How Can You Calculate Small Business Liability?

Finding out how much federal tax you owe is really complicated, most small business owners actually ask CPAs to do it for them.

But even after hiring a CPA, it is still essential to know the mysterious art of calculating the own taxes. You should be able to plan ahead, save money on CPA billable hours and never enter the tax season cluelessly.

Quick Look At How To Calculate The Tax Liability

When finding out how much federal tax the small business owes, you must start by determining the entity type. If your business is a C corporation, you need to pay tax twice, at both the corporate and shareholder levels. The income tax rate would also be flat 21%.

Also, if the business is not a C corporation, the tax rate would depend on the taxable income and the filing status.

Know The Entity Type

There are several business entity types you need to know about. There are C corp, partnership, sole prop, etc. But for the purpose of finding out how much tax the small business actually owes, there’s only C corporations, and everything else.

If you are not sure what the entity type is, just ask the CPA. He would be able to guide you properly on this. Moreover, if you have a small business with no accountant and you haven’t thought about entity type, there are chances the government would classify you as a sole proprietor.

C corporations are the only business type that pays corporate income taxes. So, if your business is not a C corp, it known as a flow-through entity since profits and losses flow through your business to shareholders and owners, who pay the taxes at the individual rate.

How Can You Figure Out The Tax Rate If You Are A C Corp?

The Tax Cuts and Jobs Act really simplified tax services such as calculations for C corporations. It has replaced the graduated corporate tax rate schedule that includes eight various tax rate brackets with a flat 21% tax rate.

In simple words, if you are the owner of a C corporation, irrespective of the taxable income your business has, the income tax rate would be 21%.

Double Taxation For C Corporations

The way this tax system has been structured, the C corporations usually get taxed twice; at the shareholder level when profits get distributed to owners as dividends and at the corporate level.

One way for corporations to skip this double taxation is to incorporate as an S corporation instead of a C corporation. Now, S corporations are usually flow-through entities so income doesn’t get taxed at the corporate level.

But there are some drawbacks to choosing S corporation status that might outweigh the tax savings. It is better to consult with your CPA on this one.

How Can You Figure Out The Tax Rate If Not A C Corp?

If your business is not the C corporation type, it means this is a flow-through entity. Due to this, you would be paying taxes yourself, instead of the business paying them.

The tax rate would depend on the amount of the business’s taxable income as well as your tax filing status.

Making Estimated Tax Payments

Many business owners actually think that their income tax payment deadline is on Tax Day, which falls in mid-April. But federal income taxes need to be paid as incurred.

It means that most of the small businesses need to make payments throughout the year depending on the estimate of their total taxable income at the year-end.

Finding out how much your small business owed in taxes is actually the first step. Once you have got it all figured, you would need to pay the taxes. If you have any confusion or question, hiring a CPA would be the best option.

Contact Us Today:

Locations:

What You Must Know About the Payroll Mistakes?

Managing the payroll is an important issue, especially if you are the owner of a small business. It is difficult for small businesses to buy any payroll management systems due to the lack of money. In this situation, it is important to get accounting services from experienced accountants.

An experienced accountant will ensure that you will not do any mistakes that will cost you in any way. Therefore, prior to hiring the accountant, here is a list of common mistakes that people used to do during the preparation of payroll.

Setting up incorrect payroll

It has been found that incorrect payroll has been done due to setting it up in the wrong way. You need to deduct the right amount of tax from your employees when it comes to setting up your payroll. To make it right, you need to hire a professional accountant who will be able to guide you to set up it by following the online resources from the federal, state, and local government.

Several other videos on the internet are available also, you only need to check it. However, it is better to hire one for accounting services.

Miscalculation of overtime

Over time works is another area that creates lots of issues during the creation of the proper payroll. The Fair Labor Standards Act (FLSA) ordered that one needs to pay workers a premium for their overtime. However, calculating this overtime often becomes a huge issue for the owners. One must follow the state and federal laws while deciding the overtime.

The rate of overtime can vary from state to state. Therefore, one needs to understand the whole situation by going into depth. However, it is better to go for an experienced accountant who can handle all these situations.

Late running payroll

Paying your employees on time is a real challenge when it comes to deciding payroll. If you forget to process the payroll of the employees, it can lead to unhappiness among the employees. Therefore, you need to be on the toe. However, often the late payroll execution results into a higher amount of payment.

On the contrary, it is also true that being a busy small business owner, it is not possible for you to maintain this all the time. Therefore, hiring someone professional in accounting services is a great idea to implement.

Forget to keep records

It doesn’t matter whether you are a big firm or a small agency, the audit is mandatory for every company. Often during the audit, the company used to lose the records, including the payroll records also. You need to at least submit 3 years of records. Therefore, in case you have misplaced these documents, it can be an issue while you will prepare a new payroll in the next financial year.

Paying tax at the wrong rate

Tax rates used to change significantly every year, and overlooking it causes issues in payroll preparation. If you are not aware of rates of taxes then you will not be able to withhold the amount from your employees’ salary.

In case of paying the wrong amount of tax, it may incur penalties. Therefore, it is better to take the help of a professional who has proper knowledge about all these.

Concluding Words

Therefore, you can see over here the issues that can be happened due to processing the payroll. Therefore, it will be a wise idea to hire an account professionally for all these accounting services related matters.

What Should You Be Knowing About Bookkeeping Services?

Whether you are simply starting the business or you are just fine-tuning the financial strategies, the professional bookkeeper can be of great help. These experts help balance the daily expenses, earnings as well as managing invoices.

By allowing specialist to offer you the services is what the right thing to do. If you want to avail top-notch bookkeeping services, you always need to rely on the experts.

Now, if you have no clue about how you can avail the service, read on to discover how successful businesses locate the ideal services.

Who Can Provide You Bookkeeping Services?

The bookkeepers are in charge of maintaining the books closely day in and day out. Also, they do all the data entry into accounting software.

The bookkeepers focus more on recording financial transactions of business through maintaining records, tracking transaction and creating reports.

You can either choose part-time or full-time bookkeepers for availing services. Now, the experts need to have proper degree. Most of the esteemed firms have experienced and knowledgeable professionals offering you amazing services.

If you want to get good results, it is better to hire professionals who can devote full-time to your business. Three things are important for individuals providing you QuickBooks bookkeeping services. These are certification, insurance and licensing.

No wonder, the best bookkeepers can offer invaluable service to the small businesses.

How Do Bookkeeping Services Work?

In case of bookkeeping service, you need to hire experts from a reputed who performs several tasks of storing, retrieving and recording financial transactions to help increase the business.

The bookkeeper tracks payables and receivables to keep the business’s financial transactions documented.

The bookkeeper would manage the payroll, handle deposits, create and maintain financial reports, etc. Moreover, the experts also reconcile bank statements to the internal accounts and help with internal as well as IRS audit.

The bookkeeping services for startups also offer assistance in business loan, answering audits, etc. They even offer accurate details that you might find useful.

Since there are many duties that a bookkeeper needs to perform for your business, whether it’s big or small. You must always hire experts from a reputed firm so you don’t need to worry about a thing.

How Much Does Bookkeeping Services Cost?

The costs a small business incurs for bookkeeping usually depends on several factors. These include the company size, lifecycle, number of monthly transactions, number of employees, etc.

Along with these bookkeeping activities, the cost would also get impacted by how the accounting systems work, the policies get set up and administered, etc.

In other words, the cost of Quickbooks bookkeeping services usually depend on the size of your business. Also, finding out which type of bookkeeping is suitable for you is also important.

The cost of hiring bookkeepers usually depends on the services that you would avail, the experience your bookkeeping firm has, etc.

When Is The Right Time To Switch Bookkeeping Service?

Are you not happy with the service your bookkeeping firm offers? Well, when you want something more from than what you are getting or if you are not satisfied, you can definitely switch the bookkeeping firm.

Find out what works for your business and start tackling the problems including the potential problems and more.

No wonder, outsourcing bookkeeping service is the best since in-house bookkeepers won’t be able to provide all the services as per your need. You can free up your employees to let them concentrate on other aspects while you let experts deal with the bookkeeping work.

Finally, bookkeeping services are extremely necessary for big or small businesses. Due to this reason, hiring experienced professionals are what you must always do irrespective of your business type and company size.

Contact Us Today:

Locations:

How Can You Spot IRS Scams And Report Them?

If you are getting hounded by numerous calls, emails or letters from the IRS, how do you know these are legit? There are some warning signs of scams that you must always lookout for.

Every year you might seem to get numerous calls from scam artists who pretend to be from IRS. Whereas some people can identify the scams, others may not be able to identify and fall for it.

There are many elderly people who fall for such scams, especially widows since they might be a financially or technically less sophisticated.

With every tax season, it seems these scams get more advanced, increasing the chance of odds enticing innocent people into sharing personal information making unrequired payments.

To avoid falling for such traps, ensure you hire accountants.

Lookout for phone calls

It is rare for the IRS to call taxpayers. In fact, the IRS also initiates most contact through regular mail and not by phone. Even when it calls for a taxpayer, it would send many notices by mail. Along with this, the IRS don’t leave urgent time-sensitive calls where you need to immediately pay the tax bills.

There are robo-calls tapping the honest people who wants to do the right thing. When you are told that you owe money, they become really scared and accidentally break the law as they don’t want to get into trouble. They mistakenly follow the instructions to make payments, at times wiring money.

Now, it isn’t always a recorded voice. At some real people give you a call. If they are demanding in any ways, that’s a warning sign you might fall into a trap.

Beware of fake emails

Phishing is the actual term that is used to describe email attempts to get sensitive information appearing to look like it has been coming from a trustworthy organization or person. They might often link to fake websites that might seem real.

Apart from that, they often ask for real information to make refunds, this allows you to steal money out of the accounts.

If you don’t want to fall for such traps, it is better to hire accountants who can guide you and help you avoid such scams. Even by clicking on the links, it allows malware to be installed on the phone or PC, allowing the bad guys in so they can get exact information and capture your activities.

Take note of letters

It is easy for any graphic designer to take the IRS logo and make letterhead appear official. At times, they even create supporting documents that appear really official.

They even use the website’s URL that look quite close to official website address, with one or two letters differing. If you get a letter from the IRS it seems suspicious, you must call the agency to verify if they have contacted you.

Now, if the letter is real, the IRS would confirm it. If not, they would be help you track the latest scams. You can visit https://www.irs.gov/ to know more. If you have doubts, you must always check with a financial planner, an accountant to ensure the request is legitimate.

Finally, you must always stay alert when it comes to receiving any calls or emails from the IRS.

Critical Financial Challenges Faced By The Business Owners

A successful business venture may not always result in successful wealth creation. Often due to several challenges, owners found it difficult to convert the business into a wealth creation machine for own. However, a senior CPA mentioned that conversion of the business into a wealth enhancement machine requires some systematic approach.

Before that, we must figure out the financial challenges that business owners usually face. Here is a list of challenges which one must overcome.

How to Overcome Financial Challenges – Finalizing Strategies to lower the tax levels

The biggest challenge business owners used to face is to lower the tax amount by following all the government norms. If you can reduce the tax amount, it will help you to save more wealth for your business and personally. Here are some common things that help in tax management.

Business Entity: It is about the structure of the business that determines the tax. Like if your business is S corporation then you can show the losses to the personal tax filing. It will lower your overall tax value. But you will not get this benefit in C corporation.

Tax deductibles: You can buy a property on your own and can then lease or rent it to the business. It will benefit you in two ways. You can show the depreciation in the personal tax and can show the rented property in your business expenditure.

You need to adjust your financial goals to and plan the strategies to get the best benefit out of it.

How to protect the business against the loss of a key person?

It is difficult to fulfill the loss on a personal level but you can manage the revenue loss if you plan strategically. It is true that most of the small business used to stay on some key people. So, plan it in prior in the following way:

An owner must also make sure that in case of his absence or demise his family must get the due benefit from the business.

Protecting the business and property against liability

Legal aspects are crucial in managing the business. However, it is important to protect your business against legal liabilities. A legal entity can play a crucial role in this. It may not be able to protect the business assets but can help you to protect the personal properties. You must do the following:

- A periodic review of all the documents

- Make sure that all the employees are working in the designated sphere

- Make a review of the unutilized cash or asset to avoid the depreciation

- Review the taxation matters

- Incorporation filing

- Business licencing

- Policies and procedure

- System implementation

- Tracking expenses

- Financial planning

You know that failing to pay the proper tax can create several issues. However, you must know the ways to save taxes to protect your business against any liability.

Final words

Therefore, you can see that it is not very difficult to overcome the challenges. However, what is needed is to plan strategically to stop the challenges to become detriments for your business.

Contact Us Today:

Where Does The Accounting Services Fit The Start-Ups?

Every business owner dream of getting on well with their start-ups, but the real question is how well do they manage the accounting services. In reality, most business owners fail to perform the accounting task all by themselves since they lack proper skill and knowledge.

This is exactly when you need to hire accountants to perform the business accounting services. here are some of the highlights.

What are the services start-ups needs from their accountants?

• 71% cash plan and forecasting

• 71% tax planning

• 61% bookkeeping

• 61% business strategy and planning

Do all start-ups have accountants?

• 20% requires, but meets one a year or less

• 48% doesn’t have accountants

• 185 doesn’t outsource, but have one staff

• 14% meets the accountant every month

The start-ups always continue to be on the edge when it comes to hiring accounting services for financial support. One of the ways, you can do is by managing it on your own.

However, hiring efficient accounting services is probably the best way. It is mainly because they have all the necessary skill needed to offer you excellent accounting services.

When Should You Hire Accountant For Start-Ups?

Are you wondering when should you hire an accountant? With so many options, the answer is it depends. There are numerous reasons for contacting an accountant on an early stage.

Here are the golden rules of thumb. You need to avail accounting services if;

You have increased funding- if you have increased the series A, or a large convertible debt, it is high time that you must engage by hiring business accounting services.

Your expenses are soaring high-when you have increased the expenses to keep record of as well as have hired some employees, you need proper financial reporting. When the business grows, it is important to understand the cashflow, thereby hiring accountants is the right way.

What does start-up accountants do?

An accountant that you have hired needs to provide you several services to take your business to a new height. In fact, this is essential since you have a start-up. Here is a list of the services accounting services include:

For start-ups:

Now, these are some of the services that business accounting service includes. There are numerous other services as well. It depends on your requirement.

Accountants help in growing your business as well. Afterall, you don’t want to remain a start-up always, right?

• Finance forecasting

• Analyzing cash flow

• Pricing

• Audit preparation and support

• Creating budget

Finally, business accounting services are important irrespective of the business size. However, if you are a start-up, you need more assistance than established businesses.

Contact Us Today:

Locations:

How to Save Taxes for The Small Business Applying These 5 Techniques?

Tax saving is an important matter for all types of business. However, the small business owner faces several difficulties due to the restricted amount of capital for the business. A CPA for tax preparation for years mentioned the importance of knowing the tricks and way to lower the taxes. An experienced CPA can help a lot in saving taxes.

In this current post, we will discuss some of the ways to save taxes for small businesses:

You must look for adjusted gross income (AGI)

One can adjust several tax breaks limitations through the AGI or Modifies Adjusted Gross Income (MAGI). You can avoid 0.9% Medicare tax over the earned income by not exceeding your AGI $200,000 in case of being single. However, if you are married it is more $5000.

Never to look over the carryover

Some limitations on the deduction and credits are there, which you cannot use in the same year. However, you have permission to carry some of them over to the next financial year. Therefore, it is important to keep track of those carryovers. You can use them in the next year.

However, if you will hire a CPA for tax preparation, they will automatically include this during preparing the tax preparation. Some of the examples of such carryovers are as follows:

• Capital losses

• Charitable contribution deductions

• General business credits

• Home office deduction

• Net operating losses

Related Article: Role of CPA’s For Business

Leave the Property rather than selling it

If you find a particular property has no value, it is better to leave it in the way instead of selling the property for a less amount. Remember that amount that you will get by selling the property will come under taxable income.

On the contrary, leaving the property as it is will be countable as a loss to the company, which is deductible.

You can classify the property under Section 1231. It allows you to show it as capital or ordinary loss.

Look out for tax-free ways to generate income

Salary, bonus, share distribution all come under the taxable income of the business. However, certain ways are there which do not come under taxable income. Your accountant can help you with the following matters:

• Medical Plans

• Retirement Plans

• No-interest or lower interest loans

Use the fringe benefits for employees

Giving fringe benefits to the employees can lower the amount of taxes for your business. in IRS Publication 15-B (2017), Employer’s Tax Guide to Fringe Benefits, you can find the details of the fringe benefits. Increasing the wages of the employee can increase the tax but give fringe benefits can be a smart way to avoid tax. Following things, you can consider in this regard:

• Health benefits

• Long-term care insurance

• Group term life insurance

• Disability insurance

• Educational assistance

Therefore, you can see several ways are there to save a good amount of tax. However, hiring a CPA for tax preparation can help you more to save the taxes for your business.

Contact Us Today:

Locations:

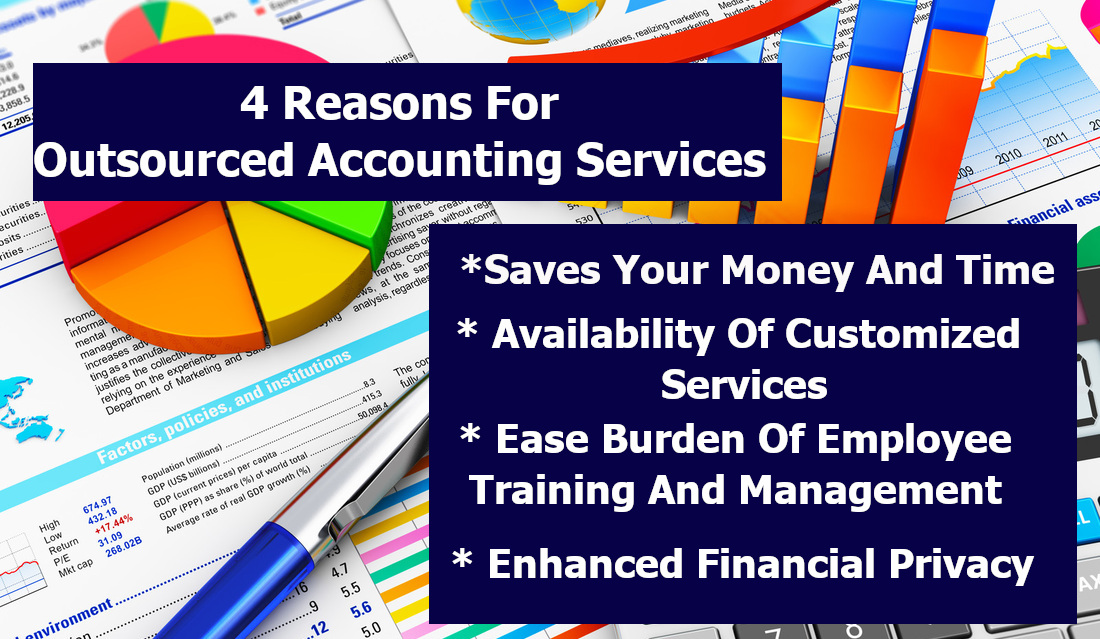

Top 4 Reasons Why Your Small Business Needs Outsourced Accounting Services

On the first day of your business, the chances are that other than the expense receipts, you would not have enough accounting demands. But once your company starts growing and becomes busier, you would know accounting assistance. Just like most of the business owners, you would probably be spending more time managing the finances apart from concentrating on the other aspects of the business.

This is when you need to avail small business accounting services to streamline and keep your expenses, etc in check. In other words, outsourcing the accounting services definitely turns out to be in your favor, undoubtedly. Here you will find out what outsourced accounting service professionals can do for you and your small business.

Partnering With Outsourced Accounting Services

Saves Your Money And Time

As the business owner, your time is extremely crucial. When you find out how much you can earn for the hours you spend itemizing expenses, sending invoices, paying bills, you would find out that you are working at a pretty expensive rate. Now, this wouldn’t happen when you outsource the accounting services. This frees up your time, thereby allowing you to focus on what you can do best, i.e. running the business.

Availability Of Customized Services

Most of the service providers offer you customized services. When you choose one, it would allow you to pay for the services that your small business actually needs. In other words, it allows you to add more value to your business. Moreover, often customized services are designed in a way that seems to be tailor-made for your business alone. This helps you stay organized, which otherwise wouldn’t have been possible.

Ease Burden Of Employee Training And Management

In the case of small-sized businesses, the responsibility of managing and training employees belongs to you since you are the business owner. Now, training and managing accounting employees can also become quite challenging. Now, the constant change to compliance rules, technology updates make it quite difficult to find, supervise and train employees. However, when you outsource small business accounting services the professionals are well-trained thereby relieving you from the hassle altogether.

Enhanced Financial Privacy

When you actually hire an individual for handling the bookkeeping and accounting tasks, you actually risk your business’s financial privacy. However, there is no guarantee the employee would remain with your company or they would refrain from discussion about business. But an outsourced provider ensures a proper layer of confidentiality the in-house employee can’t. Due to this reason, you must hire an outsourced small business accounting service.

Finally, hiring small business accountants is one of the ideal ways to keep your business running. They are experts with proper knowledge and expertise that you need.

Contact Us Today:

Locations:

Outsourced Payroll Service Providers Can Really Be an Asset

With many companies looking for various ways to save on the operational costs, it is better to look for outsourced payroll services provider who can actually help the company oversee the financial management.

Most of the payroll service providers operate to help you handle staff wages, government taxes, update employee benefits such as sick leaves, vacation leaves, etc., as well as impose the deductions needed by the federal and state government.

However, businesses that would want to make the most of their time as well as remove the burdens of handling employee payroll functions, getting the assistance from a third-party management team is like a boon. It reduces the burden in hand as well as worker expenditure.

Offering Convenience and Accuracy Like Internal Finance Department

Running each and every department in the company requires proper precision and skill that might sometimes turn into a huge tiring task. However, outsourcing the financial department is one of the best things to do to reduce the overall burden. Moreover, experienced accountants would relive you from incurring extra personnel so you can concentrate on other aspects of your business.

There is nothing an outsourced payroll services provider since they have all the skills and expertise you need to streamline payroll service. Many big and small businesses are taking to hiring an external service provider who can help you in streamlining your services for the betterment of your business. The service providers have their own team and don’t disturb your operations.

Ensures The Company Complies With Federal And State Laws

The payroll department needs to get updated with the new laws that has been passed wit the Federal and State government. Now, being up to date with the new legislation might be difficult if you have too many things on your mind. However, with outsourced payroll services, you never need to worry about keeping yourself updated with so many laws. Since it is the work of the experts, leaving it on their hands in what you need to do. Moreover, the best service providers stay updated on new and existing laws as well as legal issues.

Since payroll service is an intricate process, most big and small businesses take the help of external service providers to make financial management, easy and hassle-free.

Finally, hiring payroll service providers can be extremely cost-effective since you get expertized service without paying a lot. The experts know what service suits your need and offer it accordingly so you can concentrate on other important matters except payroll of employees.

Contact Us Today:

Locations:

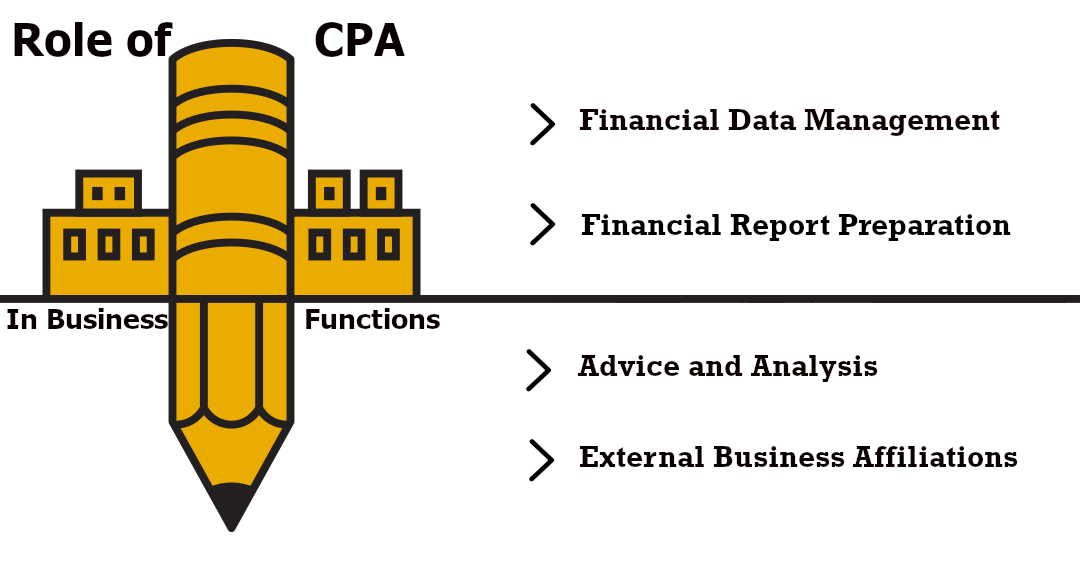

What Role Does A CPA Century City Play In Business Functions?

Accounting is the pulse of the business, whether it’s big or small and there is nothing like CPA who can help you. The expenses, cash flow, income and budgeting are all needed functions of every company, regardless of industry and its size.

Multinational corporations, sole proprietorships as well as businesses must know where they actually stand financially. Now, you must know that cash flow is an integral part of the business. Also, for success, proper tools to tracking the financial health needs to be in place.

The CPA Century City can offer you all the assistance that you need regardless of the business size. Whether it’s a startup or a reputed company working since long, everyone needs an experienced and qualified CPA to manage the accounting tasks well.

Assistance From CPA Century City

Middle or large sized businesses might utilize the CPA as a financial interpreter or as an advisor, who might be able to present the company’s financial data to the others within as well as outside of the company. Apart from this, the CPAs also deal with third party agents such as customers, vendors and more.

Ways In Which CPA Helps

If you are still wondering whether or not you must hire a CPA, you need to think again. The professionals help you in every aspect so that you can concentrate on taking your business to a new height.

Financial data management– The accounting structure of your company is an important component for business operations. One of the main roles of the CPA Century City is to collect and maintain the financial data, as it related to the firm or company. Also, the professional ensures the financial records are well maintained in compliance with the law. They understand how important it is to maintain the financial information in a pristine system since it is the main component for managing business.

Advice and analysis– the CPAs also play the role of an analyst and perform some kind of analysis using proper financial data that’s used to help in the bigger business decisions. Right from deciding which type of supplies you need to order, bill payment as well as payroll, the CPAs do it all and with precision. That’s not all, they also handle intricate several financial details on a regular basis. Advising you on business operations is another area where they prove their expertise. The CPA Century City also analyze the financial data to solve several irregularities and discrepancies that might arise.

Overall, the CPAs help your business in several ways such financial report preparation, external business affiliations and more.

Contact Us Today:

Locations: