in full on time, you’ll still garner a much lower penalty than you would by waiting to file the return. So bottom line, get the return in by filing deadline if not before.

Also, pay as much of your taxes owed as you can when you file. Even if you can’t pay in full, paying something towards the balance due can reduce the amount of interest and penalties later.

Hire the right tax accountant services Beverly Hills for the best assistance.

Review the option for paying

Whether you owe $100 or $10,000, the first thing you must do is try to find possible sources to obtain the money you need to pay.

For instance, you may consider tapping the equity in your home, using a credit card to pay the taxes, digging into the savings, getting a personal loan, borrowing from friends, or cashing out paid time off at work.

A more extreme option is pulling money out of your IRA or retirement savings. But again, this can trigger its own penalties, so it’s best to view this as the best option of last resort.

Next, if you are considering a loan or credit card o pay the tax bill, remember to weigh the interest rate and fees in the balance.

If you can repay the loan or credit card fairly quickly, or use a credit card with 0% APR, the cost may be minimal.

But if you owe a large tax bill when it comes to business accounting services, the interest may add up really fast. Apart from these, be aware that the IRS charges processing fees for paying income taxes with a credit card, which can increase the total cost.

|

Start Early Tax Planning! |

Do check the timeline

While it’s always the best to pay the taxes, and avail tax accountant services Beverly Hills you owe in full and on time, there are scenarios when all you may need to pay is to get the next paycheck. In such cases, you could file your return and accept the late payment penalty.

As long as you filed the taxes on time, the IRS will send you a letter in the mail stating how much you owe plus additional interest or penalties due.

Schedule A Consultation Today!

The downside is that your tax bill will be lingering over the head a bit longer and what you owe will accrue penalties and interest until you pay.

The upside, however, is that the interest you pay will be low compared to financing the money with any source.

However, this is not going to be a long-term solution and your goal should be to pay the IRS as fast as possible, since the longer you wait the more the penalties and interest can add up.

Wait too long to pay and the IRS may take action against you to place a lien against the property or garnish the wages or bank account. The right expert offering you business accounting services can help a lot.

How To Pay The IRS When You Owe Taxes?

You’ve finished the tax return only to realize that you owe money to the IRs. Having a balance due to the IRS is never good news, but you have some options for paying what you owe- even if it’s more than the cash you have on hand.

First, file an extension

Don’t take that completed tax return and your debt to the IRS at face value. You can get an automatic extension of six or more months from the IRS. This gives you 180 additional days to review your return.

Look for deductions you might have missed or miscalculations you have made. Consult a tax professional if you don’t do so before- you might be eligible for a tax credit or deduction that you aren’t even aware of. The idea is to reduce the preliminary tax debt if at all possible.

If you don’t have the money to pay, remit as much as you can. If it ends up that you pay too much-your tax bill is less than you thought it was after you spent some time finalizing the return.

Note, the IRS will send you a refund just as it would if you had overpaid all year through withholding from paychecks.

The tax accountant services Beverly Hills can actually help you file the extension easily.

Meeting the deadline

The most important thing is getting Form 4868 to the IRS on or before the tax filing deadline. Also, the IRS charges a late filing penalty, a late payment penalty, and interest on unpaid balances owed if you don’t file the return or the extension on time and if you fail to pay on time.

It’s better to file the extension and pay as much as you can, and then go back to the drawing board to ensure you really owe all that you think you owe.

Finally, if you can’t pay off the tax debt monthly, or if you owe a lot, it’s better to seek assistance from an experienced tax accountant services Beverly Hills. He would help evaluate the other ways to resolve your tax debts.

The IRS also considers offers in a compromise where it may be willing to accept an amount that’s less than what you owe under some circumstances.

Schedule A Consultation Today!

Contact Us Today:

Locations:

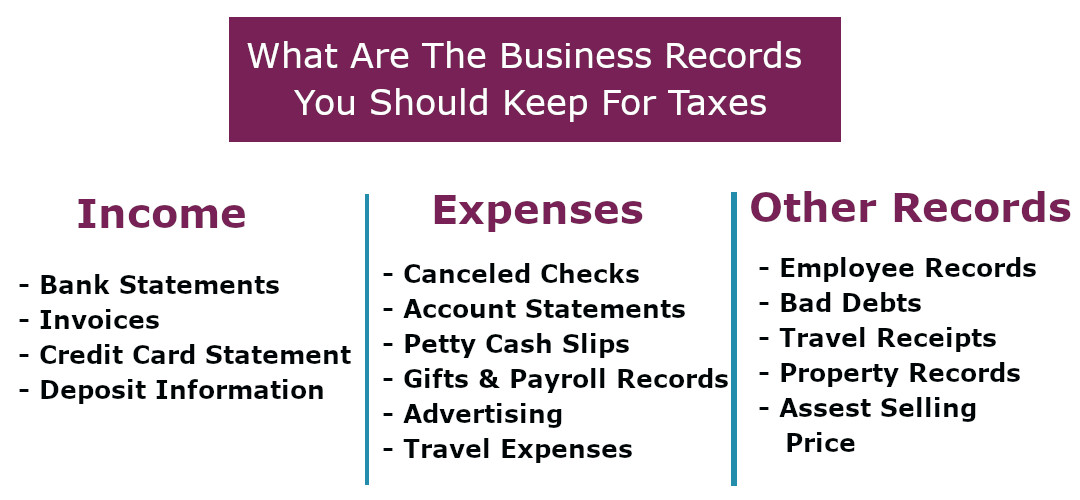

Why And How Long To Keep Business Records For Tax Purposes?

For many new small business entrepreneurs, the first year is actually the hardest. First, you need to decide what form of business you actually want, then there’s extensive business record keeping.

Bad record-keeping can be a big pitfall if you are a small business owner. You can avoid headaches when you are filing your tax return, keeping business records for tax purposes becomes useful. You need to keep the records all through the year.

Everyone in business must keep tax records for small business. Good business records will surely help you do the following:

Monitoring the progress of the business

You definitely need good records to monitor your business’s progress. Records can show whether your business is improving, which items are selling or what changes you need to make.

Do you know that good records can actually increase the chances of business success? But, how to find business tax records? Read on and you will find out.

Project the estimated tax payment

During the first year of business, you will need to project the tax liability so that you can make the estimated tax payments. Estimated tax is the method used to pay tax on come is not subject to withholding.

When you are dealing with tax preparation, keeping the business records can actually be a lot of help. Estimated tax is used to pay income tax and self-employment tax, as well as other taxes and amounts reported on the tax return.

Preparing the financial statements

You need good business records for tax purposes to prepare accurate financial statements. These include income such as profit and loss statement as well as balance sheets. These statements can really help you deal with the bank creditors and manage your business, well.

Preparing the tax return

You also need good business records to prepare tax returns. These records support the expenses, income, and credits you report. Now, these are the same records you use to monitor the business and prepare the financial statements.

Now, you may wonder how to find business tax records. This is easy. Every business leaves a paper and electronic trail of tax records, business licenses, corporate filings, financial statements, etc.

If you are a small business owner, you can find tax records information online and hard copies at government offices.

So, once you know why you should keep business tax records, your next questions may be how long should you keep it. Let’s see.

How Long Should You Keep Business Tax Records?

Good business recordkeeping allows you to prepare the financial statements, helps you keep tabs on the expenses as well as comes in handy in case you get audited or sued.

But did you know the IRS requires you keep the business records for tax purposes? Let’s find out which records you are legally allowed to keep and how long you must keep it. Also, how to ensure that you don’t lose it, at all.

| Record type | How long to keep it |

|---|---|

| Previous tax returns | 3 years |

| Receipts | 3 years |

| Miscellaneous financial records | 3 years |

| Employment tax records | 4 years |

| If you omitted income from your return, keep records for.. | 6 years |

| If you deducted the cost of bad debt or worthless securities, keep records for.. | 7 years |

The Eight Small Business Tax Record Keeping Rules

You never know which record you need when dealing with tax preparation, so keep these handy.

- Always keep bank statements, receipts, payroll records, invoices, receipts and any document that supports an item of deduction, income or credit shown on the tax return.

- The most supporting document needs to be kept for at least three years.

- Keep employment tax records for about four years.

- If you omitted income from the tax return, ensure you keep the records for at least six years.

- If you deduced the cost of bad debt, keep the records for up to seven years.

- It is better to get the documents electronically backed up and go paperless.

What receipts to keep for taxes?

As much as you live by your words, the IRS requires that you keep documentation that includes your income, deductions, credits you report on the tax return.

Here are the main records you must keep for tax preparation:

- Cash register tapes

- Receipts

- Deposit information such as cash and credit sales

- Invoices

- Credit card receipts

- Bank statement

- Tax filing

- Payroll records

Are there documents you don’t need to keep?

It is impossible to keep all the documents. Receipts at times get lost, especially for small expenses. But can you still claim those receipt-less expenses as tax deductions?

Maybe, but the expenses need to be less than $75. You can get away with not keeping tax records for small business for three reasons:

- The expense is less than $75. (This isn’t applicable for lodging expenses)

- The expense is for transportation and it is not possible to have a proper receipt.

- You are reporting meals and lodging expenses under an accountable plan.

Wait, in order for the IRS to uphold a deduction under $75 without any receipt, you need to present them with:

- The expense amount

- Where and when it was made

- The essential character or purpose of your expense

The easiest way to keep the records

The IRS suggests that you can use any recordkeeping system as long as it shows your expenses and income. However, the IRS accepts digital copies of documents as long as they are identical to original copies.

No wonder, digitizing the records is the best way to prevent accidentally tossing them in the trash can. Also, paper records can fade and are susceptible to damages.

It is better to scan each record and receipt in your business and archiving forever.

Concluding words

When dealing with tax preparation and wish to avoid the IRS audit, it is better to stay sorted. One of the most important things is to keep the necessary business records. So, before tossing them up, double-check whether you or anyone else you do business with might need it.

Contact Us Today:

Locations:

Is Financial Planning Important For Small Business?

Want to build a business that will last well into the future? The secret is sound is proper finance planning.

Financial analysis and planning allow would-be business owners to look at several things before starting the company, including current funding, initial costs, potential funding sources, the viability of an idea, etc.

Starting a business is complex and expensive than paying rent and making passive investment payments. Though similar to personal financial planning, smarter planning for a business does involve looking at the financial situation, including investments and debts, to understand what is possible financially.

It is also more complicated and harder for new businesses to understand what is affordable and possible for their venture.

Working with a financial planner to help you understand the basics of finance seems necessary to getting a business off the ground and maintaining it successfully.

Planning To Start A Business? Get The Finance Planning Order First

In-Depth planning is necessary to start your own business. These guidelines will help you venture into the business world successfully.

Cash management

Many businesses have seasonal and monthly variations in revenues. This translates into periods when cash is plentiful and times when cash shortages occur.

In building the financial plan, you must take these cycles into account to keep a tight rein on expenditure during the forecast low revenue periods.

Poor cash management can result in negative consequences such as not being able to make payroll. Having the right financial planners Los Angeles by your side can help you sleep better at night. He provides a structure so there is a cash cushion helping you all the time.

The cushion allows your small business to take advantage of opportunities that arise, such as the chance to purchase inventory from suppliers at a temporarily reduced cost.

Long-range views

In business, it is easy to focus on the crisis and issues that must be dealt with on a daily basis. The price for being too short-term oriented is that you may not spend enough time planning what needs to be done to grow the business long-term.

The financial planning, with its forward-looking focus, allows the business owner to better see what expenditures need to be made to keep the business on a growth track and to stay ahead of competitors.

Spotting trends

As a business owner, you make so many decisions over the course of a month that it can be difficult to tell which decisions resulted in success and which ideas resulted in failure.

Preparing the financial plan involves setting quantifiable targets that can be compared to actual results during the year. As a business owner, you can see whether an increase in expenditure led to the hoped-for jump sales.

Prioritizing expenditure

Conserving financial resources in a small business is a critical element of success. The financial planning process helps you identify the most important expenditure, those that bring about improvements in efficiency, productivity, or market penetration, versus those that can be postponed until cash is plentiful.

Most well-capitalized corporations go through the prioritization process, comparing the cost to benefits of each proposed expenditure.

Hiring an experienced financial planner Los Angeles can help you deal with everything related to expenditure.

Measuring progress

In the early stages of their ventures, you work for long hours and deal with numerous challenges. It can be difficult to tell whether the progress is being made or whether the business is mired in mediocrity. Seeing the actual results are better than forecast provides the small business owner needed encouragement.

A chart showing steady growth in revenues month by month, or a rising cash balance is a great motivating factor. The financial plan helps you see, with clarity, that the business is on its way to being successful.

|

Start Your Financial Planning Now!Financial Planners Plays a Crucial Role in Financial Planning & Adjustments. Need Expert Who Monitor The Finances Closely?

|

Locations:

How Can You Spot IRS Scams And Report Them?

If you are getting hounded by numerous calls, emails or letters from the IRS, how do you know these are legit? There are some warning signs of scams that you must always lookout for.

Every year you might seem to get numerous calls from scam artists who pretend to be from IRS. Whereas some people can identify the scams, others may not be able to identify and fall for it.

There are many elderly people who fall for such scams, especially widows since they might be a financially or technically less sophisticated.

With every tax season, it seems these scams get more advanced, increasing the chance of odds enticing innocent people into sharing personal information making unrequired payments.

To avoid falling for such traps, ensure you hire accountants.

Lookout for phone calls

It is rare for the IRS to call taxpayers. In fact, the IRS also initiates most contact through regular mail and not by phone. Even when it calls for a taxpayer, it would send many notices by mail. Along with this, the IRS don’t leave urgent time-sensitive calls where you need to immediately pay the tax bills.

There are robo-calls tapping the honest people who wants to do the right thing. When you are told that you owe money, they become really scared and accidentally break the law as they don’t want to get into trouble. They mistakenly follow the instructions to make payments, at times wiring money.

Now, it isn’t always a recorded voice. At some real people give you a call. If they are demanding in any ways, that’s a warning sign you might fall into a trap.

Beware of fake emails

Phishing is the actual term that is used to describe email attempts to get sensitive information appearing to look like it has been coming from a trustworthy organization or person. They might often link to fake websites that might seem real.

Apart from that, they often ask for real information to make refunds, this allows you to steal money out of the accounts.

If you don’t want to fall for such traps, it is better to hire accountants who can guide you and help you avoid such scams. Even by clicking on the links, it allows malware to be installed on the phone or PC, allowing the bad guys in so they can get exact information and capture your activities.

Take note of letters

It is easy for any graphic designer to take the IRS logo and make letterhead appear official. At times, they even create supporting documents that appear really official.

They even use the website’s URL that look quite close to official website address, with one or two letters differing. If you get a letter from the IRS it seems suspicious, you must call the agency to verify if they have contacted you.

Now, if the letter is real, the IRS would confirm it. If not, they would be help you track the latest scams. You can visit https://www.irs.gov/ to know more. If you have doubts, you must always check with a financial planner, an accountant to ensure the request is legitimate.

Finally, you must always stay alert when it comes to receiving any calls or emails from the IRS.

5 Things You Must Check Before Hiring Your Financial Planning Advisor

Finance planning is not at all an easy task as your investment will decide the future of your hard-earned wealth. Finance planning is a tough task which needs deep industry knowledge. Therefore, you cannot take the matter of choosing the financial advisor lightly.

You need to do a double check before you are finalizing your advisor. Remember, choosing a wrong advisor can make your all money a bad investment. Here are a few things that you need to ask your financial planning advisor before handing over all the finance related matter to him.

-

Qualification of Financial Advisor

One of the most essential matters that you must ask your financial planner is about the educational qualification. It also includes the license and certification that he has for doing the work of financial advisor. Financial planning is not a small part so one needs the right competency to reach the benchmark level, where he can advise others to invest in the right manner.

Some of the courses are Certified Financial Planner (CFA), Chartered Financial Consultant (ChFC), and Chartered Life Underwriter (CLU).

-

Experience of Financial Advisor

It is about the financial matter so you need to select someone who has adequate experience to guide you properly. Therefore, when you are selecting someone as your financial advisor, you must ask about him about the experience in the financial domain.

The more the experience is, the chance of error diminishes. With the increasing number of experiences in years, it is assumed that the advisor gained expertise and capabilities to deal with the financial markets and investment allocations.

-

Planning meeting your needs

It is important that both you and your financial advisor must think in a single direction. However, you can judge this by asking certain basic question to your financial advisor. The questions are what the advisor is offering, what type of investment he likes to do such as aggressive or conservative etc. The answers of the advisor will help you to finalize your decision of hiring the right financial planning advisor for you.

-

Standard Caring

All the advisors in the financial sector used to follow two standard care procedure, these are suitability standard and the fiduciary standard.

According to the suitability standard, the advisors are permissible to sell the different financial products and related services as per the needs of the clients. It is not that if the products are suitable for you means it will give you the best result for you. Overall, the advisors do not have to act in the best interest of their clients.

In the case of the Fiduciary standards, the advisors must be registered with the Registered Investment Advisory (RIA) firms. Hereby, they must act to make sure of the best interest of their clients like giving the financial advice and recommendation to the client for the best outcome.

So, you can understand by now that whom you need to select to get the best advice.

-

Fees

All the financial advisors have their own fees structure. The fees used to vary from one advisor to another. Some of the common ways of fees structure are as follows:

- Hourly pay

- Fixed rate for consultation

- A percentage charge based on the total value of an investment

- Commission

It is recommended to hire fee-based advisors. In most of the cases, it has been seen that commission-based advisors used to sell wrong financial products to get a better commission.

Final Selection

By now, as you have gone through the whole post, you got the necessary information about selecting the right financial planning advisor. Contact the experienced financial planners of Jarrar CPA to know more about it.

Contact Us Today:

Why does your startup need a bookkeeping service?

A startup is a transformation of an idea into a core reality. Several things an entrepreneur needs to take into consideration. Most of the entrepreneurs love to do work on own, but at some point, you may need to include outside people.

Especially, when it comes to managing the accounts, it is important that a knowledgeable person handle this matter. In most of the cases, the founders often do not come from the finance background.

However, a firm providing bookkeeping services in Santa Monica pointed out that small transactional miscalculation can create turbulence for your startup. Here are a few more reasons to hire a bookkeeping service.

• Stay out from what you don’t know

Most of the entrepreneurs are not aware of the intricacies of accounts and financial issues. Therefore, it is difficult for them to keep track of all the accounts related information. It will be a better idea to let these things to be handled by a knowledgeable person of this field.

It will diminish the chances of mistakes, which ultimately can save a good number of Dollars. A single missing bill can cost your business a lot.

• See your business from another view

It is difficult to find faults in your own works. Probably you are thinking that your business is running well but what is the harm in running it better?

A bookkeeper will bring forth all the transactional details in front of you. You can be able to see the fund sourcing and the expenses. Based on this, you can be able to calculate that do your efforts are really paying well or not.

• Pay the necessary bills on time

An entrepreneur needs to focus on the different aspects of the business. It is difficult to remember all the scheduled dates for the bill payments. However, if you hire a professional bookkeeper, it will be much easier to remember those things.

A bookkeeper will keep these little things in mind. Therefore, you don’t you need to take any extra burden on your shoulder.

• Correct filing of taxes

An audit or a tax claim can be a nightmare for a startup. It not only gives you a headache but also put a black mark on the business, which is not at all a good sign.

However, this generally happens if you forget to pay the quarterly taxes. You may need to file different taxes such as business tax payments, corporate tax payments, self-employment tax of 15.3%, 1099-MISC etc. Tax laws always get updated with each new year.

A bookkeeper can solve all these problems.

Final words

An entrepreneur needs to look after all the things of the business. Hardly they get time to be with their family. An extra burden of accounts can take that little too.

Hiring professional bookkeeping services in Santa Monica can give you some extra time to be with your family, while your works will be done in a scheduled manner.

Contact Us

Marina Del Address:

How to Save Taxes for The Small Business Applying These 5 Techniques?

Tax saving is an important matter for all types of business. However, the small business owner faces several difficulties due to the restricted amount of capital for the business. A CPA for tax preparation for years mentioned the importance of knowing the tricks and way to lower the taxes. An experienced CPA can help a lot in saving taxes.

In this current post, we will discuss some of the ways to save taxes for small businesses:

You must look for adjusted gross income (AGI)

One can adjust several tax breaks limitations through the AGI or Modifies Adjusted Gross Income (MAGI). You can avoid 0.9% Medicare tax over the earned income by not exceeding your AGI $200,000 in case of being single. However, if you are married it is more $5000.

Never to look over the carryover

Some limitations on the deduction and credits are there, which you cannot use in the same year. However, you have permission to carry some of them over to the next financial year. Therefore, it is important to keep track of those carryovers. You can use them in the next year.

However, if you will hire a CPA for tax preparation, they will automatically include this during preparing the tax preparation. Some of the examples of such carryovers are as follows:

• Capital losses

• Charitable contribution deductions

• General business credits

• Home office deduction

• Net operating losses

Related Article: Role of CPA’s For Business

Leave the Property rather than selling it

If you find a particular property has no value, it is better to leave it in the way instead of selling the property for a less amount. Remember that amount that you will get by selling the property will come under taxable income.

On the contrary, leaving the property as it is will be countable as a loss to the company, which is deductible.

You can classify the property under Section 1231. It allows you to show it as capital or ordinary loss.

Look out for tax-free ways to generate income

Salary, bonus, share distribution all come under the taxable income of the business. However, certain ways are there which do not come under taxable income. Your accountant can help you with the following matters:

• Medical Plans

• Retirement Plans

• No-interest or lower interest loans

Use the fringe benefits for employees

Giving fringe benefits to the employees can lower the amount of taxes for your business. in IRS Publication 15-B (2017), Employer’s Tax Guide to Fringe Benefits, you can find the details of the fringe benefits. Increasing the wages of the employee can increase the tax but give fringe benefits can be a smart way to avoid tax. Following things, you can consider in this regard:

• Health benefits

• Long-term care insurance

• Group term life insurance

• Disability insurance

• Educational assistance

Therefore, you can see several ways are there to save a good amount of tax. However, hiring a CPA for tax preparation can help you more to save the taxes for your business.

Contact Us Today:

Locations:

What Role Does A CPA Century City Play In Business Functions?

Accounting is the pulse of the business, whether it’s big or small and there is nothing like CPA who can help you. The expenses, cash flow, income and budgeting are all needed functions of every company, regardless of industry and its size.

Multinational corporations, sole proprietorships as well as businesses must know where they actually stand financially. Now, you must know that cash flow is an integral part of the business. Also, for success, proper tools to tracking the financial health needs to be in place.

The CPA Century City can offer you all the assistance that you need regardless of the business size. Whether it’s a startup or a reputed company working since long, everyone needs an experienced and qualified CPA to manage the accounting tasks well.

Assistance From CPA Century City

Middle or large sized businesses might utilize the CPA as a financial interpreter or as an advisor, who might be able to present the company’s financial data to the others within as well as outside of the company. Apart from this, the CPAs also deal with third party agents such as customers, vendors and more.

Ways In Which CPA Helps

If you are still wondering whether or not you must hire a CPA, you need to think again. The professionals help you in every aspect so that you can concentrate on taking your business to a new height.

Financial data management– The accounting structure of your company is an important component for business operations. One of the main roles of the CPA Century City is to collect and maintain the financial data, as it related to the firm or company. Also, the professional ensures the financial records are well maintained in compliance with the law. They understand how important it is to maintain the financial information in a pristine system since it is the main component for managing business.

Advice and analysis– the CPAs also play the role of an analyst and perform some kind of analysis using proper financial data that’s used to help in the bigger business decisions. Right from deciding which type of supplies you need to order, bill payment as well as payroll, the CPAs do it all and with precision. That’s not all, they also handle intricate several financial details on a regular basis. Advising you on business operations is another area where they prove their expertise. The CPA Century City also analyze the financial data to solve several irregularities and discrepancies that might arise.

Overall, the CPAs help your business in several ways such financial report preparation, external business affiliations and more.

Contact Us Today:

Locations:

The Role of CPA in Improving Your Business Performance

The role and duty of CPAs have gone through a lot of transformation. Earlier the accounts would only concentrate on what happened in the past and not what would happen in the future. But their position of bean counters has changed in the modern scenario. The CPA in Santa Monica concentrates on your present business account so as to improve your business performance.

There is no doubt that CPAs can bring to the table several unique skills going beyond working with numbers. Apart from working with past data, the CPAs possess skills suited to analyze the future financial goals. In other words, the accountants are well-equipped to meet and identify the financial challenges of your business’s future.

The opportunities being taken advantage of by CPAs to help in business performance

CPAs are an asset to business planning- if you are not good with the numbers, a knowledgeable CPA might be a good source of information on business planning and development. He would guide you on what’s right and what’s not for the success of your business.

CPAs help improve ineffective operational system cutting company margins-even if you show business growth for a couple of years unless you recognize the waste in company design procedure it is of no use. This is what a CPA helps you with by tracing the non-operational system to cut down the cost. This ultimately helps in business performance.

Tax preparation and tax planning can be a bonus- The CPAs performing tax preparation and tax planning can actually be a bonus and save your money. Doing it yourself might result in mistakes. The CPAs having proper knowledge make the task easy and saves money. They also help in avoiding costly tax audits.

Here are some of the ways the CPA Santa Monica helps stretch the muscles of your business by doing some of these things.

Cuts down business expenses

By looking at your business’s payable and receivable accounts, market costs, operations, the CPA in Santa Monica proposes savings on the cost of resources and other business operation costs. With access to the raw data, the experts can suggest you accordingly so you can make the right decision.

Manages cash flow

Cash flow management and visualization are a crucial part of proper accounting. Most of the CPAs actually use this as a financial map to understand the business future. You can ask the CPA to help you point out the processes and timing that can impact your business performance.

Use financial information for proper business strategy

The CPA in Santa Monica doesn’t take away your business powers and decision-making power. All he does is guide you so you can make the decision that benefits your business. He or she provides the support you need for making mid-term or near mid-term business decisions. You can even sort them to create a 5-year plan that you can use a roadmap to improve your business performance.

CPAs are essential for every business since they have knowledge and skill to improve your business performance.

Contact Us

Santa Monica Address: