What is Phantom Tax, and How Does It Work?

Phantom tax often occurs in partnerships, investments, and real estate transactions. It refers to a taxable gross income the taxpayer has not received as cash. It typically occurs when taxable income is generated but not distributed to the taxpayer.

For example, in a real estate investment trust (REIT), an entity generates income and reinvests in the business instead of distributing it to the investors. The investors are liable to pay taxes on their share of the earnings even though they haven’t received any cash. It creates a financial burden, as they need to find another means to pay tax on this “phantom” income.

Are you one of the unfortunate phantom taxpayers? There is plenty for you to know. This blog discusses how this tax works, when to expect it, and what to do to cope with it.

Phantom Tax and Businesses

Phantom tax can be crucial for businesses, affecting budgeting, strategic development, and enterprise regulation. Here are a few things to understand:

Phantom tax benefits businesses because it can impact cash flow management and tax planning strategies. Here’s why:

-

It Impacts Cash Flow

Phantom tax can strain a business’s cash flow since it requires paying taxes on income not received in cash. The business must have sufficient liquidity to cover these liabilities, although no corresponding cash inflow occurred.

-

It Affects Tax Planning

Businesses can anticipate their tax obligations better by understanding phantom tax, which can help them avoid unexpected tax burdens. When planned properly, and the business has abundant resources to meet the liabilities, it can mitigate the effect of phantom income.

-

It Helps Make Investment Decisions

Businesses involved in real estate investments, partnerships, or other ventures with room for phantom income can be aware of potential phantom tax implications when evaluating the tax efficiency and profitability of those investments.

-

It Helps in Financial Reporting

Phantom tax also affects how businesses report financial performance. It may create a discrepancy between reported income and actual cash flow, making it essential to communicate the distinctions to stakeholders.

Overall, understanding phantom tax is essential for effective financial management and ensuring that a business is prepared for any tax obligations that arise from non-cash income.

How Does Phantom Tax Work?

Phantom tax typically arises when an entity earns income but does not distribute it to its investors or partners. Here’s how it works in different contexts:

-

Partnerships and LLCs

In partnerships or LLCs, income is passed to the members or partners, who must report it on their tax returns. Even if the business retains the income for reinvestment or other purposes, the partners or members are still taxed on their share of the earnings. This situation can lead to a phantom tax scenario where individuals owe taxes on income they haven’t received as cash.

-

Real Estate Investments

In real estate ventures, such as a real estate investment trust (REIT) or a real estate partnership, the entity might generate rental income, capital gains, or other types of earnings. If the entity decides to reinvest these profits into acquiring more properties or improving existing ones instead of distributing them to investors, those investors may face phantom tax. They must pay taxes on their share of the earnings even though they haven’t received any cash distributions.

-

Stock Dividends

Another example of phantom tax can occur with stock dividends. If a company issues dividends in the form of additional shares rather than cash, shareholders may still be liable for taxes on the value of the dividend, even though they haven’t received any cash.

-

Deferred Compensation

Sometimes, employees may defer a portion of their compensation to receive it in the future. However, if the deferred compensation is vested or certain conditions are met, the employee might be taxed on it before receiving the cash. This can create a phantom tax liability.

Also Learn: What is Tax Liability?

When Should You Expect Phantom Tax?

Phantom tax can arise in various situations, particularly in the following scenarios:

Reinvested Earnings: As in the REIT example, when a business or investment vehicle generates income but reinvests it instead of distributing it to investors or partners.

Pass-Through Entities: In partnerships, LLCs, S-corporations, and other pass-through entities where income is reported on individual tax returns, even if not received.

Non-Cash Dividends: When a company issues dividends in forms other than cash, such as stock dividends or property.

Deferred Compensation: If compensation is deferred and becomes taxable before being received by the employee.

How to Cope with Phantom Tax?

Dealing with phantom tax can be challenging, but there are strategies to help mitigate its impact:

Plan Ahead:

Anticipate potential phantom tax liabilities by staying informed about the income your investments or business may generate and how it will be distributed. Proper tax planning is crucial to ensure you have the liquidity to cover any tax obligations.

Set Aside Reserves:

Consider setting aside a portion of your cash flow or income to cover future tax liabilities. This is especially important if you are involved in investments or business activities where phantom tax might arise.

Tax-Advantaged Accounts:

If possible, structure your investments in tax-advantaged accounts, such as IRAs or 401(k)s, where the income can grow tax-deferred, potentially reducing the immediate impact of phantom tax.

Communicate with Partners and Investors:

If you are a business owner or part of an investment partnership, maintain open communication with your partners or investors. Ensure they understand the potential for phantom income and the related tax obligations, so everyone is prepared.

Consult a Tax Professional:

Given the complexities of phantom tax, working with a tax professional is advisable. They can help you navigate the tax implications, explore potential deductions, and develop a strategy to minimize your tax burden.

Conclusion

Phantom tax is a challenging aspect of tax law that can catch businesses and investors off guard. It’s the tax on income you haven’t received, which can strain cash flow and complicate financial planning. By understanding how phantom tax works, recognizing when it might arise, and implementing strategies to manage it, you can mitigate its impact on your finances.

Also Read: What is a Payroll Register? A Guide to Master

Steps You Should Have Taken to Maximize Your Tax Refund in 2024

The time for income taxes is closing in, and careful planning could help you receive a bigger tax refund.

We hope you remember that income taxes are due April 15, 2024. While you have another two months, it may be beneficial to check your financial scenario and make necessary adjustments to boost your tax refund or liability for last year.

We will discuss a few tax strategies that help lessen tax liability, but these steps would have worked best if you had checked before 2023 ended. However, you can put some effort into reviewing your tax situation and expect better results.

Double-check your Paycheck for Tax Withholding

Since the United States follows a pay-as-you-go income tax model, freelancers must pay estimated taxes quarterly, and some employers withhold money from their employees’ paychecks. Result: some people fail to pay taxes during the year and have to pay a penalty at tax time.

Imagine you are an employee, and your employer determines the amount withheld from your paycheck by your W-4 tax form, including your filing status and estimated tax deductions. While the end of 2023 would have been a good time to review your W-4 and existing withholdings, you may still check it.

Use the IRS’ Tax Withholding Estimator tool to evaluate your existing withholding and projected tax refund to tweak your W-4 form. Submit an up-to-date W-4 form to your employer, and they must institute the changes before the first payroll period starts, which is approximately 30 days after your W-4 submission (sometimes longer).

Maximize Your Retirement Account Contributions

One of the most productive tax deductions comes from retirement funds like IRAs and 401(k) accounts. It is because you can decrease your tax bill while developing something for the future. Sounds affordable? Maximize your possible contributions to any retirement account. However, it would have been best if you could have done it before the end of the previous year.

$22,500 was the deduction limit for 401(k) contributions for 2023 taxes without counting your employer’s contributions. An employee in the 24% tax bracket can get nearly $5,000 off their tax bill simply by saving money for the future. Turning up your regular 401(k) percentage for the final pay period of 2023 could have been perfect to boost your potential retirement deductions.

Are you over 50? You can contribute more to your 401(k) with catch-up contributions, which was about $7,500 per year or $30,000 in 2023.

However, it would only be useful if it was permitted by your 401(k) plan. You do not even need to be behind on your 401(k) contributions to make extra deferrals to your account.

In the case of IRAs, your maximum amount of tax-deductible contributions for 2023 was $6,500 or $7,500 for those over 50. The amount deductible from your taxes depends on your income and whether you have a work-provided retirement plan.

Strategize Business Expenses

Are you a freelancer or are self-employed? You could save considerable tax money by deducting business expenses. How would it help if done before the previous year?

For instance, you could have ordered supplies you needed for several months in 2024 by December 2023 and paid for them instead of buying monthly supplies each month now. Your deduction timing depends on whether you use an accrual basis or a cash method of accounting. However, front-loading business expenses for the next year is a great way to reduce taxable income for the current year.

Conclusion

Do not be disheartened about having missed this checklist before your tax season. You still have some time to impact your taxes positively. Additionally, keep these tips in mind and check them before 2024 ends so your income taxes are better in 2025.

Also Read: When Can You Start Filing Taxes 2024?

Top FAQs On How To Pay Property Tax Online?

Have you been wondering how to pay property tax online? This easy-to-understand blog will help you know everything you must about property taxes.

What Is Property Tax?

Municipal authorities like municipalities or municipal corporations impose a property tax on real estate owners.

Some of you may call it house tax. The government uses your information to maintain and upkeep local civic amenities. These include parks, street lighting, sewage, roads, and other infrastructural facilities. The tax helps keep them running to serve the purposes of the localities.

Schedule A Consultation Today!

How To Calculate Property Tax?

They calculate property taxes by multiplying the assessed tax value by the tax rate. Property taxes apply to assessed values, and the rate varies according to location. The standard Californian tax rate is 1% per proposition. So, the residents pay the set percentage of their property’s value for real property taxes. If it seems complex, avail professional tax services in California for errorless filing and repayment.

When Is Property Tax Due in California?

The first installment of the secured property taxes is due November 1 and inadvertent beyond December 10. The second installment is due February 1 and inadvertent beyond April 10. Property tax deadlines are December 10 and April 10. Do not confuse it with the IRS. The best way to avoid missing deadlines is to subscribe to e-notifications.

However, taxpayers can pay both installments together during the first due. There is no penalty for not receiving a bill.

How To Pay Property Tax Online?

Professional business accounting services can help you pay your taxes effortlessly. The other easy way is to use electronic software called eCheck. It is free to use and requires your PIN (Personal Identification Number). You can find it printed on both unsecured and secured property tax bills.

Secured property tax bills have a unique PIN for each AIN (Assessor’s Identification Number). For unsecured property tax bills, every PIN is unique to the bill number and roll year. The per eCheck limit is $999.999.99.

Where To Pay Property Tax by Credit or Debit Card?

Apart from paying using software, you can pay property tax online using your cards. The transaction limit is the same but includes a service fee of 2.22% of the transaction amount.

You need to use your PIN on your unsecured property tax bill for your current unsecured property taxes. You have the option to pay 24 hours a day, every day of the week before midnight.

How Much is the Property Tax in California?

The overall property taxes in California is below the national average. While the national rate is 1.07%, the average property tax rate is 0.73%.

What States Don’t Have Property Tax?

The US enables each state the ability to discern how it generates revenue through taxation. Currently, it has nine states that do not tax income at the state level. These are:

● Wyoming

● Washington

● Texas

● Tennessee

● South Dakota

● New Hampshire

● Nevada

● Florida

● Alaska

But every state includes property taxes. Here are the ten lowest:

● New Mexico (0.55 percent)

● Mississippi (0.52 percent)

● Arkansas (0.52 percent)

● South Carolina (0.5 percent)

● West Virginia (0.49 percent)

● District of Columbia (0.46 percent)

● Delaware (0.43 percent)

● Alabama (0.33 percent)

● Hawaii (0.26 percent)

● Louisiana (0.18 percent)

Are Property Taxes Included in Mortgage?

Yes, a property owner’s monthly mortgage payment usually includes 1/12th of the annual property taxes. While some lenders manage their taxes by preparing an escrow account and replenishing it with monthly payments, small business accounting services can play a crucial role.

Lenders safeguard the tax bill to secure their investment. Any government claims for due property taxes must be paid from the foreclosure sale if they foreclose on your property. So, lenders ensure all the taxes are paid.

Conclusion

These are some of the most critical pieces of information property owners need to understand their property taxes. Now you know how to pay your property tax online and the due date and calculation process. Since all of these can be complicated if you are not familiar with tax procedures, you can consult with a professional tax and accounting company for assistance.

Contact Us Today:

Locations:

Money Laundering & How It Affects Your Small Business

You can find crooks everywhere, and you never know when your small business may come in contact with anyone who’s trying to launder money. To avoid falling into the trap of money laundering use small businesses accounting services.

In this blog, we’ll help you know about money laundering, the US law relating to money laundering, and what you need to do as a business person to ensure you don’t fall under money laundering regulation.

What is Money Laundering?

Money laundering is transaction and activities used for hiring real source of money.

In several cases, illegal enterprises attempt to make dirty money from illegal activities such as drug deal, etc, look clean and legitimate. This way the money is laundered.

Now, for big or small businesses, money laundering is a big problem. Often business owners fall into its trap without even knowing.

How Does Money Laundering Take Place?

The concept of money laundering is to get cash into financial systems without actually revealing its source.

For instance, someone has cash from any illegal deal. The person attempts to pay with that cash so the cash enters the financial system without revealing where it came from.

How money gets laundered operates into three stages:

- First stage is the placement stage. Dirty money is introduced in the financial system in small deposits.

- Second stage is the layering. The money is dispersed or distributed.

- Third stage is integration. The money is reintroduced into the business, and is used to buy large items including businesses, buildings and more.

Hire small business accounting services to know about money laundering.

Schedule A Consultation Today!

What Laws To Know About Money Laundering?

Two US Laws are based on attempts to curb money laundering activities. The Bank Secrecy Act of 1970 included several requirements for financial institutions and banks to report some types of transactions, and bigger cash transactions.

In 1986, Congress passed the Money Laundering Act making money laundering specific federal crime. It stops particular criminal acts related to financial transactions attempting to hide where funds really come from, who owns those funds, and who controls those.

The right small business accounting services firm knows more about these laws and can guide you.

The law may prosecute violations with no minimum amount for transaction. Several new laws have been enacted to banks with strict regulations and requirements for identifying bank customers.

Why Do You Need To Comply With Anti Money Laundering Laws?

Even if your small business isn’t a bank, you may be the victim of money laundering schemes. If your business has had large transactions, or if you do enough business in cash, you must be aware of where the money is coming from to your small business.

The principle, in terms of banking industry, is known as Know Your Customer. Particularly, federal law requires reporting large cash transactions over $10,000 to the IRS.

There is a specific form you’ll need for using to report the transactions, the form is Form 8300. Note these are actually cash transactions that are untraceable through financial systems. Consult with small business accounting services firm to know more.

How To Stop Money Laundering From Affecting Businesses?

Be Careful Of Warning Signs

The warning signs that we share in this blog isn’t conclusive. Criminals use dark web to launder money and their methods are creative.

Trust your gut instinct- if the transaction appears to be really true, then it is ideal to walk away!

Ask Questions When Needed

Criminals don’t like answering questions- the more questions you ask, the more agitated they may become.

If they get really impatient and rush you to complete transactions fast, it is best you don’t proceed any more.

Finally, make sure you don’t fall into the trap of money laundering. Be careful whom you work with and be careful always.

Contact Us Today:

Locations:

Accounting For Restaurant – Key Points To Know

When you think of opening a restaurant, the first time, the owners are driven by their love for food and dedication towards hospitality.

But having a good chef and a winning personality are just two components and not everything. If small businesses fail, it is mostly during the first years and because of bad decisions.

Now, developing a restaurant accounting system is somewhat similar to up accounting systems for small businesses.

However, there are differences you must consider.

Restaurants have little profit margins, so maintaining proper KPIs (Key Performance Indicator) is crucial.

One way is by hiring an accountant in Los Angeles who can help you with the nitty-gritty of business accounting.

How Does Restaurant Accounting Work?

The restaurant accounting system tracks restaurant’s financial transactions, prepare all reports based on financial transactions, gather tax information and put the information in a way that you can understand.

Using this information, you can take financial decisions for the restaurant and minimize expenses, maximize profits and keep your visitors happy.

Without an accounting system for your restaurant, this would all be a mess for you and you wouldn’t have the proper information that can help you make sound decisions.

Schedule A Consultation Today!

How To Implement Accounting Process For Restaurant Business

Hiring An Accountant Or Bookkeeper

Without hiring an accountant in Los Angeles or a bookkeeper alongside a chef, you cannot expect your restaurant to work well.

Even the smallest coffee shops must have a proper financial record so they can file taxes on time and can keep the business successful.

It is best if you can outsource accounting services since the experts will help you when you need them. However, there are differences between accounting and bookkeeping.

Bookkeeping is recording transactions and organizing all receipts. Accounting is the practice of analyzing the information a bookkeeper reports for making the concept easy to understand for business owners.

One of the other ways you can do this is by hiring an accountant and doing the bookkeeping yourself. It is a benefit if you can hire an accountant who is aware of the hospitality industry.

Choosing Accounting Software

There are several accounting software packages available. You need to pick one that is easy to learn as well as offers better reporting or financial analysis features.

You must choose software that can generate profit and loss statements along with other financial statements.

This software must-have inventory management features and must integrate with payroll software if you consider in-house payroll.

The complexity of the restaurant and the offerings must help you know which software to choose.

Choose The Right Accounting Method

Many decisions depend on the right software you choose. First, you must decide if you are using double or single-entry bookkeeping for organizing books. Since the restaurant industry includes inventory holding, double-entry bookkeeping is a better option.

You also need to decide whether to use accrual or cash accounting. Accrual accounting offers an accurate financial image as it records expenses and revenues when a transaction occurs.

Choose A POS System For Managing Cash

POS or point of sale is a place where the customers pay for their food and other services they received from the restaurant.

All restaurants need features in the POS software that suits their need. Some POS packages may help with preparing menu and employee timekeeping.

Restaurants even need POS software having strong inventory managing functions for the front and back office. You can consult with your accountant to choose the right POS software since they know what works best for your restaurant.

How To Track Flow Of Fund For The Restaurant?

You must have close eye on payroll. Restaurant workers may be part-time or full-time with different payouts. Check accounts payable using accounting software.

Keep track of the cash flow daily, monthly, weekly and quarterly. You also must know how much sales come in from beverages and foods using your accounting software or by hiring an accountant Los Angeles.

What Reports Do You Need For Restaurant Accounting?

You can generate for your restaurant with POS and accounting software. These include:

- Input items yoDaily sales report- it allows you to compare weekly or monthly sales to see how the restaurant is doing.

- Food costs-you can check how food costs are compared to total revenue brought in by food item sale.

- Occupancy costs- the costs like utilities and rents are like overhead and don’t change a lot.

Finally, there are many things that go into restaurant accounting. You must hire the right accountant who can guide you into this.

Related Article: Top 5 Accounting Mistakes That Put Your Business At Risk

Contact Us Today:

Locations:

What’s The Importance Of Foreign Currency Accounting In Small Businesses?

You may be thinking of expanding your store for buyers in other countries. Or perhaps you cracked a deal with a new foreign supplier. Taking your business to the international level is a hard task as well as a big step that determines your growth.

However, dealing with small business accounting when foreign currencies are involved is no fun. Let us check out the basics of foreign currency accounting and all that you need to know.

Why Think Of Foreign Currencies?

So why not just avoid this situation in the first place?

First, most people like paying in their own currency. Now, accepting different currencies may help you attract new customers from different countries.

Second, you may have suppliers accepting their local currency or charge fees for conversion. However, for a better and long-term business relationship, it makes sense that you pay those suppliers with the currency they want.

Getting Practical – How To Pay And Get Paid?

While dealing with vendors or customers in other nations, you must decide the right way to get money from A to B and state the terms properly in online policies and contracts.

It is a good moment to consider what you can do in your small business accounting to keep your transfer fees to a minimum and manage the risks of exchange rate fluctuations.

Choose Proper Payment Methods

How will you get the money from your customers? Or how will your suppliers in foreign countries get their money from you?

- Ecommerce Payment Providers- Find out whether or not your current situation allows you to put down prices and accept payments through various currencies. Depending on that, decide if you are fine with the fees.

- PayPal- This one lets you accept and make payments in over 20 currencies and even hold foreign currency in balances. They don’t charge you for currency exchange.

- International wire transfers- Banks at times charge you a fee of $50 for an international money transfer. You can try new web-based services such as OFX or TransferWise for a quick and better solution.

Setting Payment Schedule

It is better to know when you can have the money entering your account. But invoices must be in foreign currencies.

Why? Remember exchange rates fluctuate, and the value of your invoice may change drastically in some weeks. Get assistance from a firm offering small business accounting services.

Getting paid fast really helps, so you know the invoice is worth it, or you may end up paying more. Once in a while, it may work in your favor, but for proper planning, the shorter the payment time, the better it is.

How To Know What Exchange Rate To Use?

Exchange rates change frequently. You must know which rate you must use when converting amounts to your country’s currency.

The rules are as follows:

- For expenses and revenues – use the rate that was in use during the transaction date. If you find the currency to be stable, it is fine to use a monthly or weekly average. But if the exchange rates are fluctuating, you need to track the rate of every transaction date.

- For liabilities and monetary assets – you must use exchange rates in effect on that date when you have created the balance sheet.

Monetary assets, as well as liabilities, are things with fixed and clear value. Consider an international bank account, accounts receivable, and payable.

When Is It Time For Financial Reporting?

When you think of preparing the financial statement at the end of a month, use proper exchange rates on the balance sheets for converting assets and liabilities included under foreign currency.

It includes the accounts receivable and payable. If the exchange rate changes between the balance sheet date and the transaction date, you list the changes as income in case it is a gain or an expense for loss.

Foreign currencies may be hard to handle, make sure you hire a pro to get the best results and avoid mistakes.

Contact Us Today:

Locations:

Tax Law Changes To Know Before Filing Tax Return In 2021

With 2020 over, it means the tax season to account is round the corner. Just like 2020, this tax season promises to be full of unique considerations- due to the coronavirus pandemic.

So it is essential to familiarize yourself with the latest updates to the IRS tax code and how it may affect you. The IRS is pushing the filing deadline back this year.

Below listed are the biggest tax law changes you will want to take heed of when filing in 2021.

Increase In Tax Brackets

What tax bracket your household income comes under defines what tax rate you will have to pay. While rates remained the same for 2020, the tax brackets increased by a few hundred dollars since 2019 to account the inflation.

You can determine at what percentage your income will get taxed this year from the AARP chart.

Standard Deduction Increased

The standard deduction for the tax year 2020 increased relative to inflation by $200 for single or married taxpayers filing separately, $300 for heads of households, and $400 for married couples filing jointly.

Remember, you can opt for itemizing deductions that take more time to calculate but may be worth it if the expenses exceed the standard deduction amount.

What To Know About Postponed Tax Deadline?

The IRS announced that it planned to extend the usual April 15 tax deadline to May 17 2021. This extension is necessary to give US citizens some needed flexibility in a time of unprecedented crisis.

This one of the tax law changes 2021 that you must know about that will prevent you from confusing tax deadline

Greater Deductions For Charitable Contributions

Under the Coronavirus Aid, Relief, and Economic Security Act, taxpayers no longer have to itemize deductions to write off charitable contributions. It is one of the other tax law changes 2021 you should be aware of.

If you do itemize deductions, you can deduct up to 100% of the remaining adjusted gross income based on how much you contributed to charities.

Medical Deductions

Under a bill Congress passed, Americans can now deduct for 2020 and beyond out-of-pocket medical expenses that exceed 7.5% of their AGI.

It is good news for taxpayers getting enough health care last year, provided they itemize deductions to write off the treatment bills.

Schedule A Consultation Today!

Unemployment Benefits

According to CARES Act, taxpayers under 59 ½ were allowed to withdraw up to $100,000 from their 401(k) or IRAs. That too without incurring an early withdrawal penalty.

The downside is that money taken out of the tax-deferred retirement accounts prematurely will be taxed as ordinary income.

You can still score a refund on that tax amount by replacing the emergency withdrawals in 401(k) or IRA within three years.

More Time To Deposit In IRAs

Under the Setting Every Community Up for Retirement Enhancement Act of 2019, owners of traditional IRAs can continue depositing money into them past the earlier ceiling age of 70 1/2.

It means an ongoing chance for seniors to defer paying taxes on whatever income they stashed away in 2020, though the funds will get taxed on withdrawal down this road.

It is another crucial tax law changes you should be well aware of.

Increased Threshold For Earned Income Tax Credit

Any refundable credit eligible to low- and middle-income earners, the Earned Income Tax Credit got a bump in the maximum credit amount available and the income limits they get.

For 2020, taxpayers are eligible if the adjusted gross income isn’t higher than $50,594 or $56,844 for those filing jointly as married.

This credit can help save anywhere from $538 to $6,660 on taxes, depending on income; and household size. Keep this in mind as it is one of the crucial tax reforms 2021.

Finally, if you did take some money out of 401(k) or traditional IRA and you are facing a huge tax bill, don’t panic! You have three years to put the funds back and get a refund on any taxes you paid on that money.

Contact Us Today:

Locations:

IRS Tax Levy: What It Is and How To Get Exemptions?

Tax levies put your assets at risk. To remove them, you need to work with the IRS to pay your back taxes. A tax levy is a serious business if you owe back taxes.

Here’s how a tax levy can affect you, and how you can remove the IRS levy.

What Is An IRS Tax Levy?

A tax levy is the seizure of property to pay taxes owed. Tax levies can include penalties including garnishing wages, seizing assets and bank accounts. Tax levies show up after you have gotten a tax lien. It is a claim the government makes on the property, when passed due on the income taxes.

![]()

What To Know About IRS Levy Exemptions?

Pay The Tax Bill

Sounds obvious, but in most cases paying back taxes is the only way to stop the tax levy. The most important thing is to cooperate with the collection action. If they ask for something, you give it to them.

Get On IRS Payment Plan

Your tax balance will accrue interest and penalties until it’s paid off, but if you allow the IRS to take three consecutive payments, you may convince the IRS to withdraw the lien from public record.

Ask For Offer In Compromise

It is a request to settle your back taxes for less than the full amount you owe. Beware: the IRS accepts fewer than half of the applications it gets in a year. You also won’t be considered if you are in bankruptcy or being audited.

File An Appeal

You have 30 days from the time the IRS notifies you of its intent to levy an asset to make a formal appeal. This appeal temporarily stops the IRS levy from being enacted until a decision is made on the tax situation.

Now, to file a formal appeal, you need to complete and submit IRS form 9423 that can be found on IRS.gov.

Appealing a levy may be a relatively straightforward process. However, it is no guarantee that the IRS will reverse its decision to levy the assets.

Request Installment Agreement

When the levy your assets, it will not relinquish its claim until tax debt is satisfied.

Rather than wait for months or years before it happens, you could have the IRS levy release fast by requesting an installment agreement with which to pay off the debt.

How Can Tax Levy Affect You?

Can You Reverse Tax Levy?

The IRS is required to provide a legal notice stating the time gap the taxpayer has for arranging the funds, reversing a tax levy, and securing assets once again.

However, it is harder for levied assets to be returned than it is to avoid levy before it takes place. The IRS only reverse a levy if:

- The IRS levy was made before a taxpayer was given 30 days to request a hearing.

- The IRS didn’t follow procedures

- The seized property is needed to earn income, thus helping the taxpayer pay the debt.

Finally, these methods are available to you when you want to have a tax levy against the property released. These are designed to help avoid having the assets sold off in order to settle the IRS debt.

Related Article: Dealing with Tax Problems- IRS Problem and Solution

Contact Us Today:

Locations:

What Should You Know Before Signing A W-9 Form?

Form W-9 is one of the simple IRS Forms that has just one function: it allows you to send a Tax Identification Number (TIN) that is employer identification number (EIN) or the social security number (SSN) to another bank, person, or other financial institution.

W 9 California is an information return, meaning it is just for giving someone else a piece of information they need. But as you are not sending it to the IRS, you should be careful about who exactly to send it to. Want to know what is a W9 tax form? Read on.

Schedule A Consultation Today!

What is A W-9 Form For Business And What’s Its Purpose?

Form W-9 is a tax document that the independent contractor’s sign to provide a taxpayer ID number. If the employer doesn’t have a taxpayer ID, or if the taxpayer ID is incorrect, the independent contractor should have federal income taxes withheld, as backup withholding.

Form W-9 is a standard tax document often utilized in business and finance transactions. So, by itself, a W-9 doesn’t pose problems. Still, there are some issues you must be aware of.

Where Do I Get A W-9 Form?

Your client, bank, or other financial institution have to send a W 9 themselves if they need to fill it out. Usually, if you want to file one, it is on its way. Download a PDF version of it on the IRS website.

|

Want To Know More About W-9 Form? |

When Not To Send Someone A W-9?

If You Get It From Someone You Don’t Know

If you are a contractor and you get a W-9 from a business or individual who isn’t a client, don’t fill this out. Sending your Social Security Number or SSN and other personal information to a stranger must be dangerous.

Scammers will sometimes send individuals W-9s to collect the SSNs. If you are suspicious about W-9 that someone has sent, ask them which tax forms they plan to send you back after filling it.

If you don’t know how to fill out a w 9 form for an individual. Consult a tax CPA, consult a tax CPA for assistance. Remember the only reason anyone would need a W-9 from you is that they need it to send some type of IRS form.

When You Employer Sends You One

Employers shouldn’t ask you for a W-9. The appropriate form for them is W-4. If you are starting a full-time job, and your employer gives you a W-9 instead of a W-4, it means they have hired you as an independent contractor and not an employee. Now, it can be a hook for tax payments to the IRS.

When To Send W-9 Form?

If someone is asking for a W 9 California, they need it to send you to form 1099, which you will need to report some kinds of income to the IRS.

It is in both your interest to get the forms in as soon as possible. Even though there isn’t any official deadline for filing a W-9, you must fill it out as soon as you get one.

Remember: if you fail to send someone a W-9 or send one with the wrong information, you may be subject to a penalty.

Contact Us Today:

Locations:

5 Accounting Mistakes That Put Your Business At Risk

In a business, as with anything we strive to excel at, we are bound to make mistakes. That’s not always a bad thing. Many would agree that some wrong steps are necessary to reach long-term goals.

While some accounting mistakes are costly than others, they are sure to serve as a teaching moment if you allow them. There are mistakes that we all want to avoid. If these put your small business at risk, you will want to be sure you are paying close attention.

Below listed are some dangerous mistakes made in business crops up from spending and reporting money earned, also known as accounting.

Find out the common accounting mistakes you can make if you don’t hire experts.

Schedule A Consultation Today!

Mistake 1 – Failure To Keep All Proper Receipts

In this digital age we live in, it can often be considered cumbersome for keeping receipts for business expenses.

Many businesses have already paid their price for not keeping track of all receipts.

Small expenditures add up fast and cause differences when the tax season approaches.

Mistake 2 – Mix Business With Personal Finances

When you aren’t able to keep the business and personal spending separate, you end up making an accounting mess. It’s necessary to open different bank accounts before starting your business and keep everything separate.

The problem is if you don’t stick to the discipline from early on, it becomes easier to blur the lines, and you end up in a bad situation. Now you how to fix negative accounts receivable in QuickBooks.

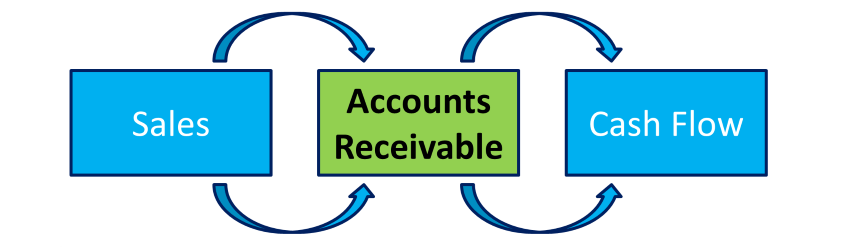

Mistake 3 – Not Considering Receivables

The best part about running or working in a small business is getting paid. Right? One would assume, since earning money is a big goal for businesses, carefully managing the money that is coming in or should be coming in must be a top priority.

However, many small businesses fail to track down receivables and end up spending too much time, too much money on overpaid taxes and bad debt.

Schedule A Consultation Today!

Mistake 4 – Attempting To Do It Alone

There is no reason for you to spend time and energy focusing on areas of your business that you aren’t an expert in. There are professionals available who can handle the accounting task for you.

Moreover, there are accounting issues in business that you can avoid by hiring experts.

Mistake 5 – Not Working With An Accountant

One of the costly mistakes you can make is not working with a firm that excels in small business accounting services.

Take time to discuss ideas and deadlines; so everyone is aware of what is happening. When you hire an accountant and forget about them, you are missing out on crucial resources.

Finally, don’t rush things and start with managing your accounts if you don’t have any idea. Wondering how to do accounting for your business? Let the experts help.

Contact Us Today:

Locations: